The Aluminum Monthly Metals Index (MMI) remained sideways with an upside bias. Overall, the index rose 1.99% from June to July as aluminum prices slowed their ascent. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Midwest Premium Returns to the Upside Stabilization proved temporary for aluminum’s Midwest […]

Category: Commodities

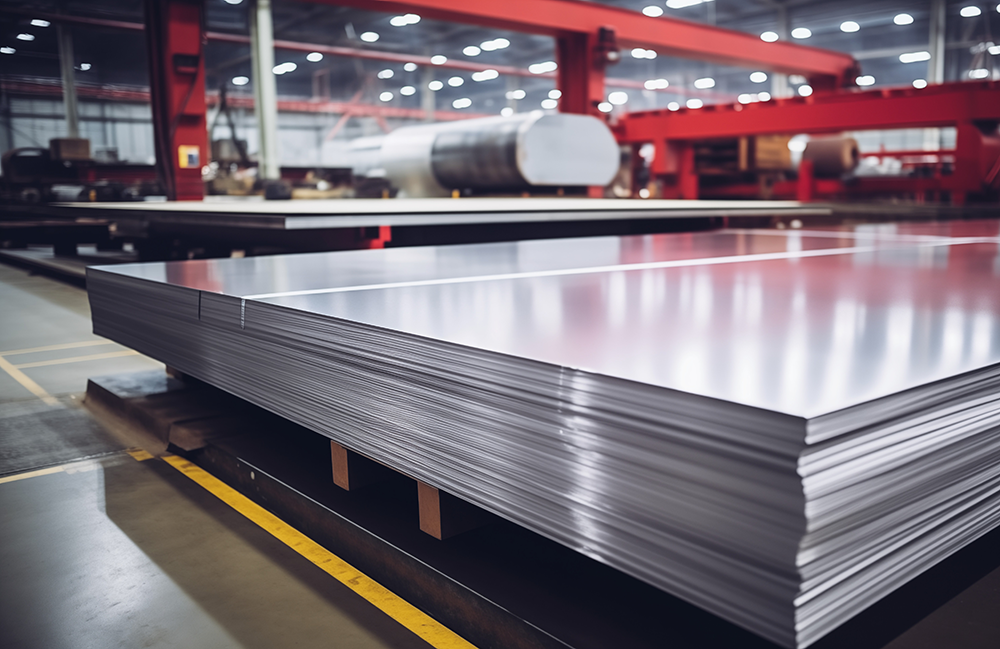

Stainless MMI: Mills Secure Price Increases Despite Weak Demand

The Stainless Monthly Metals Index (MMI) moved sideways, but the downside bias continued. Overall, the index fell 0.9% from June to July. Meanwhile, nickel prices continued their slow slide downward. Mill Price Hikes Hold June brought in a wave of price hikes from U.S. mills. NAS led the market, issuing possibly its largest ever increase […]

ThyssenKrupp Bets €800M on Strip Mill Overhaul

German flats producer ThyssenKrupp Steel recently commissioned a modernized strip mill at its main site in Duisburg as well as new upstream equipment. On July 4, the steel industry titan released a statement detailing that the modernized hot rolled strip mill will be able to roll 3.1 million metric tons of hot rolled coil in […]

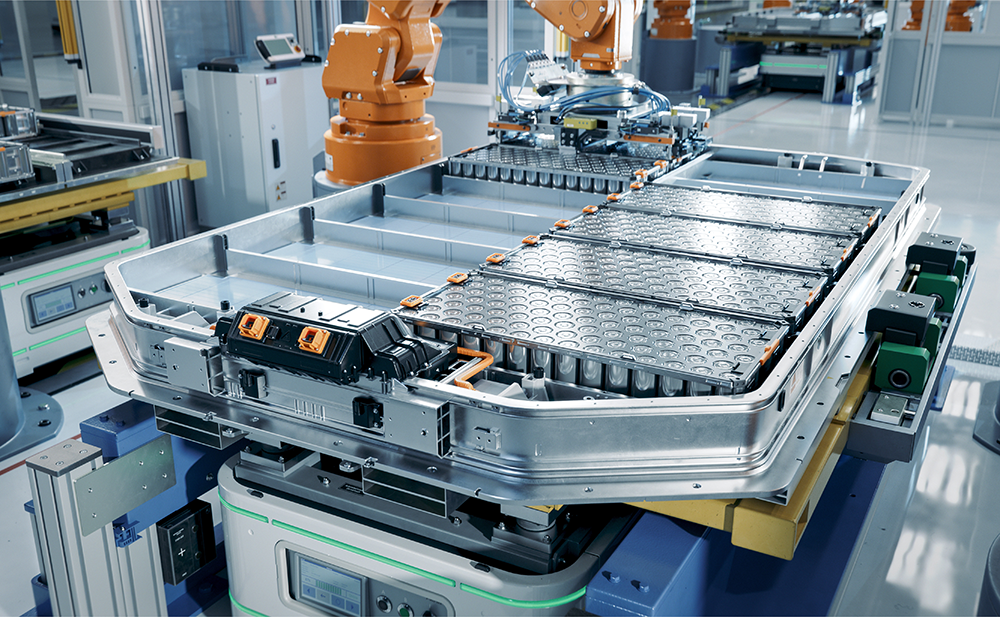

Automotive MMI: Trump’s 50% Copper Tariff Sends Shock Through Auto Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways, inching up by 2.29%. While the index has maintained a mostly sideways trend over the past year, short-term volatility may be on the way. President Trump recently announced a 50% tariff on imported copper, a move expected to impact U.S. automotive manufacturing firms that source the red […]

Copper MMI: Copper Prices Chase All-Time High as 50% Tariff Looms

The Copper Monthly Metals Index (MMI) moved sideways with an upside bias, rising 2.69% from June to July. Comex Copper Prices Nearing All-Time High on 50% Tariff Reports Comex copper prices resumed their uptrend, ending a brief pause witnessed in early June. As of July 7, the price of copper on the exchange stood $266/mt […]

Raw Steels MMI: Steel Prices Steady Ahead of Trade Deals

The Raw Steels Monthly Metals Index (MMI) trended sideways, with a 1.37% increase from June to July. With a few exceptions, steel prices remained largely steady as long-awaited trade deals with the U.S. began to materialize. Nippon Officially Acquires U.S. Steel After an arduous 18-month process, Nippon Steel officially acquired U.S. Steel. Initially blocked by […]

Rare Earths MMI: US–China Trade Deal Eases Rare Earth Export Controls

The Rare Earths MMI (Monthly Metals Index) moved sideways, rising a modest 0.66%. Meanwhile, prices for rare earths may experience short-term stabilization in the upcoming months, primarily due to President Trump reaching an agreement with China to ease restrictions on critical mineral exports. Track macroeconomic signals, pricing pressure, and supply shifts before they hit your […]

Is BYD’s Hungary Plant a Steel Game-Changer for Europe?

Chinese automaker BYD recently appointed Austria’s Voestalpine as its first steel supplier for the planned production plant in Hungary. On June 24, the Linz-headquartered steel industry leader officially announced it will begin supplying autobody and outer-skin components from its rolling mills to BYD’s Szeged plant in Q4 2025. Szeged sits about 180 kilometers south of […]

Steel Wars: China Floods Russia with Cheap Metal as Sanctions Cripple Kremlin Mills

Ongoing geopolitical conflicts, including one active war, combined with market instability, declining steel demand in certain global regions and a rise in protective tariffs on exporting nations, have all come together to force some steel-producing countries, including China, to reassess and refocus their steel industry supply chains. Faced with weak domestic steel demand due to […]

Steel Giant Bows Out: Who’s Taking Over Bosnia’s Mills?

ArcelorMittal recently announced the sale of its steel plant as well as its stake in its iron ore mine in Bosnia and Herzegovina, with news reporting stating that the steel industry giant will unload the plant to Bosnian industrial conglomerate Pavgord Group. According to the details of the deal, Pavgord Group will acquire the longs […]