Back in the 1970’s, Arab oil embargoes caused short-term pain for the West due to rising crude prices. However, it also spurred a drive for fuel efficiency that ultimately reduced the country’s reliance on foreign oil. At the same time, it boosted the GDP per unit of energy consumed. Will history repeat itself? There’s no […]

Category: Commodities

Is the Battery Metals Gold Rush Really Over?

The term battery metals typically refers to lithium, nickel, and cobalt. The name stems from the fact that the three metals are frequently used in the production of all types of modern batteries. Since 2021, these metals have enjoyed a rather lengthy bull run. This has proved profitable for investors and provided some much-needed predictability […]

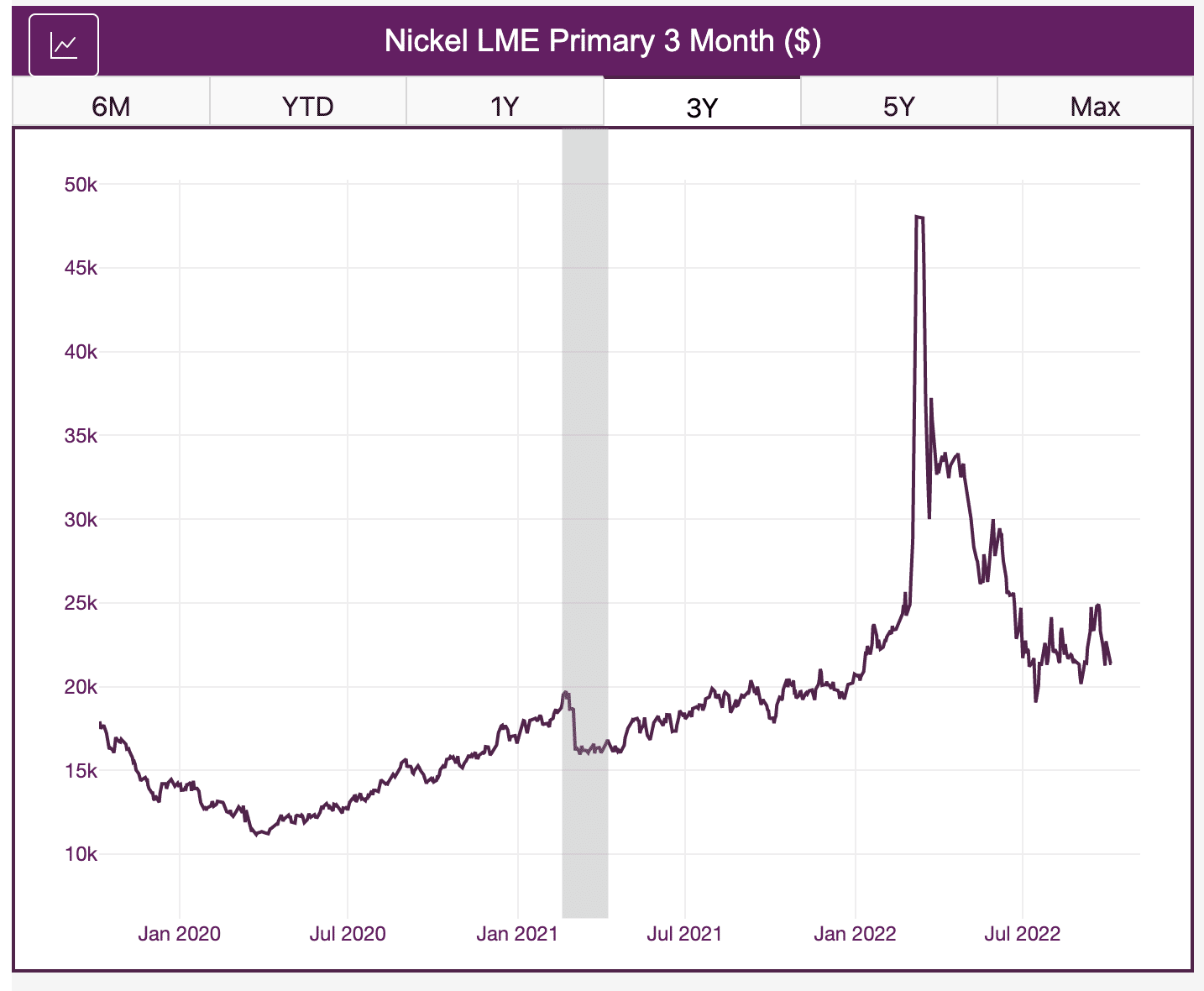

Nickel Prices: LME Nickel Contract Continues to Lack Liquidity, Harming Price Discovery

Nickel prices are seeing a lot of attention due to an overall lack of liquidity on the LME contract. But what exactly does this mean? Moreover, what does it mean for buyers looking to mitigate price problems in the face of global supply problems? The metals market moves fast. Sign up for the weekly MetalMiner […]

Iron Ore Prices Show Gains in China, but Is This a Temporary Rebound?

It’s still touch-and-go for the steel sector in China despite the sprouting of the first shoots of a possible manufacturing recovery. However, last Monday, benchmark iron ore prices in the country gained a surprising 7%. This is the biggest daily rise in two-and-a-half months. Is it a sign that we should be more optimistic, or […]

Metal Market News: Glencore Hit By Record Fines

$1.5 billion US is a lot of money by any measure. However, the reality is that Glencore is making so much in this climate of metal scarcity and elevated prices, they likely won’t have a hard time accommodating the fine. So when metal market news broke of their massive, three nation fine, there was not […]

European Gas Impact on Steel Prices

Steel prices and gas are the primary topics of conversation today. It seems that steel traders in China are seeking more buyers abroad for their finished steel products. Meanwhile, Russia is mulling cutting gas supplies to the EU. Gas prices have an enormous impact on steel prices. China: Lockdowns at Home, Low Demand Abroad The […]

China Demand is Sagging

The bears are back in the metal markets, and one of their prime motivators is this year’s dismal prospects for China. A note in the FT’s Unhedged today explored the country’s “impossible trilemma” of achieving 5.5% GDP growth, reaching a stable debt-to-GDP ratio, and meeting zero-COVID initiatives. When you combine this with the reality that […]

Ukraine Invasion Changes Global LNG Equation in Favor of US

Japan is reportedly actively considering extending financial support to the US to boost liquefied natural gas (LNG) production. Incidentally, the US is already the world’s 3rd largest exporter of LNG behind Qatar and Australia. However, the country is set to play an even bigger role in global LNG production and export as the Russian market […]

Is Energy-Intensive Metals Production in Europe Coming to an End?

The extremely high natural gas prices this past winter have left many Europeans reeling. At the time, the increased costs were blamed on a shortage of Russian supplies. Today, many are wondering if the restrictions on gas exports by Russia were intentional. A reminder to Europeans of their vulnerability prior to the invasion of Ukraine, […]

Recession Fears: Could the Fed Risk Too Much Too Fast?

Of late, all talk related to the US economy seems focused on inflation. And while the Fed has continually issued statements regarding interest rates, the organization seems split on how to proceed. Moreover, concerns are rising that too much intervention too soon could actually push the economy into a recession next year. In the meantime, […]