The Automotive MMI (Monthly Metals Index) dropped by 6.32% this past month, a downward trend it has been maintaining since May. The drop comes despite valiant efforts to put out some of the fires plaguing the car manufacturing industry. But with the microchip shortage, surging inflation, and issues with both supply and demand, the automotive […]

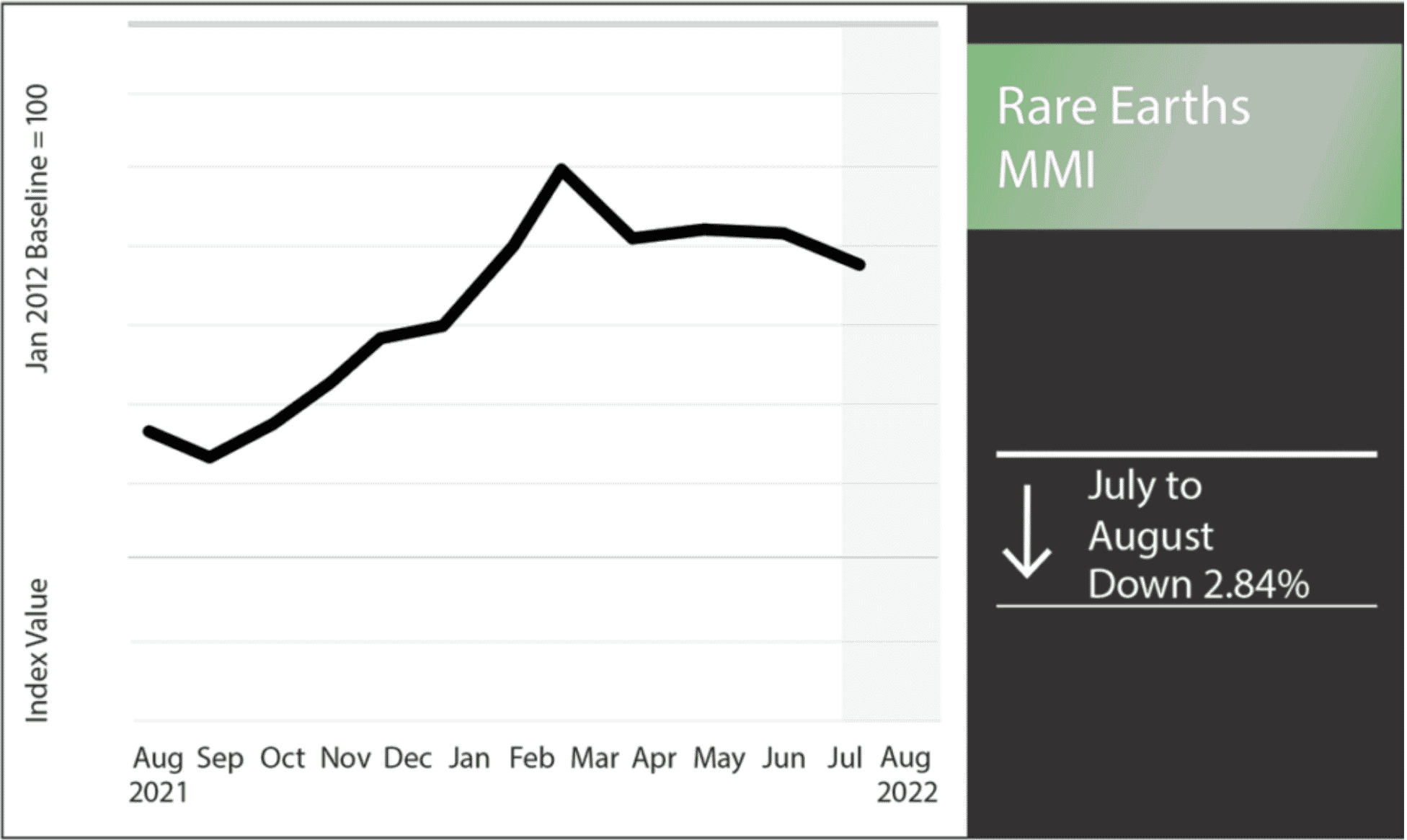

Rare Earths MMI: Rare Earth Prices Slide Further as World Looks for New Supplies

The Rare Earths MMI (Monthly MetalMiner Index for rare earth metals) extended its decline in July, dropping another 2.8%. This is a significant move for rare earths prices, and reinforces the subtle downtrend that began back in April. Now more than ever, countries are frantically searching for ways to separate their rare earths supply from […]

Russia, Ukraine, and the “New Normal” of Global Steel Supply

Steel prices have waxed and waned more than usual this past year. MetalMiner has reported extensively on all of the various factors contributing to this unpredictability. Of course, you can’t ignore China’s rolling COVID lockdowns or the year-long supply chain hangups. However, we feel one of the biggest X factors for the global steel supply […]

Significant Decline in LME Stock Levels Brings Commodity Markets into the Spotlight

MetalMiner follows the LME (London Metal Exchange) very closely, as it remains the largest commodities exchange for base metal options and futures. Recently, we mentioned how the LME had quietly withdrawn its precious metals contracts due to low liquidity. However, that’s only part of the story when it comes to dwindling LME stock. Both LME […]

Construction MMI: Indices and Demand Decline for Another Month

The Construction MMI (Monthly Metals Index) extended its decline from last month. Altogether, the index fell 10.69% from June to July. China is Poised to Inject Big Money into Infrastructure News recently broke that China’s State Council is preparing to increase credit lines across the board, providing an additional 800 billion yuan to fund […]

Automotive MMI: Industrial Metal Supply Woes, EV Demand Grows

The Automotive MMI (Monthly Metals Index) experienced another decline from June to July. After a -6.53 drop last month, the 30-day price change jumped to -7.77%. As with the previous months, the automotive industrial metal marketplace has been plagued by problems. Curiously enough, it’s supply – not demand – that can’t make any headway towards […]

Copper Prices Plunge, But Chile Remains Optimistic

Copper price and prices have long been considered a major indicator of global economic health. So when they plunged to 16-month lows on June 23, investors quickly hit the “panic button.” According to this CNN Business article, the commodity’s 11% drop over two weeks shows that global growth is slowing. However, not everyone agrees. Chile’s […]

Estimating Stainless Steel Costs Becoming More Complicated

Last Month, MetalMiner reported that stainless steel cost had been holding strong amid high demand and increased production. However, we did identify some cracks in what might otherwise look like a solid recovery. As we transition from Q2 to Q3, some of those cracks have grown significantly. Low Demand in China Affecting Stainless Steel Cost […]

Construction MMI: Optimism Rises While Indices Decline

The Construction MMI dropped by 9.41% from May into June. The decline comes amid growing optimism about the state of the industry. Even so, talk of recession continues to cast a shadow over the post-COVID economy. U.S. Construction Market Expected to Grow 3% by 2026 Despite the doom and gloom recession talk going on, […]

Automotive MMI: Lower Metals Prices and Slumping Supply Dominate the May Market

The Automotive MMI (Monthly Metals Index) experienced a slight decline from May into June. The 30-day price change was roughly -9.55, a -6.52% drop. As with last month, multiple crises impacted the marketplace’s overall health. Among them are an ongoing microchip shortage and COVID-19 lockdowns. Below, we’ll discuss if and when we can expect normalization. […]