Indian Prime Minister Narendra Modi recently visited the United States. During his stay, the two nations agreed to resolve six long-standing disputes at the World Trade Organization (WTO). U.S. steel news outlets watched this exchange particularly closely. This is because one of the subjects of debate was India’s imposition of retaliatory tariffs on U.S. products, […]

Category: Imports

Automotive MMI: Vehicle Sales Up, Steel Prices Dropping

April saw a welcome boost in sales within the U.S. automobile market. New vehicle inventories are now in healthy shape. However, interest rates are still high, as are new vehicle prices. Moreover, the Automotive MMI index still has several factors working against it. Steel prices, notable HDG traded not only sideways, but completely flat. In […]

Rare Earths MMI: Prices Plunge, Flatten, Then Rise

The Rare Earths MMI (Monthly Metals Index) dropped drastically again this month, suffering a 15.5% decline. Despite this, downward price action began to slow down and flatten around March 16. As of March 30, prices began to rise again. Further adding to the confusion was the fact that some components in the index traded flat. […]

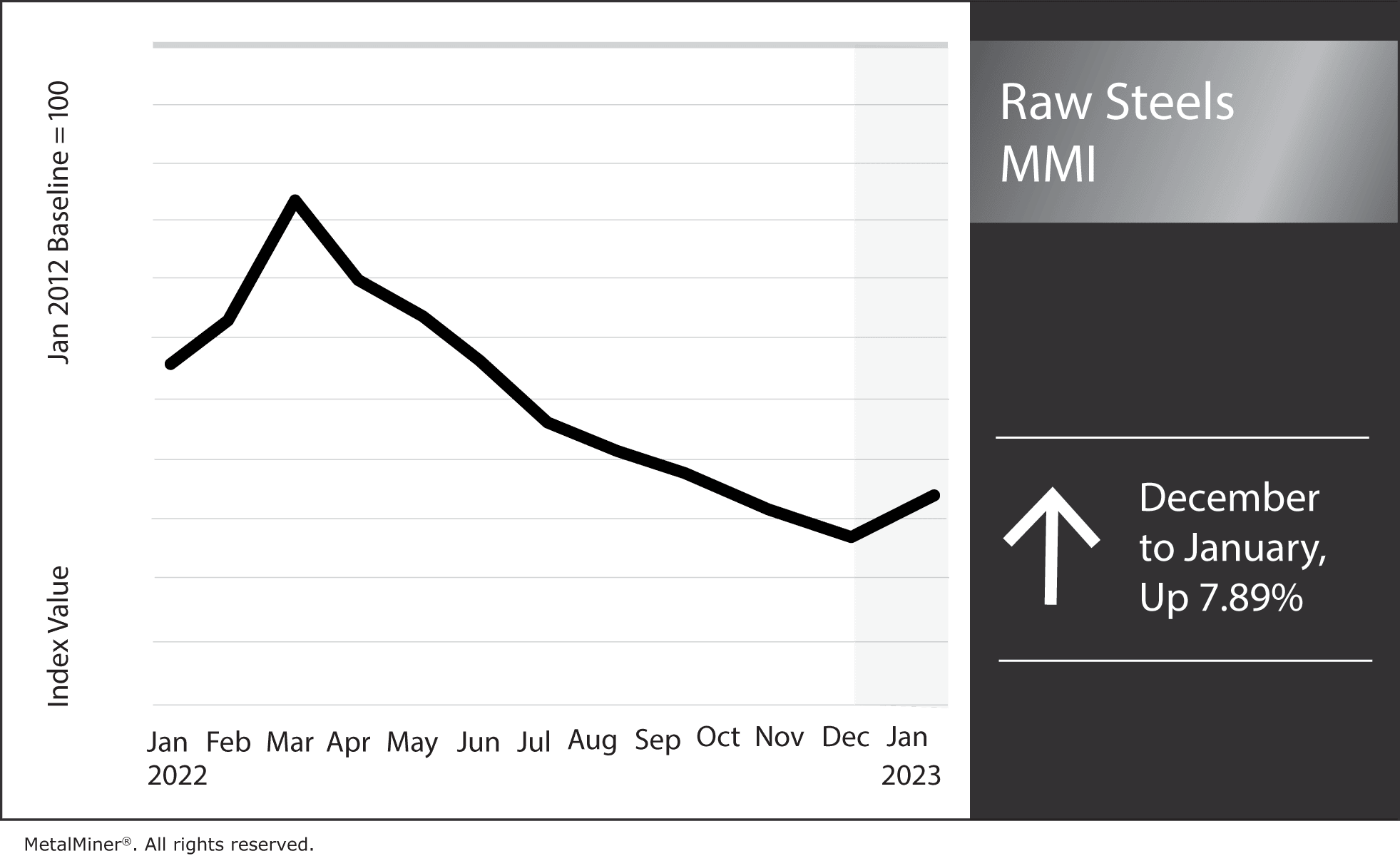

Raw Steels MMI: U.S. Steel Prices Find Bottom, Begin Rising

U.S. steel prices hit a bottom at the beginning of December, then began to climb. Hot rolled coil prices rose over 8% from their December low. Meanwhile, plate prices traded down for the first time since September. Overall, the Raw Steels Monthly Metals Index (MMI) rose by 7.98% from December to January. MetalMiner’s free weekly […]

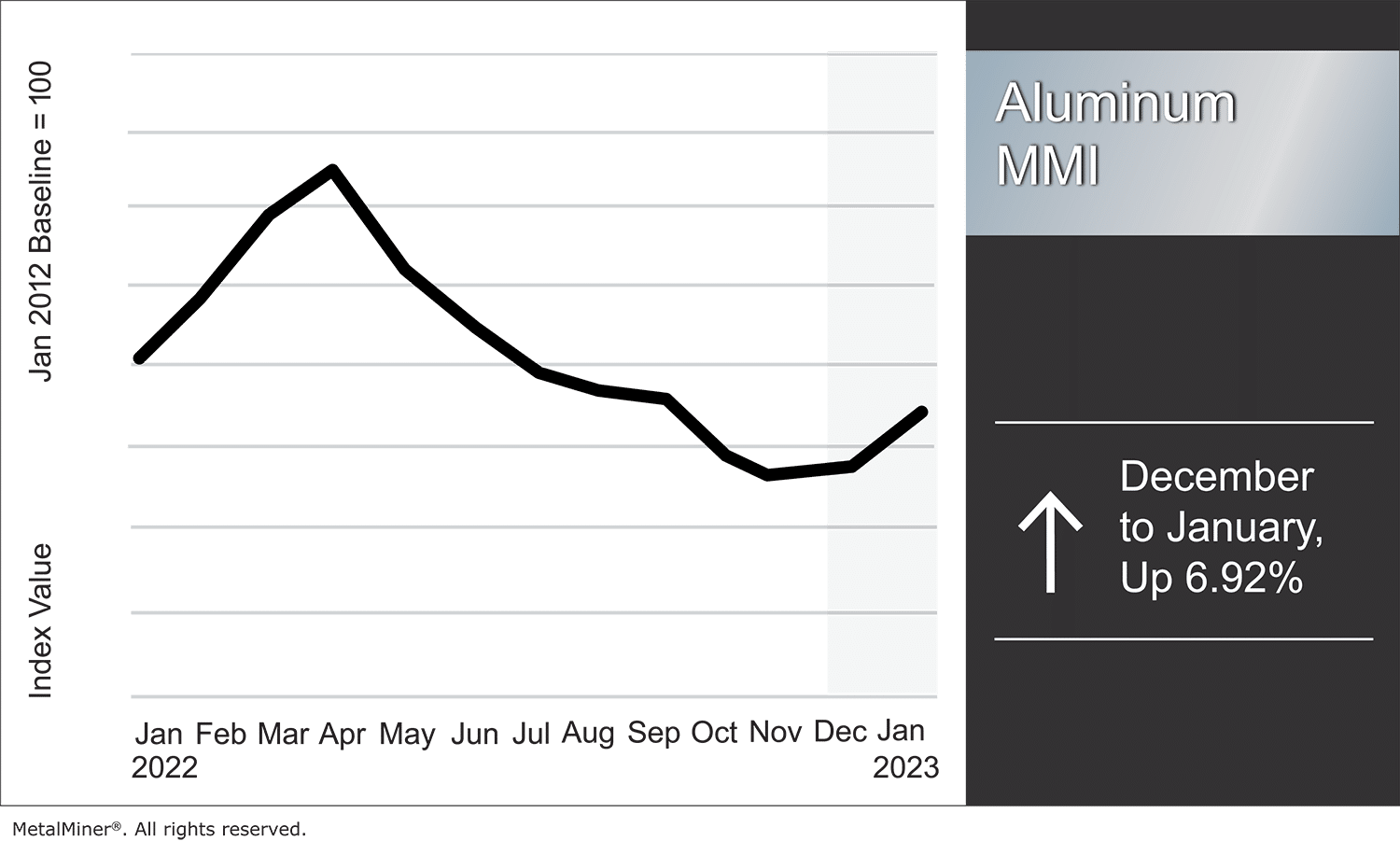

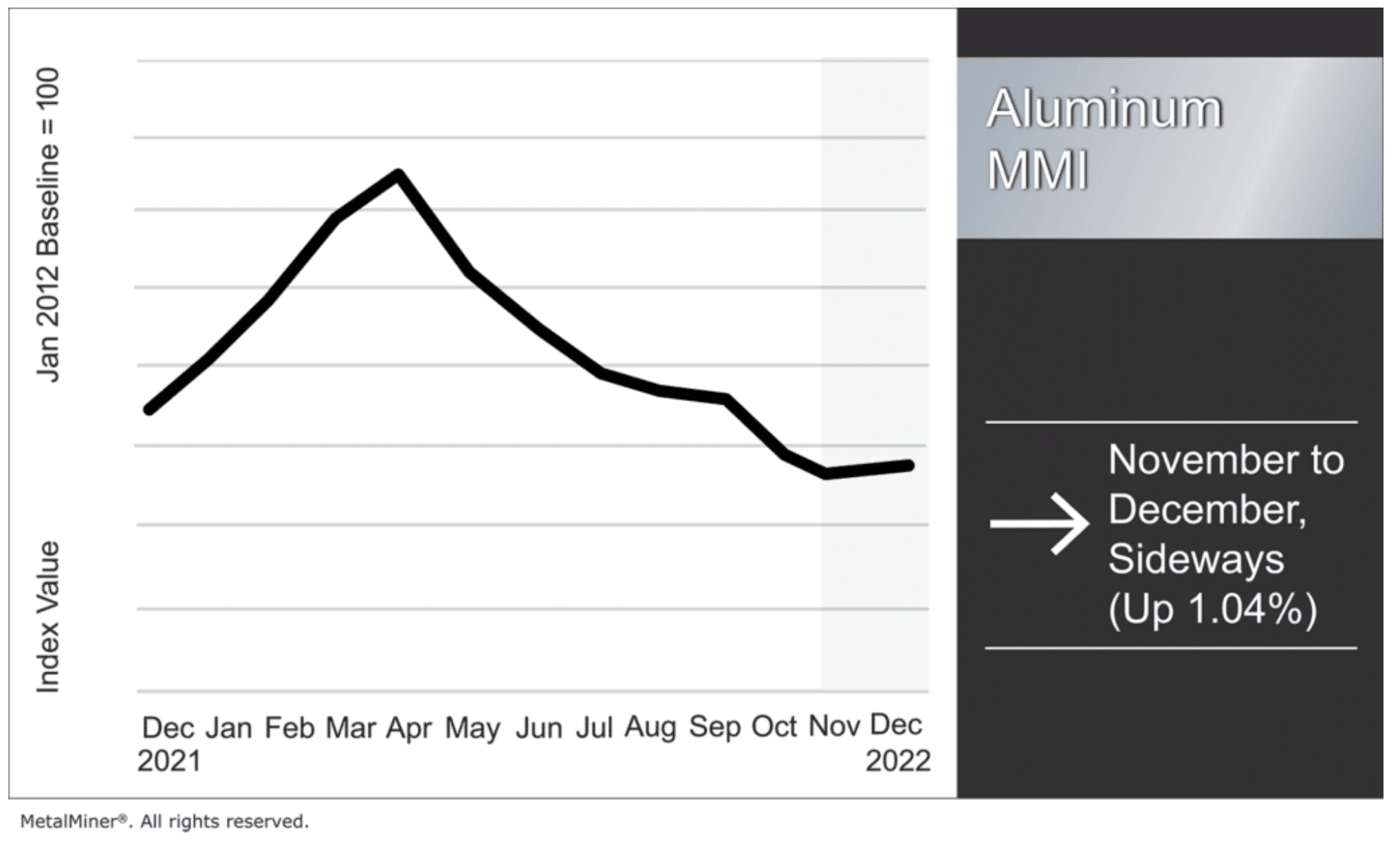

Aluminum MMI: Aluminum Prices Slide From Early-December Peak

Despite the recent short-term bounce, aluminum prices have not quite reversed to the upside following their long decline from March 2022. Ultimately, the rally between November and December was not strong enough to indicate a reversal. Moreover, bearish pressure continues to dominate the market environment at this time. Instead, prices remain largely indecisive. However, the […]

2022 Stainless Steel and Nickel Price Trends

Stainless and nickel price trends fluctuated much more than carbon steel throughout 2022. The LME nickel squeeze greatly strained both the nickel and stainless steel markets. Indeed, LME nickel prices skyrocketed by almost $25,000 per metric ton back in March. Soon after, the rally cooled down again, eventually bottoming out in July. Come November, prices […]

Copper Price Trends: 2022 Review

Looking at 2022 copper price trends, the market was nearly as volatile as metals like nickel and aluminum. Currently, copper prices are attempting to break prior highs but have yet to get there. As copper taps into short-term resistance levels, the possibility of a pullback in price appears more and more likely. Meanwhile, the copper […]

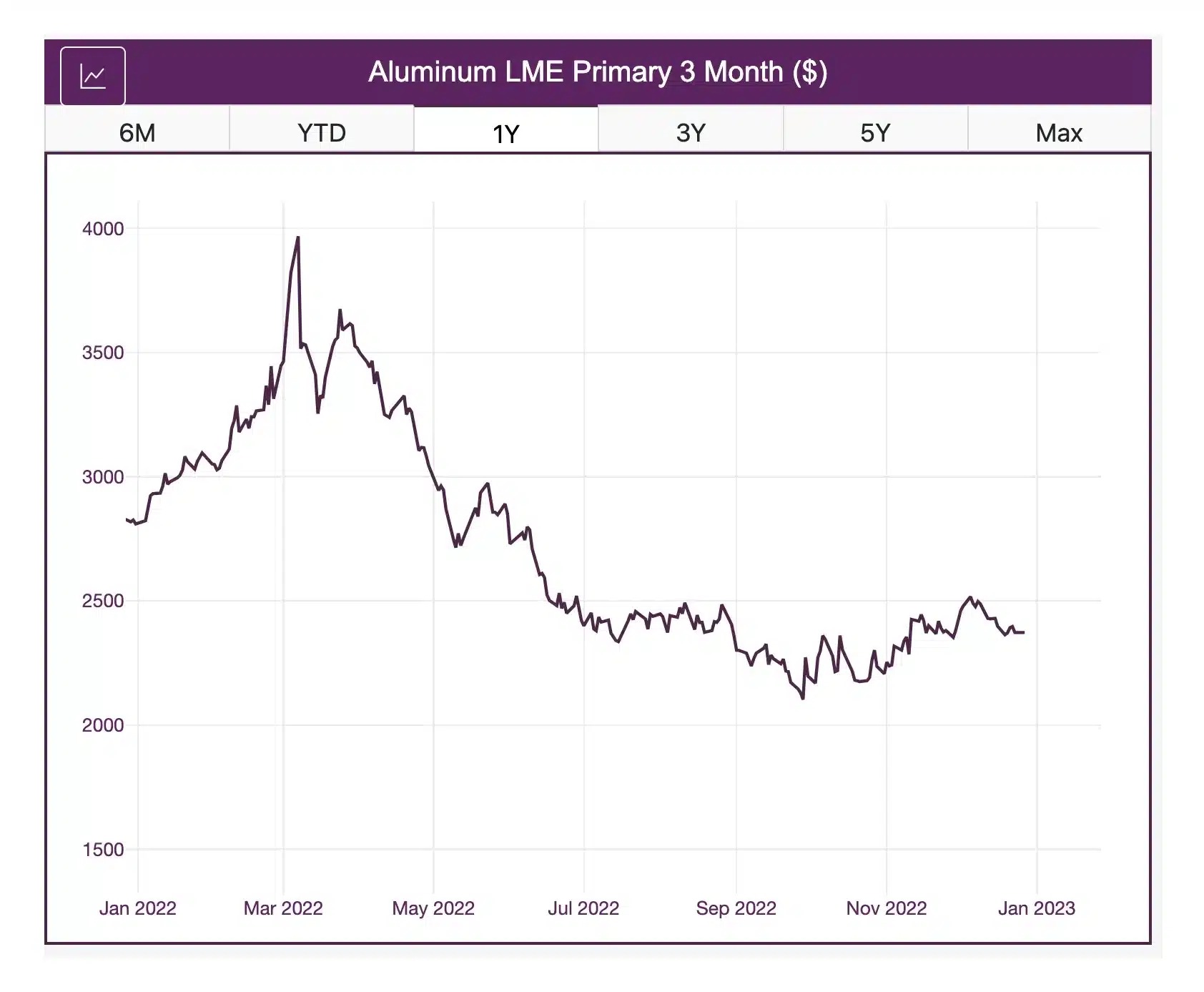

Aluminum Prices and Global Market: a 2022 Review

Aluminum prices reached a high price of almost $4,000 per metric ton on the LME primary 3-month in 2022. However, there were plenty of sales for roughly half that amount, attesting to the wide range of the 2022 index. When March’s rally ended, prices began a decline that resulted in them hitting a yearly low […]

Aluminum MMI: Rally Continues as Aluminum Prices Remain Bullish

Aluminum prices broke out of their sideways trend last month with strong upside price action. Prices rallied during the first half of November, followed by a modest retracement before they continued upward. Overall, the Aluminum Monthly Metals Index (MMI) saw a modest 1.04% increase from November to December. The MetalMiner Insights platform includes global aluminum […]

China Reacts Strongly to WTO’s Ruling of Trump Administration Metal Duties

In the latest US steel news, a WTO ruling has sparked a new war of words between the United States and China. Last weekend, the WTO finally ruled on the 25% taxes on global steel imports and 10% import tariffs on aluminum imposed under former US President Donald Trump. The WTO dispute settlement panel ruled […]