Uncertainty regarding China’s stance on zero-COVID, when restrictions might ease, and riots within China throughout recent weeks have all contributed to more flat steel prices. What’s more, recession fears are starting to notably impact commodities. Yet another contributing factor? Fears of a railroad strike. With the cut-off date for meeting railroad unions’ terms fast approaching, […]

Category: Macroeconomics

Despite Mine Expansion, Copper Price Outlook Still Bearish

Let’s begin with the good news first. Global copper mine capacity rose nearly 5% to 20.38 million tons (MT) between January and September of 2022. According to a report by the International Copper Study Group (ICSG), this was mainly due to the additional production at new or expanded mines. That said, global demand for the […]

With China Failing, Volatile Metal Prices Could Spill into 2023

There have been a number of dynamics driving metals prices this year. They’ve ranged from the strength of the USD to the war in Ukraine to the still-ongoing energy crisis. However, as with the past two decades, the primary recurring theme remains Chinese demand. As both producer and consumer of most of the world’s major […]

Conditions Ripe for a Nickel Price Squeeze

The recent rise in aluminum, copper, and nickel price have created some short-term uncertainty as companies finalize their long-term contracts for 2023. Earlier this month, all three metals rose on the back of rumors that China might begin easing zero-COVID restrictions. In addition, the USD index has dropped from its September peak of 114. As […]

Copper MMI: Copper Price Moves Sideways Before Starting Rally

The Copper Monthly Metals Index (MMI) moved sideways, with the overall copper price falling 2.0% from October to November. While volatility remains a risk, copper prices traded in a tight range throughout October. In general, prices traded just above the low found in late September. Copper was also among multiple base metals who’s prices move […]

Renewables/GOES MMI: Political Factors Yank Renewable Energy in Different Directions

November’s Renewables MMI (Monthly MetalMiner Index) traded sideways for the first time since June. The index rose by 1.56% month-over-month. This primarily resulted from GOES (grain-oriented electrical steel) rising in price. Meanwhile, other renewable energy resources, like neodymium and Japanese steel plate, traded sideways. Silicon remains in particularly high demand, but supplies remain pinched along […]

Copper MMI: Copper Prices Move Sideways in Tight Range

The October Copper Monthly Metals Index (MMI) fell 5.59% from September to October, with all components experiencing declines. Still, future copper prices face a wide range of challenges. Copper prices continue to show signs of short-term consolidation following a brief rebound that stalled in late August. Meanwhile, the bottom found in mid-July and the peak of […]

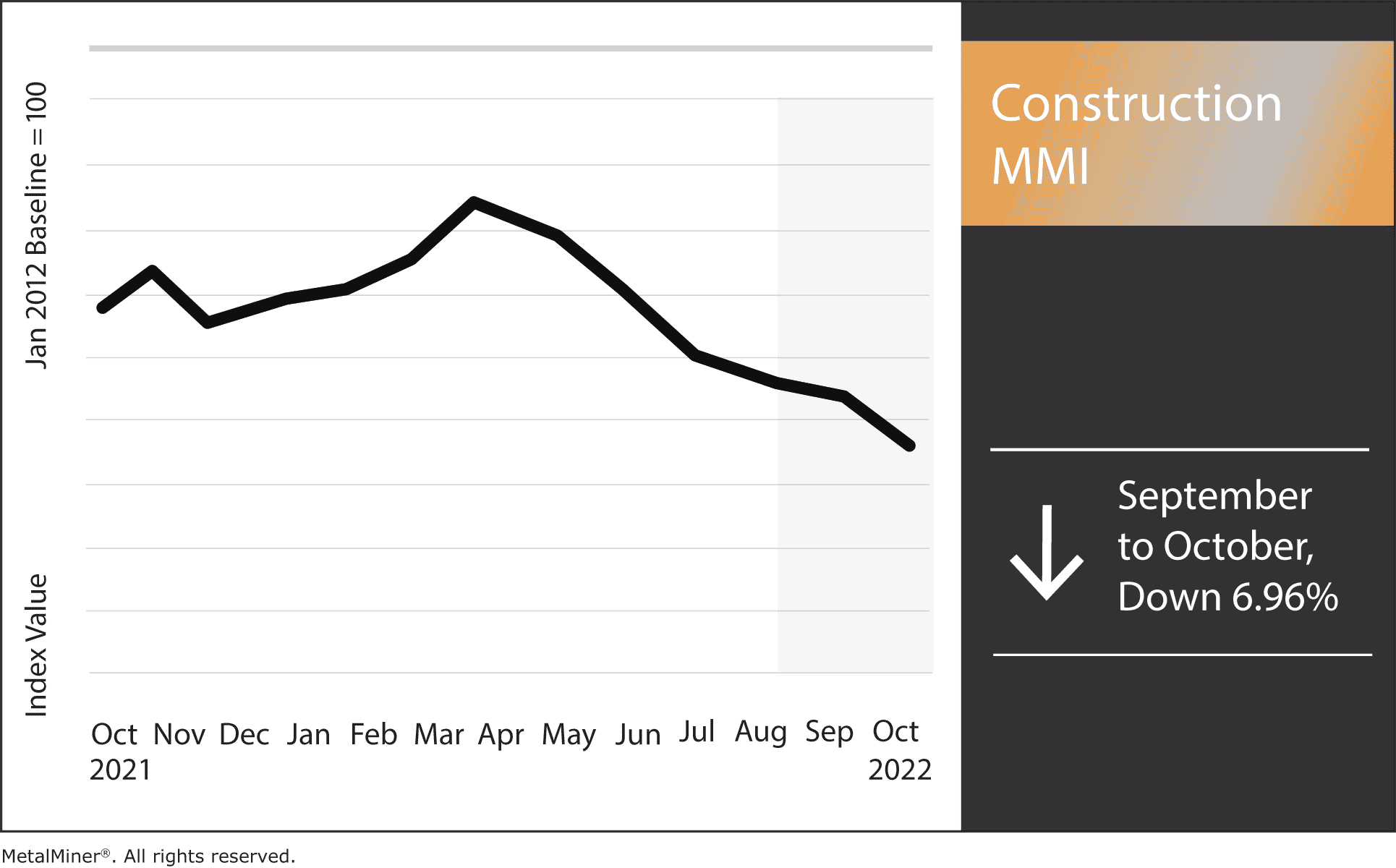

Construction MMI: High Interest Rates Haunt US Construction

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due […]

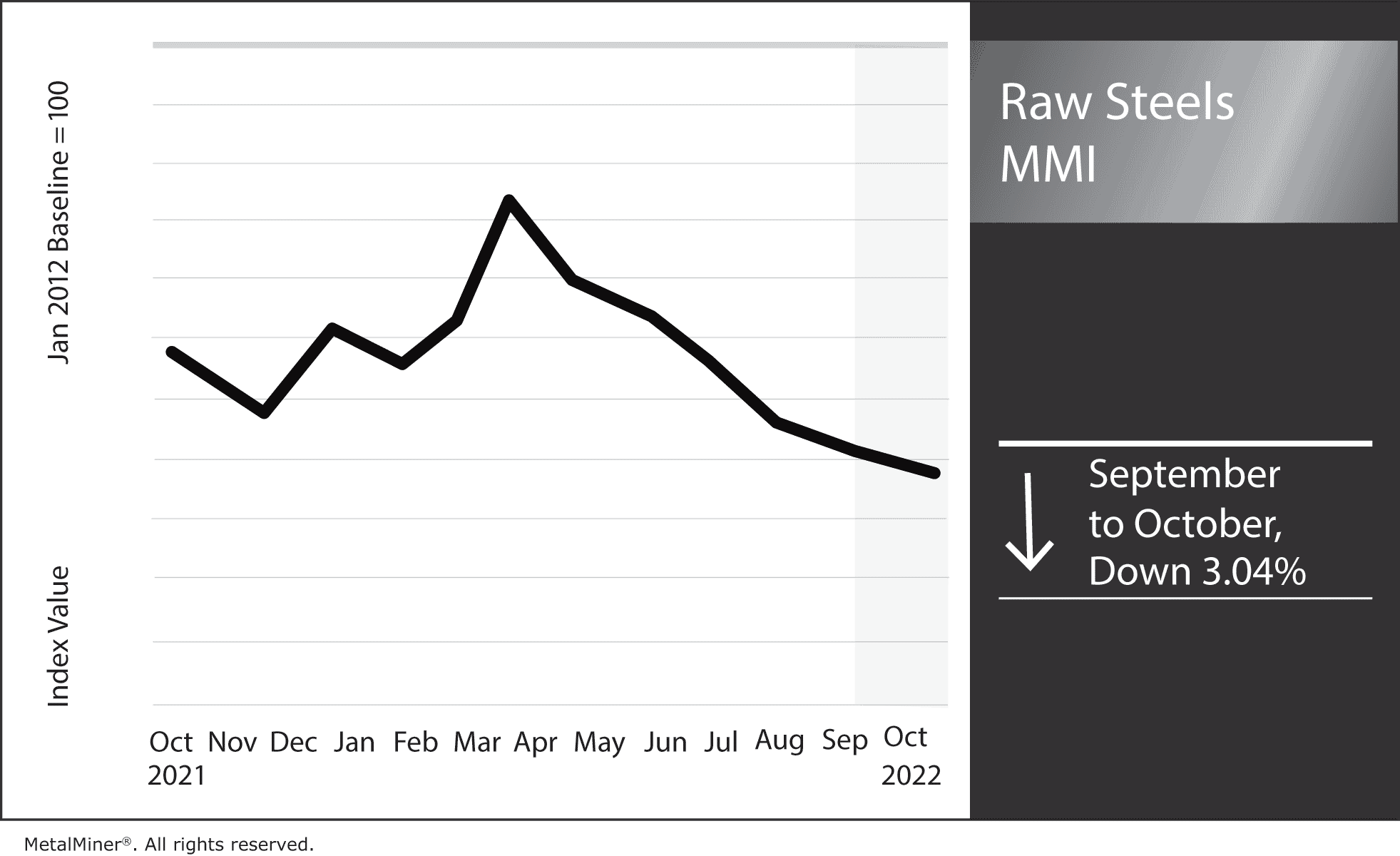

Raw Steels MMI: Steel Prices Flatten, Slowly Edge Downward

The Raw Steels Monthly Metals Index (MMI) fell by 3.04% from September to October. U.S. steel prices continued to drop throughout September. However, declines for both hot rolled coil prices and cold rolled coil prices slowed to a sideways trend. Plate prices, which have shown the most strength of steel prices, traded down for the […]

Amid Energy Crisis, German Industry Follows Toilet Paper Manufacturers Down the Drain

An attention-grabbing headline in the Financial Times perfectly illustrates the dire predicament in which Germany’s manufacturing industry finds itself. The title, “Energy crisis leaves Germany’s Toilet Paper Makers Struggling to Clean Up” conjures up all kinds of images. Unfortunately, sky-high power costs continue to deprive Germans of more than sanitary products. From heat and light […]