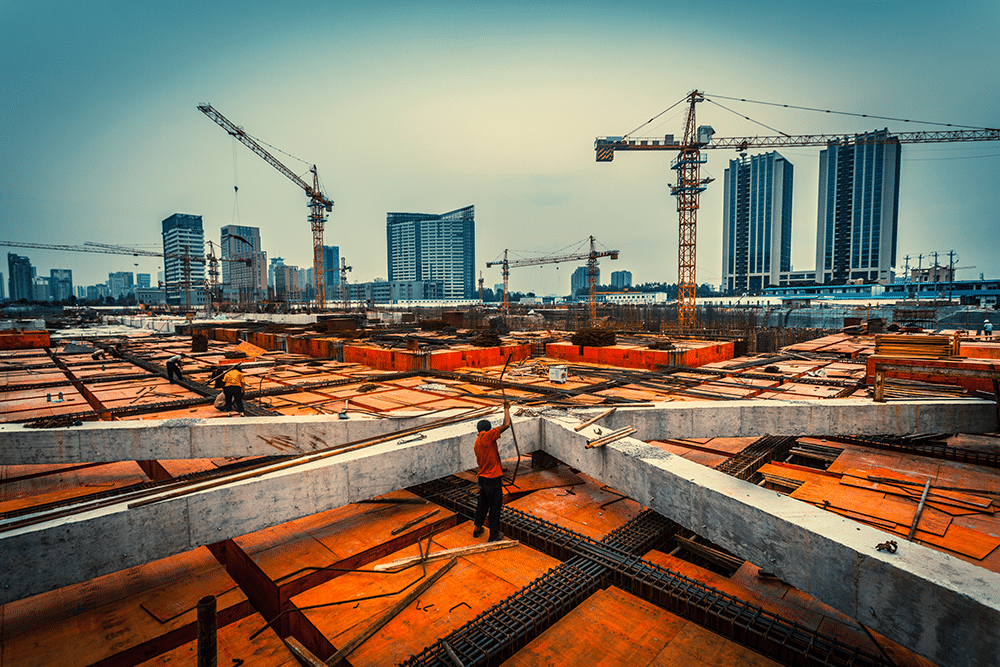

The Construction MMI (Monthly Metals Index) moved in a relatively sideways trend, only budging up 0.65%. Steel prices continuing to flatten out, along with bar fuel surcharges dipping in price, kept the index from breaking out of the sideways movement we’ve witnessed since December. As the index enters 2024, U.S. construction news continues to focus […]

Category: Macroeconomics

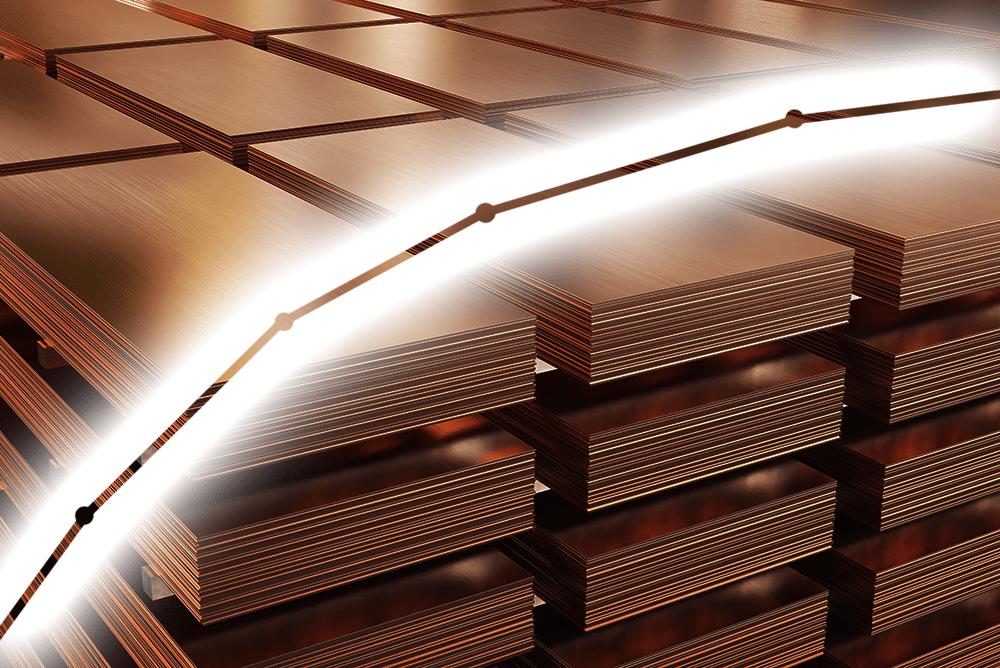

Copper MMI: Copper Prices Remain Sideways as China Uncertainty Looms

Copper prices today remain trapped in a sideways range. Prices lack enough bearish or bullish momentum to establish a strong trend in either direction. Prices declined during the first weeks of January, falling to their lowest level since November. However, they rebounded in the second half of the month. This brought them a mere 0.52% […]

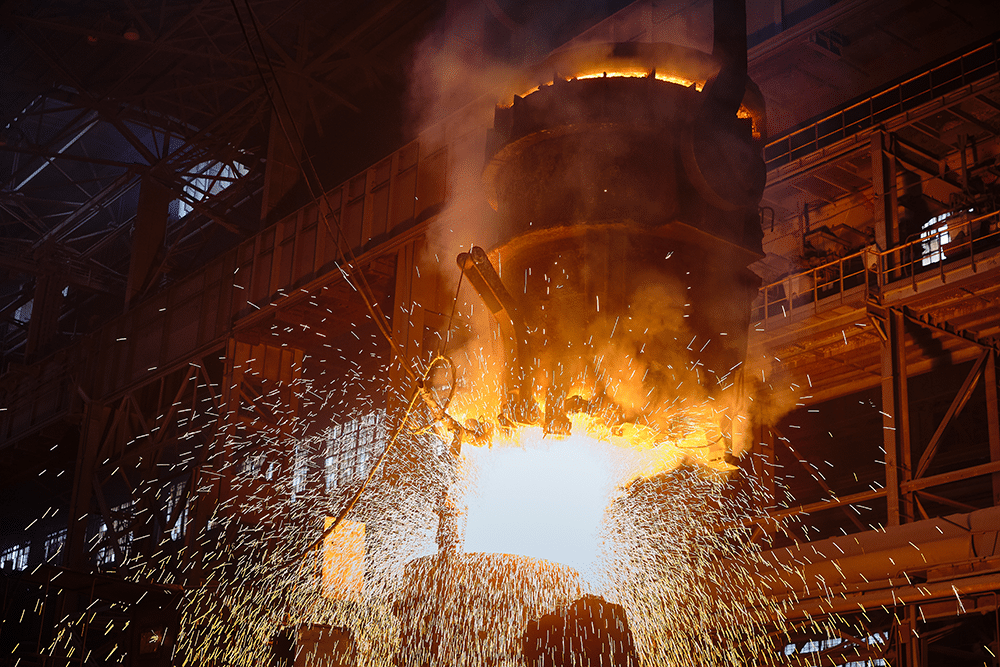

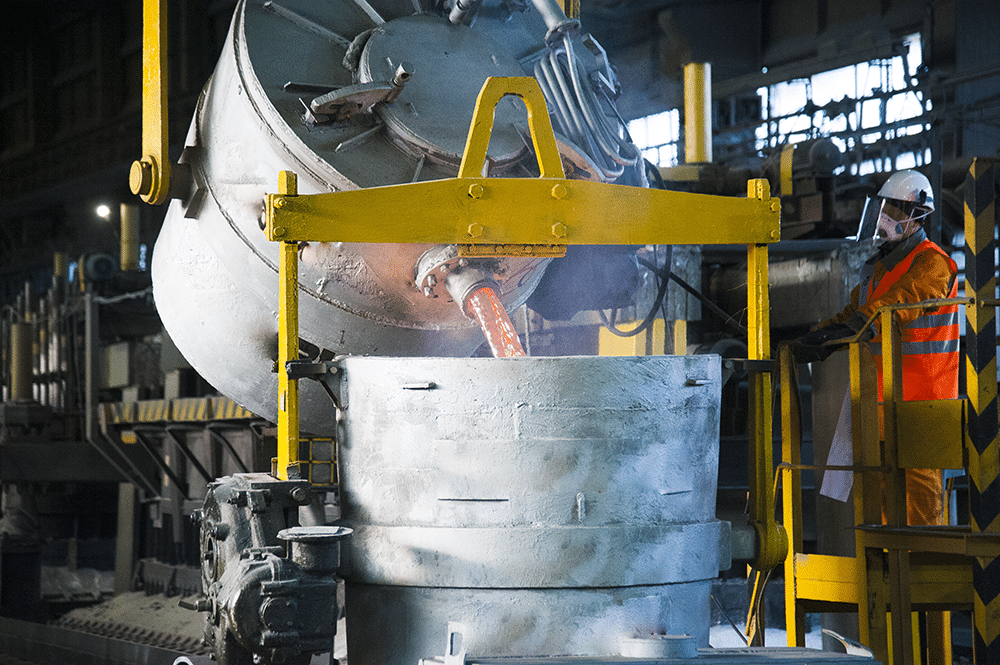

Steel Production Declines in December 2023: Factors Impacting the Global Steel Market

Data from the World Steel Association (Worldsteel) released on January 25 indicates that global crude steel production remained largely unchanged year on year. Indeed, steel market analysis says poured liquid steel totaled 1.88 billion metric tons last year, which is similar to the volume poured in 2022. The association also stated that crude steel production […]

China’s Economic Jitters: Evergrande Liquidation Sparks Global Concerns

The recent liquidation order by a Hong Kong court of debt-ridden Chinese property giant Evergrande has once again raised that dreaded question: is China’s economy a ticking time bomb? It is a question experts continue to ask amid worsening Chinese construction news. Not long ago, two rival property construction firms, Evergrande and Country Garden, were […]

January Market Roller Coaster Ride from Euphoria to Bearish Pressure

January 2024 unfolded as a dynamic and volatile month for financial markets and commodity prices. The early weeks of January saw euphoria among investors fueled with hopes of receding inflation concerns and a dovish fed. However, a hawkish central bank and geopolitical tensions soon dampened that optimism. Meanwhile, falling oil prices and tightened investments drove […]

Is China’s Surge in Crude Oil, Coal, and Iron Ore Imports Really a Sign of Economic Strength?

News coming out of China indicates the country set new records in 2023 for the import of crude oil, coal, and iron ore. The revelation caught many by surprise, but analysts caution that this may not really signify a robust demand for these essential materials. Nor does it indicate that there has been any reversal […]

Copper MMI: Deep Market Contango, Index Moves Sideways

Copper prices saw a 1.90% increase during the final month of the year. By late December, this managed to bring them to their highest level since August, leading to mixed copper price forecasts for 2024. However, prices began to retrace from their 5-month peak by the start of 2024. By mid-January, they remained trapped within […]

Construction MMI: Construction News Puts Infrastructure on Top for 2023

After a mostly sideways 2023, the Construction MMI (Monthly Metals Index) also entered 2024 sideways with only a small 2.5% increase. Furthermore, all index components except for European aluminum commercial 1050 sheet and shredded scrap steel moved in a sideways price trend. Meanwhile, construction news sources indicate that infrastructure projects proved to be the top-performing […]

Raw Steels MMI: Steel Prices Weak Amid Backwardation

The Raw Steels Monthly Metals Index (MMI) rose 3.25% from December to January. U.S. flat rolled steel prices closed the year decidedly bullish. A nearly 14% month-over-month rise saw HRC prices easily outperform all base metals both during the month and throughout 2023 as a whole. Meanwhile, plate prices saw an upside correction after prices […]

Conflicting Reports Signal Chinese Aluminum Supply Uncertainty

Conflicting reports continue to emerge from China regarding aluminum supply, demand, and production. Some information notes that the downturn in the country’s economy is largely due to the ongoing real estate crisis. As demand wanes, this poses questions regarding the internal pickup of aluminum and other base metals. However, other reports talk of the country […]