The GOES MMI (Monthly Metals Index), which tracks, grain-oriented electrical steels, fell one point to 188 as other flat-rolled steel products saw a price increase.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Meanwhile, imports continue to grow, but none of the growth has come from China. In fact, Japan and the U.K. supplied the bulk of the imports in January. Buying organizations continue to report to MetalMiner they import grades of electrical steel not currently produced by the sole domestic producer, AK Steel. (See the latest import data below.)

[caption id="attachment_90225" align="aligncenter" width="585"]

AK posted a Q4 loss but CEO Roger Newport made a number of comments regarding electrical steels during the most recent earnings call that indicated why the company supports strong Section 232 import measures:

“As we previously stated, we strongly believe that the ongoing high level of imports is a threat to the national security of our country…

Imports of grain oriented electrical steels, also known as GOES have more than doubled year-over-year and these imports are coming primarily from Japan, Korea and China. In my opinion this surge of GOES imports stems from a deliberate effort on part of these and other countries to beat the clock on any future 232 remedies and also by the Chinese trade protection causing Korea and Japan to send products to the United States.”

Unlike other steel products, such as tubular goods, cold-rolled steel, hot-dipped galvanized steel, solar panels and washing machines, MetalMiner is not aware of a single circumvention case for grain-oriented electrical steels.

Meanwhile, Bank of American Merrill Lynch analyst Timna Tanners double downgraded AK Steel on weak first quarter guidance and “lack of catalysts” to improve margins.

In Other Producer News…

ThyssenKrupp and Tata Steel have finally announced a joint-venture in Europe with the goal of becoming “a leading European flat steel provider and position it as a quality and technology leader,” according to a ThyssenKrupp press release. Both ThyssenKrupp and Tata have GOES production capability.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Exact GOES Coil Price This Month

Category: Premium

Global Precious MMI: Palladium-Platinum Gap Narrows, Moves Closer to Historical Norm

The Global Precious MMI (Monthly Metals Index) picked up one point this month, rising to 92 for our February reading. Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need Within the basket of metals, Chinese gold bullion and U.S. silver ingot/bars picked up in price. Palladium, which has bucked the historical trend by […]

Copper MMI: Copper Prices Cool After December Surge

The Copper MMI (Monthly Metals Index) traded lower this month, falling one point for a February reading of 87. The fall was driven by a slight retracement of copper prices, which had skyrocketed in December. In January, LME copper prices fell by 1.21%.

Despite the price retracement, LME copper prices held above the $7,000/mt level at the beginning of February, and fell below this level during the second week. Trading volumes still support the uptrend. Copper prices could continue their rally.

Need buying strategies for copper in 2018? MetalMiner’s Annual Outlook has what you need

[caption id="attachment_90192" align="aligncenter" width="585"]

Labor Disputes Could Threaten Copper Supply

Mine strikes continually threaten copper supply. BHP’s Escondida mine, the world’s largest copper mine, failed to develop a new labor agreement in advance of formal negotiations, scheduled for June. Last year, a 43-day strike at the Escondida mine impacted copper supply.

Since BHP’s Escondida copper mine produces around 5% of the world’s copper, it’s easy to see the impact of strikes on LME copper prices.

Meanwhile, Glencore forecasts its own copper output to increase by 150,000 tons at its Katanga mine in the Democratic Republic of Congo.

U.S. Dollar, Copper Back to Negative Correlation

Copper and the U.S. dollar maintain a strong negative correlation. The negative correlation gives the direction of the trends; when the U.S. dollar is weaker (downtrend), copper prices are stronger (uptrend).

The negative correlation did not hold during the first six months of 2017, nor did it hold for commodities and the U.S. dollar. However, the historical negative correlation has reappeared, as copper prices and the U.S. dollar now trade in opposition to one another.

[caption id="attachment_90193" align="aligncenter" width="585"]

The U.S. dollar traded sideways during Q3 2017. Many analysts (not MetalMiner) started to believe the U.S. dollar had reached a bottom.

MetalMiner, however, remained more bearish on the U.S. dollar, as the dollar did not give any clear signs of a trend reversal. The distinction between a short-term trend that could impact prices in one to three months, versus a long-term trend, which could actually impact a buying strategy becomes important. The fact remains, the U.S. dollar has fallen to a more than three-year low.

Copper Scrap vs. LME Copper

In January, copper scrap prices did not move with the LME copper price. LME copper prices fell slightly, while copper scrap prices increased by 2%. Therefore, the spread between the two decreased slightly this month. We can expect these types of divergences in the short term, although the two tend to trade together over the longer term.

[caption id="attachment_90194" align="aligncenter" width="585"]

In January, several Chinese copper scrap restrictions went into effect. The Ministry of Environmental Protection announced that only end-users and copper scrap processors will be allowed to import. This restriction in effect removes Chinese traders from the copper scrap market.

What This Means for Industrial Buyers

In January, buying organizations had some opportunities to buy some volume. The weak U.S. dollar and strength of other base metals support the bull narrative for copper. As long as copper prices remain bullish, buying organizations may want to “buy on the dips.” For those who want to understand how to reduce risks, take a free trial now to the MetalMiner Monthly Outlook.

Want to see an Copper Price forecast? Take a free trial!

Actual Copper Prices and Trends

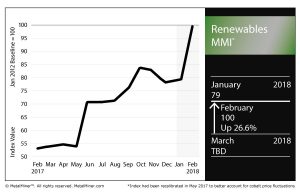

Renewables MMI: Steel Plate, Cobalt Prices Post Sharp Increases

[caption id="attachment_88708" align="alignleft" width="300"]

The Renewables MMI (Monthly Metals Index) skyrocketed this month, gaining 21 points en route to a 100 February reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The basket of metals posted price increases across the board, particularly in the steel plate category.

Japanese steel plate jumped 2.8%, while Korean steel plate rose 2.4%. Chinese plate jumped slightly, by 0.3%, and U.S. plate was up 6.5% as of Feb. 1.

Prices of neodymium, silicon and cobalt from China all posted significant price increases over the past month.

Scarcity of Critical Minerals to Threaten Renewable Industry?

According to a report from Stanford University, a scarcity in rare minerals could undercut the move toward greener forms of energy.

The topic was put forth for discussion at a mineral resources conference hosted by the university last month.

“Due to the rapidly increasing need for mineral resources as Earth’s human population continues to grow exponentially and the need to minimize the environmental and social impacts of mining, it’s essential that Stanford be involved in the field of economic geology — the study of the formation, exploration, and utilization of mineral resources,” said Gordon Brown, a professor of geological sciences at Stanford’s School of Earth, Energy & Environmental Sciences, as quoted in the report.

Uranium, copper, gold, lithium and rare earth elements (REEs) were among the materials cited in the report as critical to the future of renewable energy.

Among the trends impacting the supply of these valuable materials, according to the report, included: humanity’s increasingly growing rate of metal consumption, the concentration of rare elements in a relatively few countries, the quality (or lack thereof) of U.S. mineral mapping and reduction of mineral waste.

Cobalt Price Rises as Congo Seeks More Control of Market

Speaking of the concentration of minerals, the Democratic Republic of Congo is home to more than half of annual global cobalt production each year (in 2016, 66,000 of the 123,000 tons produced worldwide were sourced in the DRC, according to the U.S. Geological Survey).

Prices of cobalt are on the rise, shooting up a whopping 44.8% month over month.

With a number of international mining firms doing business in the DRC, the country’s largest state-owned mining company, Gecamines, is seeking to assert greater control of the market, Bloomberg reported.

“I find it scandalous that when cobalt is discussed, and the explosion of electric vehicles, only the traders and consumers are referenced and Congo and Gecamines are not cited,” Gecamines Chairman Albert Yuma was quoted as saying.

As reported by Reuters, Gecamines wants to renegotiate its contracts with foreign firms in order to work toward asserting further control of that cobalt market.

Cobalt is valuable for, among other uses, its application in electric vehicle batteries.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

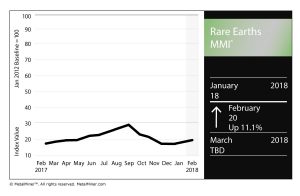

Rare Earths MMI: U.S. National Energy Technology Lab Works on Rare Earth Element Recovery Projects

The Rare Earths MMI (Monthly Metals Index) hit 20 for our February meeting, up from 18 last month.

Several of the heavier hitters in the basket of metals posted price increases this past month. Yttrium jumped 3.3%, while terbium oxide rose 12.4%.

Neodymium oxide surged 11.3% and dysprosium oxide rose 6.0%.

U.S. Lab Works to Increase Rare Earth Element Recovery

As we mention here every month, China has overwhelming control of the global rare earths market, meaning supply-side squeezes in the country often yield price spikes for the valuable materials used in things from electric vehicles to smartphones.

Unsurprisingly, the U.S. is looking for ways to increase its ability to recover rare earth elements (REEs) in domestic supplies of coal.

According to the National Energy Technology Laboratory (NETL), it is taking steps toward that goal.

“Four rare earth elements (REEs) recovery projects managed by the U.S. Department of Energy’s (DOE) Office of Fossil Energy and the National Energy Technology Laboratory (NETL) have made significant progress in the development of a domestic supply of REEs from coal and coal by-products by successfully producing REE concentrates,” a NETL release states.

The lab has run four test projects in different parts of the country. According to the release, the results of the projects are as follows:

-

Physical Sciences, Inc. (pilot-scale project) achieved 40 percent REE concentration at 15 percent REE recovery using post-combustion fly ash from burning Central Appalachian Basin coal. Field implementation and testing of physical processing technology will occur in Kentucky, with subsequent chemical processing in Pennsylvania.

-

The University of Kentucky (pilot-scale project) achieved greater than 80 percent REE concentration at greater than 75 percent REE recovery using Central Appalachian Basin and Illinois Basin coal preparation plant refuse. The project team plans to implement and test their technology at multiple field locations in Kentucky.

-

The University of North Dakota (bench-scale project) achieved 2 percent REE concentration at 35 percent REE recovery using North Dakota lignite coal. The University will build and test the technology in their laboratory.

-

West Virginia University (WVU) (bench-scale project) achieved 5 percent REE concentration at greater than 90 percent REE recovery using acid mine drainage solids from the Northern Appalachian and Central Appalachian Basins. WVU plans to build and test their unit in the WVU laboratory.

Of course, any new domestic capacity to recover REEs in the U.S. will be met with happiness by domestic end users, who have to pay a fortune for these rare and valuable materials.

Southeastern Alaska Town to be New Home of Rare Earths Plant

According to the a report in Mining News, the town of Ketchikan, Alaska, was chosen to be the new home of a rare earths processing facility.

Ucore Rare Metals Inc. picked the southeastern Alaska town for a new planned strategic metals complex (SMC).

“Engineering and economic studies have confirmed that Ketchikan is our preferred location to construct our first strategic and critical metals separation facility” said Mike Schrider, Ucore’s vice president of operations and engineering, in a company release. “Additional engineering and product specification criteria are being initiated at this time targeting rare earth by-products and primary concentrates from non-Chinese sourced projects world-wide. The intent is also to maintain the processing flexibility and capacity to accommodate ore concentrate from the Bokan-Dotson Ridge Project, once that project has been developed.”

According to the release, among other factors, Ketchikan’s proximity to the container port and rail head at Prince Rupert was cited as part of the locale’s desirability for the new SMC.

“Ketchikan features deep water port, barge-container facilities and direct access to markets in the US and the Pacific Rim by way of ocean vessel, the lowest-cost mode of bulk transport,” the release states. “Ketchikan offers a unique work force, ice-free harbors and is in close proximity to Ucore’s flagship in-situ development project, the Bokan Dotson-Ridge Rare Earth Project (“Bokan”).

Actual Metal Prices and Trends

Aluminum MMI: Aluminum Demand Gets Boost from Automotive, Aerospace Sectors

After last month’s sharp increase, the February Aluminum MMI (Monthly Metals Index) inched up one point.

The basket of metals increased despite the slight retracement of LME aluminum prices.The current Aluminum MMI index reads 99 points, 1.0% higher than in January.

In January, MetalMiner anticipated a possible retracement in aluminum prices, as aluminum — and, generally, all base metals — increased sharply at the end of the month. LME aluminum prices fell by 2.8% in January from the previous 2-year high closing price in December.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_90155" align="aligncenter" width="580"]

Aluminum prices inched lower during the first few days of February. Aluminum prices broke out of their previous sideways trend back in August, providing a strong buying signal. As prices may continue to increase, buying organizations may want to understand how to better purchase aluminum, reducing both risks and costs.

U.S. Domestic Aluminum Market

The U.S. Department of Commerce sent the Section 232 report for aluminum products to President Trump in January. President Trump has 90 days (from January 22) to review and announce actions regarding the probe for aluminum products.

Meanwhile, domestic aluminum demand received a boost from stronger U.S. automotive and aerospace sectors.

Despite the fall in U.S. auto sales in January, aluminum producers see increased demand. Demand has increased so significantly that Novelis Inc., the biggest flat-rolled products maker, announced the investment of a new plant in Kentucky to support growing automotive demand.

[caption id="attachment_90156" align="aligncenter" width="580"]

Chinese Aluminum Market

SHFE aluminum prices currently trade lower than LME prices. Although the trends appear to be similar, SHFE aluminum prices fell further in January. Lower SHFE prices relative to LME aluminum prices lead to increased Chinese exports to Asia.

[caption id="attachment_90157" align="aligncenter" width="580"]

According to the latest Chinese customs data, Chinese exports of unwrought aluminum and aluminum products increased by 12.8% in December compared to December 2016 data. December exports also increased on a monthly basis by 15.8% over November’s figures.

Aluminum Premiums

U.S. Midwest aluminum premiums moved again at the beginning of February, and currently trade at $0.12/pound. The Section 232 investigation and uncertainty around the outcome has increased the volatility in the U.S. Midwest premium.

Other aluminum delivery premiums also increased this month. The CIF Japanese spot premium increased 12% over January, to $98.50-$110/mt from the previous $90-96/mt. The European duty-unpaid premium jumped by 8.1%, while the Brazil CIF duty-unpaid premium increased by 3%.

What This Means for Industrial Buyers

As expected after last month’s sharp increase, aluminum prices retraced in January. In bullish markets, buying organizations still have many opportunities to forward buy. Therefore, adapting the “right” buying strategy becomes crucial to reduce risks.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Construction MMI: 2017 U.S. Construction Spending Rises 2.7%

The Construction MMI stood pat this past month, holding at 94 for our February reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap steel jumped 7.7%. European 1050 sheet aluminum dropped marginally (by 0.05%), while the Chinese aluminum bar price jumped 1.7%.

U.S. Construction Spending

According to the most recently available Census Bureau data, U.S. construction spending in December 2017 amounted to $1,253.3 billion, up 0.7% from the revised November estimate of $1,245.1 billion.

December 2017 spending was up 2.7% year over year, compared with the $1,221.6 billion spent in December 2016.

By value, the value of construction in 2017 was $1,230.6 billion, up 3.8% from $1,185.7 billion in 2016.

Private construction spending grew more than its public counterpart. Private construction spending jumped 0.8% from the previous month to $963.2 billion, Within that umbrella, residential and nonresidential spending jumped 0.5% and 1.1%, respectively.

Meanwhile, public construction spending jumped 0.3% to $290 billion in December 2017 from the previous month. Educational construction spending jumped 1.6% from November, while highway construction picked up a 0.3% spending gain.

Home Sales Down in December but Up for the Year

According to the National Association of Realtors, existing-home sales dropped in December but were up 1.1% for 2017.

The 5.51 million sales executed in 2017 marked the highest total since 2006 (6.48 million).

“Existing sales concluded the year on a softer note, but they were guided higher these last 12 months by a multi-year streak of exceptional job growth, which ignited buyer demand,” said Lawrence Yun, the NAR’s chief economist, in a prepared statement. “At the same time, market conditions were far from perfect. New listings struggled to keep up with what was sold very quickly, and buying became less affordable in a large swath of the country. These two factors ultimately muted what should have been a stronger sales pace.”

New housing starts, however, were down significantly in December.

According to jointly released data from the Census Bureau and the U.S. Department of Housing and Urban Development, new home starts in December dropped 8.2% compared with November totals. The 1,192,000 housing starts in December also marked a drop compared with December 2016, falling by 6.0%.

The Future of Construction

According to an article in Forbes, three trends could have a significant impact on the construction industry: robotics, drone imagery and digital project collaboration tools.

“Construction will benefit from robotics in work that is dangerous, is repetitive, and where heavy lifting is required,” Zak Podkaminer, of Construction Robotics, told Forbes. “[In] high precision work such as complex designs and patterns, robotics will provide a significant time savings allowing for more digital fabrication and provide architects more creative flexibility.”

Actual Metal Prices and Trends

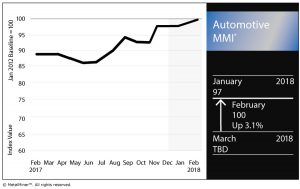

Automotive MMI: General Motors Starts 2018 on Strong Sales Note

The Automotive MMI got off to a hot start in 2018, picking up three points en route to a February reading of 100. The February reading marked the first triple-digit performance for the MMI since it posted a 101 in January 2014.

As for the basket of metals, a majority of the bunch posted price increases this past month.

Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need

U.S. HDG steel jumped 2.7% as of Feb. 1, while U.S. platinum bars rose 6.2%. Fellow platinum-group metal (PGM) palladium fell for the month, however, by 5.8%.

U.S. shredded scrap jumped 7.7% and Korean aluminum 5052 coil rose 6.7%.

U.S. Auto Sales

January proved to a be a mixed bag for automakers vis-a-vis their U.S. sales.

According to data from Autodata Corp released Feb. 1, topping the charts in January was General Motors Corp., with 198,386 units sold, up 13% year over year. Sales of light trucks carried the day, as they increased 12.6% to soften a 30.2% drop in car sales. (General Motors is expected to announce its fourth-quarter 2017 and full-year earnings Tuesday, Feb. 6.)

In mid-January, GM forecasted 2018 would be another good year. According to a GM release, the company benefited from “continued strength” in North America and China, plus improvement in South America.

“GM had a very good 2017 as we continued to transform our company to be more focused, resilient and profitable,” GM Chairman and CEO Mary Barra said in the release. “We are positioned for another strong year in 2018 and an even better one in 2019.”

GM touted its growth in truck sales in a release last Thursday.

“All of our brands are building momentum in the industry’s hottest and most profitable segments,” said Kurt McNeil, U.S. vice president, sales operations, in the prepared statement. “Chevrolet led the growth of the small crossover segment with the Trax as well as the mid-pickup segment with the Colorado. Now, we have the all-new Equinox and Traverse delivering higher sales, share and transaction prices.”

Meanwhile, Ford Motor Company, which called 2017 a “challenging” year during its earnings call last week, didn’t have quite as good of a month. Ford posted a 6.3% year-over-year sales drop, with 160,411 units sold in January.

Down the list, Fiat Chrysler had a rough month, posting a 12.8% year-over-year decline. Toyota sales jumped 16.8%, Honda‘s were down 1.7% and Nissan‘s jumped 10.0%.

Volkswagen, meanwhile, found itself adding to the bad press from its Dieselgate scandal when it was reported last month that the company conducted exhaust tests on monkeys. Volkswagen’s January U.S. sales were down a whopping 32.8% year over year.

China and EVs

Everybody knows about Tesla and Elon Musk — but what about China and its role in what will assuredly become an increasingly electrified automotive world?

According to Bloomberg, one small town in southeast China will house a planned $1.3 billion battery factory that could stymie the global competition.

“The company plans to raise 13.1 billion yuan ($2 billion) as soon as this year by selling a 10 percent stake, at a valuation of about $20 billion,” the Bloomberg report states. “The share sale would finance construction of a battery-cell plant second in size only to Tesla Inc.’s Gigafactory in Nevada—big enough to cement China as the leader in the technology replacing gas-guzzling engines.”

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Renewables MMI: International Trade Commission Mulls Extending 18-Year Steel Plate Tariffs

The Renewable Monthly Metals Index (MMI) picked up a point for our January reading, rising from 78 to 79 (a 1.3% jump).

Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need

Several of the heavier hitters in this basket of metals posted price increases this past month.

U.S. steel plate rose 4.0% and U.S. grain-oriented electrical steel (GOES) coil rose 3.8%. Korean steel plate also increased, rising by a whopping 8.9% for the recent monthly window.

Chinese silicon and cobalt cathodes also posted notable price jumps. Meanwhile, Chinese steel plate fell slightly, while Japanese steel plate posted a small price jump.

Continuation of Steel Plate Tariffs on the Table

U.S. Rep. Pete Visclosky (D-Merrillville, Indiana) testified before the International Trade Commission recently on the subject of extending 18-year-old duties on cut-to-length carbon-quality steel plate from India, Indonesia and South Korea, the Northwest Indiana Times reported.

Northwest Indiana, where Merrillville sits, is home to significant domestic steel industry activity, including by ArcelorMittal, which produces steel plate at its Burns Harbor Plate Mill — located in Gary, Indiana — the paper reported.

“As a representative and resident of Northwest Indiana, I am acutely aware of the challenges facing the American steel industry due to the onslaught of illegal steel imports,” the Times quoted Visclosky as saying during testimony at a hearing in Washington, D.C. “The ArcelorMittal facility at Burns Harbor in Northwest Indiana makes cut-to-length carbon-quality steel plate, and every one of those dedicated workers deserve to be able to continue to fairly compete and make the best steel to the best of their ability in our global economy.”

Of course, the issue is one of many metals-related trade issues before U.S. trade bodies (the most headline-grabbing being the Section 232 probes into steel and aluminum imports, for which a ruling is expected this month).

Like the Section 232 probes, which seek to determine whether those imports negatively impact the country’s national security, Visclosky also cited national security concerns vis-a-vis steel plate imports.

GOES Gets a Boost

As reported by our Lisa Reisman yesterday, grain-oriented electrical steel (GOES) got a boost this past month.

GOES prices, as Reisman noted, usually don’t move in tandem with other forms of steel — but it didn’t play out that way in December.

Import levels, however, are something to monitor going forward.

“In addition to prices moving in a similar direction, import levels also followed similar patterns, although GOES imports showed a dramatically higher increase whereas finished steel imports grew by 14.5% on an annualized basis according to the American Iron and Steel Institute (AISI),” Reisman added.

While China is often the subject of much discussion regarding a flood of imports into the U.S., when it comes to GOES, Japan is actually the leader in exports to the U.S.

[caption id="attachment_89715" align="aligncenter" width="580"]

Japan owns about two-thirds of the U.S. GOES import market share, rising significantly despite a drop in overall finished steel sent to the U.S.

The explanation for that disparity?

“Increased domestic efficiency standards have led to the development of higher performance electrical steels (HB), which have taken share away from the more conventional grades produced by the sole U.S. producer,” Reisman wrote. “With no U.S. producer of these grades, the market has become more reliant on exports from Japan.”

Actual Metal Prices and Trends

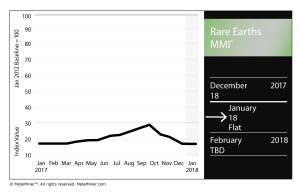

Rare Earths MMI: Global Market Projected to Hit $20 Billion by 2024

The Rare Earths Monthly Metals Index (MMI) held flat for the month, posting a value of 18 for our January reading.

Reflecting the lack of movement in the MMI value, the basket of metals posted modest price fluctuations.

Two-Month Trial: Metal Buying Outlook

Chinese yttrium rose 1.9%, while terbium oxide dropped 0.8%. Neodymium oxide fell 1.3% on the month.

Australian Miner Receives State’s EPA Approval

A $900 million Australian miner received approval from the state’s Environmental Protection Authority (EPA), mining.com reported.

According to the report, Arafura Resources received approval on Friday after a two-year process. The EPA had been considering the environmental impacts of the Nolans rare earths project, the website reported, concluding that those risks at the site could be managed.

According to the report, Arafura estimates the project would create an investment of about $900 million in central Australia.

Global Market to Reach $20 Billion by 2024

The global rare earths market is projected to hit a value of $20 billion by 2024, according to a research report by Global Market Insights, Inc.

“Growing demand for magnets in automobiles, and energy generation will majorly contribute to the growth of global rare earth metals market over the forecast period,” the Globe Newswire release states. “The demand for rare earth magnets is majorly increasing by their consumption in electric and hybrid vehicles, and wind turbines. Increasing focus on utilizing clean and renewable energy is giving a substantial pressure on the electricity providers, to generate energy through renewable sources, which in turn will show a positive impact on the growth of this market.”

Not surprisingly given China’s overwhelming dominance of the rare earths markets, prices will continue to fluctuate somewhat wildly based on Chinese supply.

As for individual metals, neodymium will continue on in its place at or near the top of the rare-earths heap.

“By revenue, neodymium had the highest market share in 2016, with a market share of over 30%,” the release states. “It will dominate the global rare earth metals market till the end of projected period. Neodymium market will grow at a CAGR of 8.2% from 2017 to 2024.”

Free Sample Report: Our Annual Metal Buying Outlook