The Global Precious Metals MMI (Monthly Metals Index) moved sideways, trending up by a slight 1.14%. Despite the sideways movement, precious metals prices have been anything but stale. The past two weeks have been dramatic for the precious metals market, as gold set new records, silver touched levels not seen since 2011 and palladium and […]

Category: Sourcing Strategies

Rare Earths MMI – End of Summer Rally: New U.S. Policy Moves and 40% Price Spikes

The Rare Earths MMI (Monthly Metals Index) moved sideways, but gained bullish momentum from the prior month, rising 2.15%. This comes as the rare earths market experienced numerous developments over the past 30 days, including discussions between Malaysia and China to develop new plans for rare earth processing. Notably, this would be limited strictly to […]

Rare Earths MMI: Rare Earth Metals Market in Flux as U.S. Intervenes and Prices Rise

The Rare Earths MMI (Monthly Metals Index) moved sideways, rising a modest 0.37%. Overall, the global rare earth metals market has seen a whirlwind of developments in the past few weeks, sending ripples through both supply chains and pricing. A series of U.S. and Chinese policy moves, from Washington’s unprecedented price support for rare earth […]

Aluminum MMI: Midwest Premium Finds a Peak

The Aluminum Monthly Metals Index (MMI) moved sideways as the global price of aluminum ticked modestly higher. Overall, the index rose 0.73% from May to June. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Aluminum Midwest Premium Finds A Peak The Midwest Premium found a peak in […]

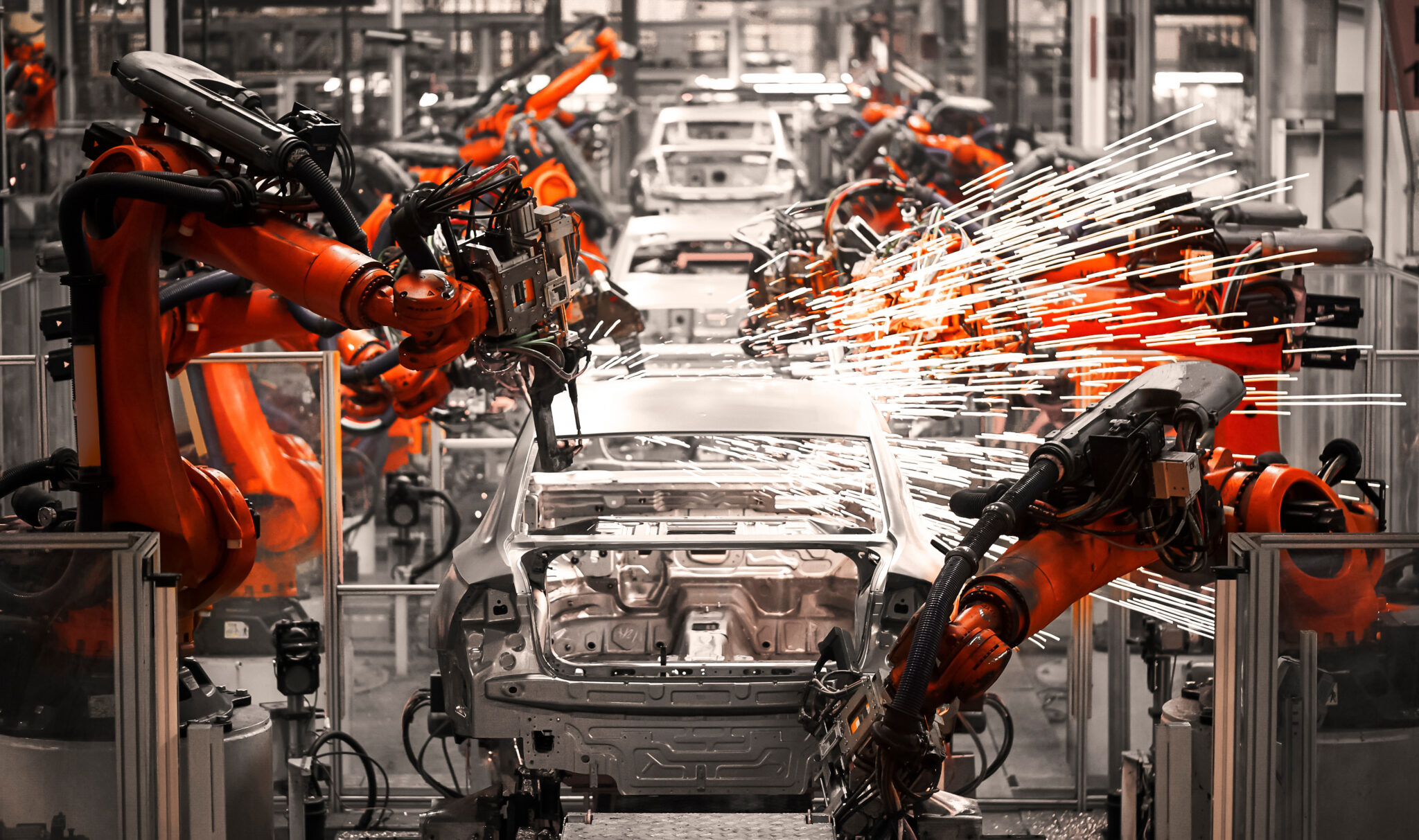

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]

Construction MMI: Hurricane Helene and Hurricane Milton Leave “Path of Destruction” in U.S. Construction Industry

The Construction MMI (Monthly Metals Index) moved sideways, nudging up just 2.54%. Overall, the index continues to move in its more than year-long sideways range, with metal prices remaining stagnant. While the index had a slight response to the September interest rate drop, it will take a lot more than that to generate any type […]

Automotive MMI: Dropping Steel Production Likely to Impact Automobile Manufacturers

The Automotive MMI (Monthly Metals Index) reduced its downward price action, moving sideways month-over-month by 0.43%. While the automotive industry dodged a bullet with the east coast port strike only lasting 3-4 days, the industry could still face more pressure due to lower steel output. Thanks to ongoing mill maintenance that began in August, hot-dipped […]

How Black Swan Events Impact Metal Sourcing. What Can Companies Do to Protect Their Bottom Line?

If you’ve been in the metal procurement game long enough, you’ve likely encountered unanticipated market shocks. These rare occurrences, known as “Black Swan events,” hit hard, leaving devastating consequences in their wake. From global pandemics to geopolitical conflicts, Black Swan events can cripple industrial metal markets, forcing companies to scramble to source critical materials and […]

Renewables MMI: China’s Battery Metals Stockpile, What Does it Mean for U.S. Companies?

The Renewables MMI (Monthly Metals Index) continued to plateau, moving sideways with only a slight 1.29% drop. Currently, there isn’t enough bullish or bearish price action to yank the index too far out of its sideways trend. The historically volatile movements of grain-oriented electrical steel prices are currently the only factor adding any significant volatility […]

Unlocking Efficiency: The Art of Metal Price Forecasting

Metal price forecasting is essential for businesses that buy metal, particularly when dealing with commodities like copper, steel, and aluminum. By precisely projecting future metals prices, companies may make educated judgments regarding their purchasing strategy and ensure that they acquire the metals at the most advantageous periods. Companies that understand the importance of metal price […]