Rare Earths MMI: Value of U.S. mining production rises 3% in 2019

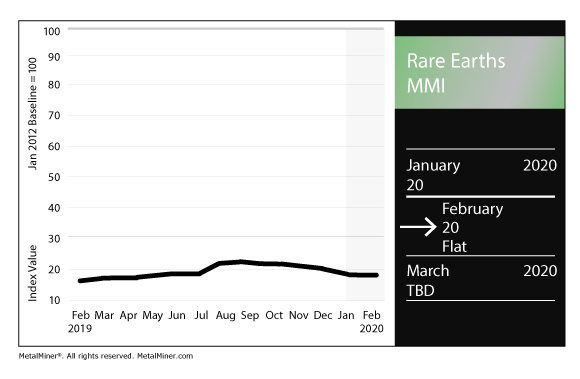

The Rare Earths Monthly Metals Index (MMI) held flat this month for a February MMI reading of 20.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

U.S. mining production rises in 2019

According to the U.S. Geological Survey, the estimated value of nonfuel mineral mining production reached $86.3 billion, up 3% from 2018’s revised total of $84.0 billion.

“The data we are releasing today is vital to understanding which minerals are vulnerable to disruptions in America’s supply chains and provides the analytical foundation for President Trump’s broader strategy to make our economy and defense more secure,” USGS Director Jim Reilly said. “American production of minerals – having an estimated value of more than $86 billion – is critical for all means of commerce and manufacturing with many of these minerals being used in every day household items.”

The U.S. produced 26,000 metric tons of rare-earth mineral concentrates in 2019, marking a 44% increase compared with the previous year.

Nonetheless, the U.S. remains reliant on imports for a number of critical minerals.

The USGS said imports made up more than one-half of apparent consumption for 46 nonfuel mineral commodities; the U.S. was 100% reliant on imports for 17 of those.

In 2017, President Donald Trump issued an executive order defining what is considered to be a “critical mineral” as a “non-fuel mineral or mineral material essential to the economic and national security of the United States” of a supply chain “vulnerable to disruption” and that “serves an essential function in the manufacturing of a product, the absence of which would have significant consequences for our economy or our national security.”

Per the critical mineral definition outlined in the order, 14 of 17 minerals with 100% import reliance qualified as such, in addition to 17 other critical minerals for which the U.S. had an import reliance of at least 50%.

Unsurprisingly, China is the U.S.’s No. 1 import source for mineral commodities, followed by Canada.

Since then, the U.S. has looked into developing new sources of rare earths minerals, which, among other uses, are valuable for military applications.

Late last year, Reuters reported the U.S. and Australia had reached an agreement to cooperate on development of rare earths projects.

Lynas reports quarterly results

Australian rare earths miner and processor Lynas Corporation, the largest rare earths firm outside of China, recently reported its quarterly results for the period ending Dec. 31, 2019.

The firm’s rare earth oxide and NdPr production was in line with previous guidance, Lynas said, at 3,592 tons and 1,270 tons, respectively.

Last August, Malaysian authorities granted Lynas a six-month extension of its license to operate its rare earths processing facility, bringing the next renewal date to March 2020.

“Following announcement of the renewal conditions for our Malaysian operating licence on 16 August 2019, we have been completing all of the work required to comply with the licence conditions and we are confident of lodging renewal documents that satisfy these conditions,” Lynas said in its quarterly report.

In addition, regarding previously announced plans to develop a rare earths separation facility in the U.S., Lynas said it had submitted a compliant tender to the U.S. Department of Defense in December. Furthermore, Lynas advanced plans for the proposed plant, to be built in cooperation with U.S. firm Blue Line Corp., with whom Lynas signed a memorandum of understanding in May 2019.

Improve metal purchase timing and mitigate price risk — trial MetalMiner’s monthly metal buying outlook

Actual metals prices and trends

The Chinese yttrium price rose 0.4% month over month to $32.43/kg. Terbium oxide rose 0.2% to $508.15/kg.

Neodymium oxide rose 2.5% to $42,093.25/mt.

Europium oxide fell 2.0% to $30.27/kg. Dysprosium oxide fell 2.2% to $245.78/kg.

Leave a Reply