Global Precious MMI: Gold price bounces back in second half of August as dollar weakens

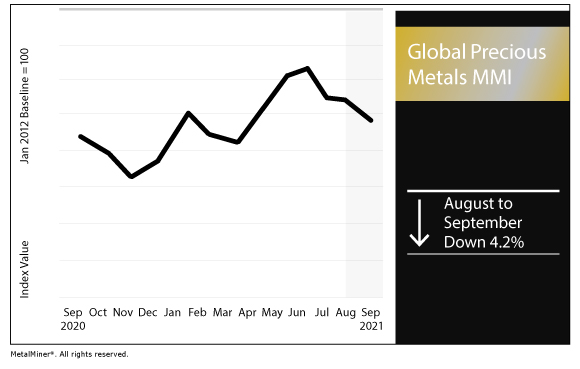

The Global Precious Monthly Metals Index (MMI) fell by 4.2% for this month’s reading, as the gold price took losses early in the month before bouncing back.

More MetalMiner is available on LinkedIn.

Gold price recovers

The gold price bounced back after falling to around $1,730 per ounce in early August.

From there, the U.S. gold bullion price rose to $1,815 by the end of the month.

Meanwhile, the U.S. dollar, which typically has an inverse correlation with gold, picked up in the first two-thirds of the month. The dollar index peaked at 93.57 on Aug. 19 before retracing, closing the month at 92.63.

In other relevant indicators, 30-year Treasury bond yield rates opened August at 1.86% and climbed to a high of 2.03% on Aug. 12 before retreating. The 30-year yield rate closed the month at 1.92%.

Thus far in September, the 30-year yield has continued to retreat, closing Tuesday, Sept. 14, at 1.85%.

Meanwhile, the 10-year yield opened August at 1.20% before closing the month at 1.30%.

Andean Precious Metals reports strong Q2 results

Vancouver-based Andean Precious Metals reported Q2 2021 revenue of $38 million, up from $12.6 million in Q2 2020.

The firm reported net income of $3.9 million, up from a loss of $300,000 in Q2 2020.

Silver equivalent production surged to 1.4 million ounces, up from 886,000 ounces.

For the first half of the year, the miner reported silver equivalent production of 2.9 million ounces. The firm set its FY 2021 guidance for silver equivalent production at between 5.8 million and 6.1 million ounces.

“Andean’s assumed commodity prices supporting this estimate are $24.00/ounce silver and $1,750/ounce gold,” the firm said.

CPI rises 0.3% in August

Runaway inflation remains a concern for consumers and industry alike, as prices for everything from food to energy to construction materials weigh on the economic recovery. In July, the Federal Reserve reiterated its long-term inflation objective of 2%.

However, in August, the Consumer Price Index for All Urban Consumers rose by 0.3%, the Bureau of Labor Statistics reported.

The CPI had jumped by 0.5% in July and by 0.9% in June.

For the 12-month period ending in August, the CPI had jumped by 5.3%, down slightly from 5.4% for the 12-month period ending in July.

Meanwhile, the energy index rose by 2.0% in August, up from 1.6% the previous month. For the 12-month period ending in August, the energy index surged by 25.0%. Within energy, gasoline jumped by 42.7% during the 12-month period.

The new vehicles index jumped by 7.6% during the 12-month period, while used cars and trucks surged by 31.9%.

Monetary policy and COVID

In comments delivered during an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming, inflation emerged as a consistent theme from Federal Reserve Chairman Jerome Powell.

“Seventeen months have passed since the U.S. economy faced the full force of the COVID-19 pandemic,” Powell said. “This shock led to an immediate and unprecedented decline as large parts of the economy were shuttered to contain the spread of the disease.”

However, Powell said “strong policy support” has led to a “vigorous but uneven recovery” from the brief but disruptive pandemic recession.

“In a reversal of typical patterns in a downturn, aggregate personal income rose rather than fell, and households massively shifted their spending from services to manufactured goods,” Powell continued. “Booming demand for goods and the strength and speed of the reopening have led to shortages and bottlenecks, leaving the COVID-constrained supply side unable to keep up. The result has been elevated inflation in durable goods — a sector that has experienced an annual inflation rate well below zero over the past quarter century.”

While rising inflation is a cause for concern, Powell added, he cited several factors that indicate elevated inflation could be a temporary phenomenon.

Powell cited the “absence of broad-based inflation pressures,” moderating inflation for some higher-inflation items, wage increases that do not appear to threaten “excessive inflation,” longer-term inflation expectations and “global disinflationary forces” over the past quarter century.

Actual metals prices and trends

The U.S. silver ingot/bars prices dipped 5.3% month over month to $24.12 per ounce as of Sept. 1.

The U.S. platinum bar price dropped 4.5% to $996 per ounce. U.S. palladium bars fell 8.4% to $2,382 per ounce.

The Chinese gold bullion price was relatively unchanged at $58.39 per gram. Meanwhile, the U.S. gold price ticked up slightly month over month to $1,815 per ounce.

Want MetalMiner directly in your inbox? Sign up for weekly updates now.

Leave a Reply