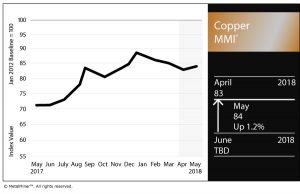

Copper MMI: Copper Prices Bounce Back Up

The Copper MMI (Monthly Metals Index) increased one point in May. Stronger LME copper prices led the increase.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

LME copper prices recovered previous price momentum and increased in April. At the beginning of last month, LME copper prices fell. At this point, buying organizations had an opportunity to buy some volume.

LME copper prices then recovered and moved toward the $7,000/mt level. LME copper prices have also risen so far this month.

Despite a falling copper short-term trend at the beginning of 2018, LME copper prices remain in a long-term uptrend. Therefore, buying organizations can expect further copper price increases.

In May, most of the prices that comprise the Copper MMI basket increased. LME copper rose by 1.5% this month. Indian copper prices increased by 1.33%, while Chinese primary copper prices increased further by 2.03%. Prices of U.S. copper producer grades 110 and 122 rose by 1.06%. Meanwhile, the price of U.S. copper producer grade 102 increased by 1.01%.

Copper Bullish Narrative

The fundamentals also support LME copper prices. Forecasts suggest copper demand will grow this year, while copper mine supply appears unsecured. Therefore, the balance for demand and supply in 2018 could result in a deficit, as it previously did in 2017.

Mitsubishi Materials Corp., Japan’s third-biggest copper smelter, might increase refined copper production by 7% in the April-September period this year. Production in this period will reach 187,374 tons. The increased production comes as a result of stronger domestic copper demand, mainly in the automobile and semiconductor sectors (where copper is used).

The pace of copper demand growth will likely increase and continue until 2020 due to construction in anticipation of the Olympic games.

India’s copper consumption has increased over the last few years. Local demand has grown at a 7-8% rate per year. If the country’s consumption rate increased, India will become a net importer of copper by the end of March 2020.

In April, Vedanta Resources Plc, one of India’s biggest copper smelters, had its renewal of consent to operate its copper smelting plant rejected. The plant remains closed due to scheduled maintenance. The company planned to double capacity at the smelter to 800,000 tons per year. This closure may create more copper imports over the next few months.

Has the EV Boom Lost Its Relevance?

Despite the EV boom that pushed some base metal prices up in 2017, copper demand corresponding to this electric-vehicle sector does not appear strong enough.

Copper demand for the EV sector could reach 1.5% of global copper consumption in 2018. The EV demand for copper will likely increase up to 3% in five years.

Chinese Scrap Copper

Since the announcement of the ban on copper scrap in China last summer, MetalMiner has followed Chinese copper scrap prices closely.

LME copper prices and Chinese copper scrap prices follow the same trend. Both appear to be in a long-term uptrend. However, the latest LME copper price increase appears sharper than Chinese copper scrap prices.

In addition, the spread between Chinese copper scrap prices and LME copper prices appears wider. The wider the spread, the higher the copper scrap consumption — and, therefore, the price. However, this equation may not play out as formulated here, depending on the U.S. Section 301 investigation. The investigation could lead to an additional 25% tariff to copper electric conductors and copper winding wire. Chinese copper products and buying organizations purchasing those could see price increases.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

What This Means for Industrial Buyers

LME copper prices recovered from their previous lows and increased in April, remaining in a long-term uptrend. Therefore, buying organizations could expect further copper price increases.

Buying organizations reading the Monthly Metal Outlook had the opportunity to identify the buying signal at the beginning of April and reduce price risks by purchasing some volume.

For those who want to understand how to reduce risks, take a free trial now to MetalMiner’s Monthly Outlook.

Leave a Reply