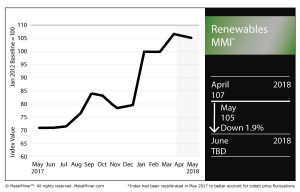

Renewables MMI: Prices Dip as Subindex Posts Two-Point Drop

The Renewables Monthly Metals Index (MMI) tracked back two points, falling to 105 for our May MMI reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Japanese and Korean steel plate posted month-over-month price drops. Meanwhile, Chinese and U.S. steel plate were up for the month.

U.S. grain-oriented electrical steel (GOES) dropped for the month, while Chinese neodymium, silicon and cobalt all posted price drops.

Ethical Concerns in Cobalt Supply Chains

As the electric vehicle (EV) race has heated up in recent years, so, too, has the demand for cobalt, a coveted material used in EV batteries.

Approximately 60% of the world’s cobalt is mined in the Democratic Republic of the Congo, where multinational miners do business despite the precarious political climate in the resource-rich country.

News reports and general coverage of child labor in the cobalt supply chain has led to some companies to issues public statements and, in some cases, take efforts to implement measures to work toward more ethical cobalt supply chains.

As reported by the Financial Times, carmaker Daimler has developed an auditing system through which it can assess its supply chains to avoid sourcing of material from mines where child labor is used.

Cobalt-mining companies came in for criticism from Amnesty International in November.

“More than half of the world’s cobalt, which is a key component in lithium-ion batteries, comes from the DRC, and 20% of it is mined by hand. Amnesty International documented children and adults mining cobalt in narrow man-made tunnels, at risk of fatal accidents and serious lung disease,” the report stated.

“The organization traced the cobalt from these mines to a Chinese processing company called Huayou Cobalt, whose products then end up in the batteries that are used to power electronics and electric vehicles.”

Speaking of Cobalt…

As we mentioned yesterday in our Rare Earths MMI report, EV maker Tesla is one firm that is deemphasizing cobalt in its product mix.

“The cobalt content of our Nickel-Cobalt-Aluminum cathode chemistry is already lower than next-generation cathodes that will be made by other cell producers with a Nickel-Manganese-Cobalt ratio of 8:1:1. As a result, even with its battery, the gross weight of Model 3 is on par with its gasoline-powered counterparts.”

Benchmark your current cold rolled coil sheet prices and see how it compares to the market

Given cobalt’s high cost, relative scarcity and sometimes unreliability of its supply (as a result of political tensions in the DRC), some companies have looked to scale back the percentage of cobalt used in their batteries, instead opting for other materials.

Leave a Reply