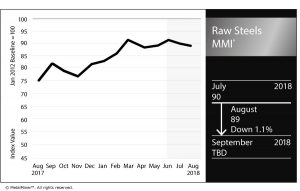

Raw Steels MMI: Steel Price Momentum Slows

The Raw Steels Monthly Metals Index (MMI) fell one point further this month, dropping to 89 from the previous 90 reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The Raw Steel MMI has returned to May 2018 levels. The slight drop came as a result of slower domestic steel price momentum.

Domestic steel prices still remain at a more than seven-year high. However, the pace of the increases seems to have slowed recently. Domestic steel prices — with some exceptions — are mostly trading sideways, and some steel forms have started to drop slightly.

Plate and HRC ended higher last month, while CRC and HDG prices dropped. Long lead times in Q2 and Q3 combined with supply shortages have supported domestic steel prices. However, lead times seem to be shortening now, which may causes prices to drift lower.

Historical steel price cyclicality could cause prices to move lower at some point. Domestic steel prices have stayed in a sharp uptrend since January 2018. Prices may begin to come off slightly at some point this year.

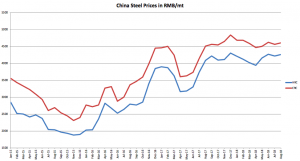

Chinese Steel Prices

So far in August, Chinese steel prices have increased. Chinese steel prices appear to be in recovery and have started an uptrend, after a slight downtrend, since the beginning of the year.

Chinese steel prices tend to drive U.S. domestic steel prices. Therefore, buying organizations may want to keep a close eye on pricing.

Domestic Shredded Scrap

Shredded scrap prices traded sideways this month. Scrap prices commonly follow the same trend of domestic steel prices.

Scrap prices have been in an uptrend since the beginning of the year (along with steel prices). The pace of the increases appears to be less sharp, but scrap price movements this year appear to be less volatile than steel prices.

What This Means for Industrial Buyers

Since steel prices remain high, buying organizations may want to closely follow price movements to decide when to commit mid- and long-term purchases.

Buying organizations looking for more clarity on when to buy and how much to buy may want to take a free trial now to our Monthly Metal Buying Outlook.

Actual Raw Steel Prices and Trends

The U.S. Midwest HRC 3-month futures price fell this month by 4.34%, falling to $815/st.

Chinese steel billet prices decreased again this month by 4.05%, while Chinese slab prices fell 2.1% moving to $626/mt.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

The U.S. shredded scrap price closed the month at $371/st, trading flat from last month.

Leave a Reply