Raw Steels MMI: U.S. steel prices make gains, aided by auto sector

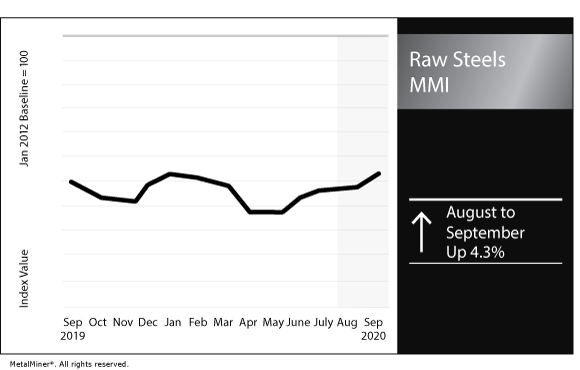

The Raw Steels Monthly Metals Index (MMI) increased by 4.3% for this month’s value.

Does your company have a steel buying strategy based on current steel price trends?

U.S. steel prices start increasing

HRC prices increased by over 5.4% throughout August, closing at $486/st. During the first two weeks of September, the price rallied up to $521/st.

Meanwhile, Chinese HRC prices mostly traded sideways during August and the first two weeks of September.

The recovery of the U.S. auto industry might be driving the steel price increases.

U.S. auto production continued to improve. Producers such as General Motors, Ford and Fiat Chrysler ramped up their assembly plants.

However, supply has not quite caught up with demand. As such, U.S. auto inventory continues to tighten.

By the end of June, vehicle inventory fell to 2.6 million, or 33% fewer units year over year. Pundits suggest U.S. auto sales will reach an annualized 13.5 million unit rate for 2020, with stronger demand coming in 2021.

The aforementioned factors have not only supported the U.S. HRC price; HDG prices also surged.

The U.S. HDG price only increased by 5.6% throughout August, reaching $736/st, but found further support during the first two weeks of September. By the end of the second week of September, HDG broke resistance to $788/st.

Chinese steel market

After record imports in July, China’s iron ore imports in August fell 10.9%.

The General Administration of Customs reported China imported 100.36 million tons of iron ore throughout August, while consumers bought 112.65 million tons in July. However, imports increased 5.8% year over year.

According to Tang Binghua, of Founder CIFCO Futures, imports slowed in August partly due to port congestion from coronavirus-related restrictions. In addition, fewer shipments came from Australia as it closed its financial year.

The Chinese steel market has recovered ahead of the U.S. market as the manufacturing and construction sectors revamped after the lockdowns.

The capacity utilization rate at Chinese blast furnace steel mills reached 86.21% at the end of August, according to Mysteel. The August 2020 rate marked an increase from the rate of 84.96% in August 2019.

Increasing EAF capacity

Chinese steel production is transitioning from predominantly blast only production (BOF) to electric arc furnace (EAF) production.

The industry’s focus on lowering its emissions is, in part, driving the trend away from BOF production.

However, this trend is also global.

The U.S. expects a 7 mmt increase of EAF capacity in the medium term.

This transformation could put pressure on scrap collection and prices. The sector that generates the most scrap is the automotive, which was particularly affected by the coronavirus lockdowns.

Even though the effect might not be felt in the short term, it is a trend worth watching.

Actual metals prices and trends

The Chinese slab price rose 4.0% month over month to $560.34/mt as of Sept. 1. The Chinese billet price rose 4.5% to $509.26/mt.

Chinese coking coal barely increased, gaining 0.2% to $289.87/mt.

As for U.S. steel prices, U.S. three-month HRC rose 6.2% to $550/st. U.S. shredded scrap steel fell 4.2% to $248/st.

Upcoming negotiation on your steel buy? Make sure you know how your service centers will negotiate with you.

Leave a Reply