Raw Steels MMI: Section 232 steel tariff upheld after challenge from steel importers

The Raw Steels Monthly Metals Index (MMI) increased for the ninth consecutive month, rising by 0.5% as US steel prices continued to rise.

Buying organizations should continue to buy as needed, as prices remain at all-time highs.

Cut-to-length adders. Width and gauge adders. Coatings. Feel confident in knowing what you should be paying for metal with MetalMiner should-cost models.

US steel market

Universal Steel Products, along with four other American steel importing companies, challenged the 25% steel tariff imposed by former President Donald Trump in 2018 under Section 232 of the Trade Expansion Act of 1962.

On Feb. 4, the United States Court of International Trade moved to dismiss the plaintiffs’ cross-motion for partial summary judgment.

Meanwhile, President Joe Biden reinstated tariffs on aluminum imported from the UAE. Trump had rescinded the tariffs on his last day in office. Biden’s decision seems to signal that the new administration sides with primary producers in view of ongoing global overcapacity.

Tariff supporters argue it promotes steel investment, newer technology, increases domestic market share, provides security of supply for steel customers and generates employment. Meanwhile, detractors believe the tariffs directly impact US steel prices.

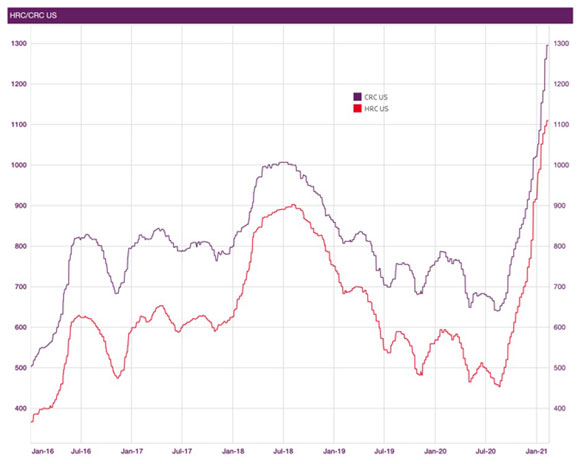

The graph below, however, shows the correlation between US steel prices and tariffs is not particularly strong.

Rather, the bullish market drives steel prices (as it did in 2018).

Today, steel prices have increased on the back of a bull market. In addition, capacity reductions have led to material shortages, as we see now.

Chinese steel prices decline

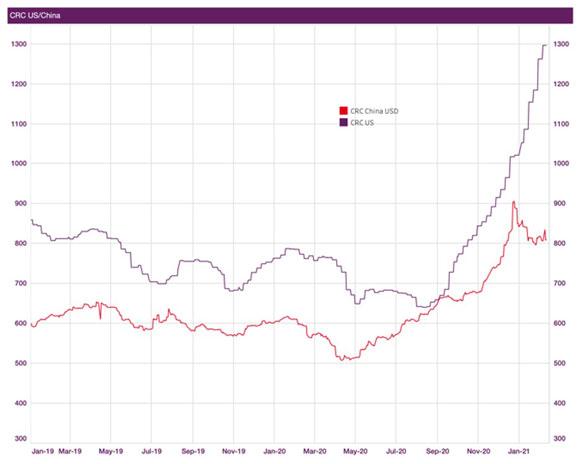

Chinese steel prices have continued to decline since late December. HRC and CRC declined by 11% and 12%, respectively.

For the past two years, Chinese prices led US prices. US prices already skipped the flattened period the Chinese market experienced from September to November 2020.

This is the first decline, however, since the start of the pandemic. The drop is most likely due to the seasonal manufacturing break occurring around the Lunar New Year.

As reported last month, demand will likely increase during 2021. The China Iron and Steel Association (CISA) reconfirmed this position at a recent conference.

At the same time, the Chinese industry ministry asked the domestic steel sector not to exceed 2020 output (in an effort to reduce carbon emissions). This led CISA’s vice president to declare imports of primary steel products will increase throughout 2021 to meet demand without increasing output, particularly billets and hot-briquetted iron.

Increasing imports and falling exports, along with rising demand, might support Chinese prices once the Lunar New Year celebrations are over.

Actual metals prices and trends

Chinese slab prices rose 2.8% month over month to $682.25 per metric ton as of Feb. 1. Meanwhile, the Chinese billet price rose 0.4% to $548.60 per metric ton.

Chinese coking coal decreased 7.9% to $399.56 per metric ton.

US three-month HRC dropped 5.5% to $909 per short ton. However, the spot price surged 29.2% to $1,149 per short ton.

US shredded scrap steel continued to rise this month by 14.5% to $459 per short ton.

With volatile steel markets, knowing which strategy to execute and when can make all the difference between saving and losing money. See how MetalMiner looks at different market scenarios.

Leave a Reply