Rare Earths MMI: Lynas reports half-year results; executive order eyes rare earths supply chain

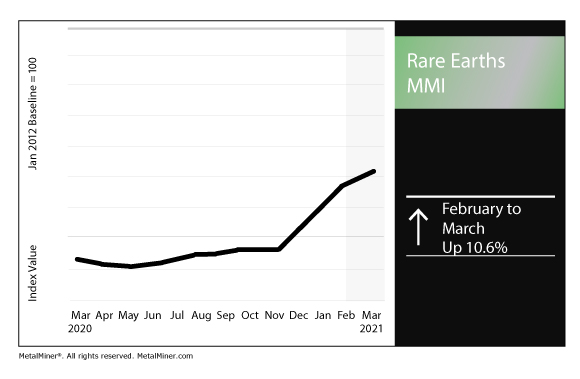

The Rare Earths Monthly Metals Index (MMI) rose by 10.6% for this month’s reading.

The MetalMiner Best Practice Library offers a wealth of knowledge and tips to help buyers stay on top of metals markets and buying strategies.

Lynas Rare Earths reports half-year results

Australia’s Lynas Rare Earths Ltd., the largest rare earths firm outside of China, recently reported its half-year results.

For the half-year ending Dec. 31, 2020, Lynas reported net profit of $40.6 million. That compared with net profit of $3.9 million in the same six-month period in 2019.

Furthermore, it reported EBITDA of $80.6 million during the second half of 2020, up from $44.2 million during the equivalent period the previous year.

“This half year demonstrated our ability to achieve strong results across all key financial metrics, while running production at 75% of Lynas NEXT rates,” Lynas CEO Amanda Lacaze said. “Despite ongoing uncertainty in the global economy and logistics/supply chain systems due to the effects of the pandemic, Rare Earths market settings were favourable and pricing for Rare Earths materials improved. We demonstrated our ability to capitalise on this upside during the period, with cost of sales maintained at $150.8m while achieving an increase in sales revenue to A$202.5 million.”

The half-year report also offered updates on several projects.

“Progress on Lynas 2025 projects continued,” the financial report stated. “A number of project milestones were achieved and critical path items secured for the Kalgoorlie facility during the period. The USA projects team continued to progress the Phase 1 planning and design work for a U.S. based Heavy Rare Earths separation facility. In line with Department of Defense Phase 1 milestones, we expect this Phase 1 work to be completed in the 2021 financial year.”

Rare earths supply chains

As noted previously on MetalMiner, President Joe Biden’s executive order from Feb. 24, titled “America’s Supply Chains,” lays the groundwork for the review of several critical supply chains.

Among the supply chains that will be up for governmental review is the supply chain for critical minerals.

The order calls for several agency heads to conducts supply chain assessments. China dominates global rare earths processing and mining capacity. The US — namely the Pentagon — long has viewed that dominance and the US’s dependence on foreign sources of rare earths as a national security concern.

“The Secretary of Defense (as the National Defense Stockpile Manager), in consultation with the heads of appropriate agencies, shall submit a report identifying risks in the supply chain for critical minerals and other identified strategic materials, including rare earth elements (as determined by the Secretary of Defense), and policy recommendations to address these risks,” the executive order stated. “The report shall also describe and update work done pursuant to Executive Order 13953 of September 30, 2020 (Addressing the Threat to the Domestic Supply Chain From Reliance on Critical Minerals From Foreign Adversaries and Supporting the Domestic Mining and Processing Industries).”

Rare earths prices a mixed bag

Despite their name, rare earths are not particularly rare. In fact, as Reuters reported late last month, abundance of elements like cerium and lanthanum has weighed on prices.

On the other hand, prices of neodymium-dysprosium have skyrocketed. Neodymium-praseodymium, used in rare earths magnets, surged by over 20% in the last month alone.

Xiao Yaqing, minister of China’s Ministry of Industry and Information Technology, lamented some lower sale prices. The minister emphasized that government should have a role in “maintaining market order.”

Xiao also said Chinese companies were producing excessive amounts of rare earths, Reuters reported.

Recently, Beijing released a draft document indicating it was considering tighter rare earths export regulations.

Actual metals prices and trends

Chinese yttrium fell 0.6% month over month to $33.20 per kilogram as of March 1. Terbium oxide picked up 10.9% to $1,521 per kilogram.

Praseodymium neodymium surged by 21.2% to $85,695 per metric ton. Meanwhile, neodymium oxide jumped by 18.3% to $105,381 per metric ton.

Europium oxide dipped by 7.8% to $30.11 per kilogram. Dysprosium oxide rose by 24.8% to $447.78 per kilogram.

Find more insight on MetalMiner’s LinkedIn.

Leave a Reply