Renewables/GOES MMI: US renewables on pace for 20% of electricity generation in 2021

The Renewables Monthly Metals Index (MMI) ticked up 4.5% for this month’s value.

(Editor’s note: This report also includes the MMI for grain-oriented electrical steel, or GOES.)

Want MetalMiner directly in your inbox? Sign up for weekly updates now.

EIA: renewables account for 20% of electricity generation

In its most recent Short-Term Energy Outlook, the Energy Information Administration reported the U.S.’s share of electricity generation from renewables will come in at about 20% in 2021.

That share is at about the same level in 2020, EIA reported.

Meanwhile, it forecast the share of renewables for electricity generation to rise to 22% in 2022. Renewables are expected to gain from a decline in natural gas use.

“The natural gas share declines in 2022 as a result of continued high fuel costs and an increasing share of renewable generation,” EIA noted. “As a result of the higher expected natural gas prices, the annual forecast share of electricity generation from coal rises from 20% in 2020 to 23% in 2021 and then drops slightly to 22% in 2022.”

The EIA forecast the U.S. will add 16.2 GW in utility-scale solar capacity in 2021. Meanwhile, it forecast an addition of 20.9 GW in 2022.

Clean energy to require new supply

As we’ve noted in previous articles on the subject, the drive toward cleaner sources of energy depends in part on the ability to mine materials like nickel, copper and cobalt (among others) — an environmentally destructive process antithetical to that green goal.

Nonetheless, OEMs and organizations like the International Energy Agency have sounded the alarm about the need for material.

“In a scenario that meets the Paris Agreement goals (as in the IEA Sustainable Development Scenario [SDS]), their share of total demand rises significantly over the next two decades to over 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and almost 90% for lithium,” the IEA said in a May 2021 report. “EVs and battery storage have already displaced consumer electronics to become the largest consumer of lithium and are set to take over from stainless steel as the largest end user of nickel by 2040.”

Despite attempts by some battery makers to seek alternatives, cobalt remains a coveted battery material.

Citing the IEA report, miner Glencore noted cobalt demand is likely to increase by between 9.9 and 32.9 times from 2020 to 2050.

“During 2021, recognising the need for strategic partnerships between raw material and battery producers to support the delivery of our net zero ambition, we signed a number of longterm supply agreements for green aluminium and cobalt,” Glencore said in its 2021 Climate Report.

Glencore added it signed a deal with Norway’s FREYR to supply 1,500 metric tons of cobalt cut cathodes. The cathodes are made with partially recycled cobalt, the miner said. The cathodes will be used for FREYR’s lithium-ion battery cells. The company’s cells go into stationary energy storage, electric mobility and marine applications.

GOES

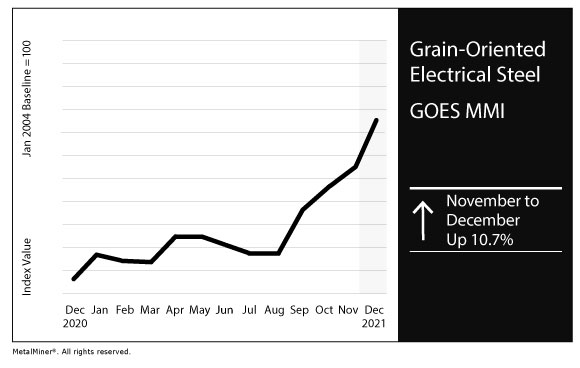

The GOES MMI, the index for grain-oriented electrical steel, jumped by 10.7% for this month’s reading.

The GOES coil price rose by 11.08% this month to $3,138 per metric ton.

Actual metals prices and trends

The U.S. steel plate price rose by 4.78% month over month to $1,865 per short ton as of Dec. 1.

Chinese steel plate dropped by 9.07% to $833 per metric ton. Korean steel plate declined by 5.74% to $908 per metric ton.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply