Stainless MMI: Nickel Prices Pull Back as Downside Risk Mounts

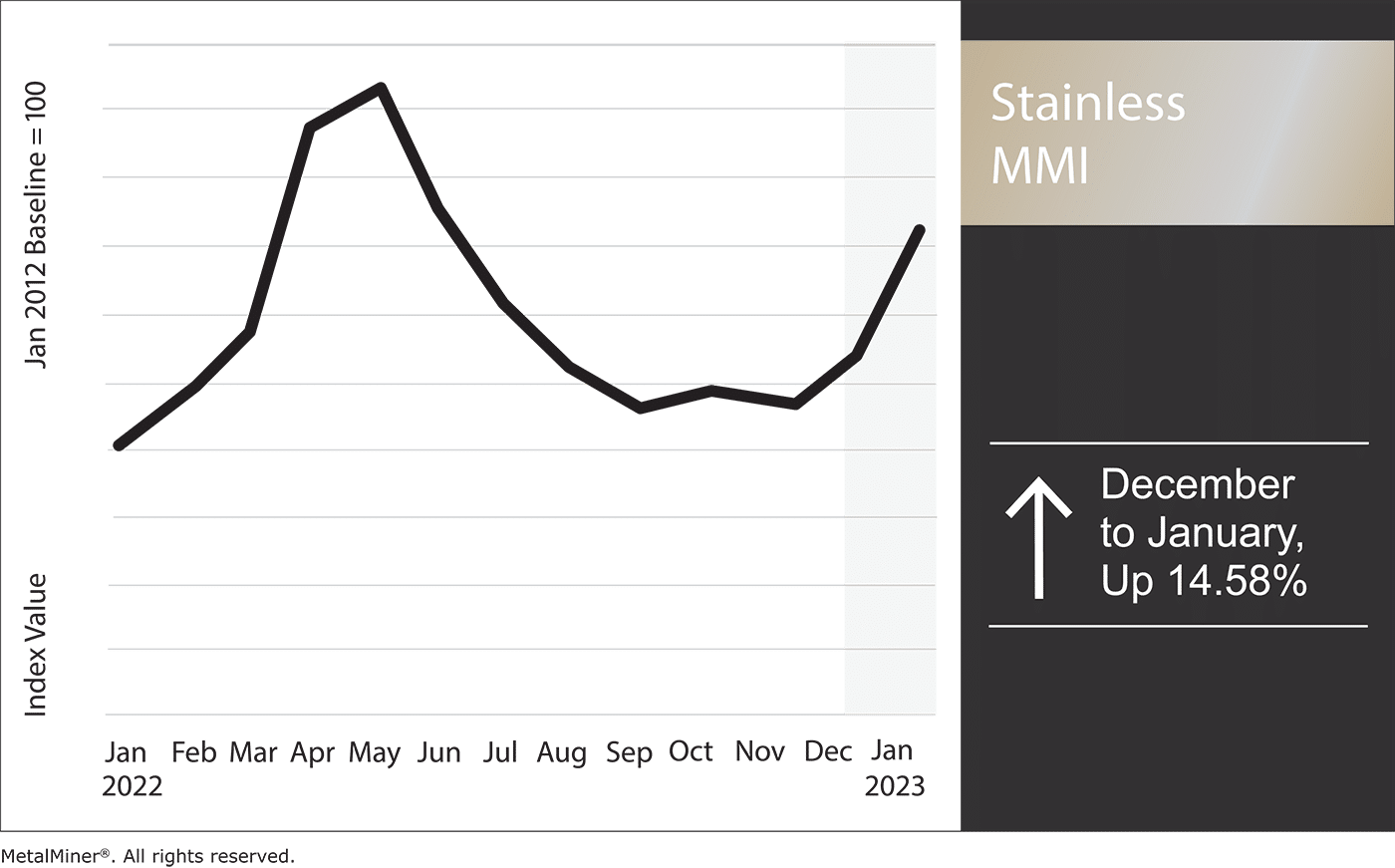

The Stainless Monthly Metals Index (MMI) rose 14.58% from December to January as nickel prices retreated.

Nickel prices continued to rally throughout December. But by January, prices began to show minor pullbacks that could become the beginning of a short-term sideways trend. Until prices break the new range, the market direction will remain unclear. Market volatility, however, remains high. This stems mainly from the lower overall volume in the LME exchange and leaves significant risk in the market.

MetalMiner’s January fireside chat 2023 Market Predictions, Forecasts & Sourcing Strategies is tomorrow at 11AM CST. Don’t miss out, register now!

Licenses at Low Levels

Import licenses remain at very low levels. As a result, there could be allocations at the domestic mills when inventory overhang resolves. Still, imports will take several months to catch up with demand. During the first two weeks of January, order intake at the service center level recovered from the December sluggishness. Mills also reported that order intake was strong. Meanwhile, the alloy surcharge will increase in February, which should spur on shipments.

Check out MetalMiner’s stainless steel should cost models by scheduling a demo of the Insights platform.

Global Nickel Output Could Jump 20%

A few months ago, brokers reportedly balked as Xiang Guangda looked to add to his short positions. Xiang Guangda is the founder of Tsingshan Holding Group and the man responsible for the March squeeze that broke the LME’s nickel contract. Now, emerging reports are detailing how the global nickel market could be due for a considerable uptick in production with Tsinghsan at the head.

According to a recent Bloomberg report, Tsingshan is negotiating with struggling Chinese copper producers about a potential material switch. Clearly, Tsingshan hopes to capitalize on the current high price premiums for refined nickel. Should others adopt a similar strategy, this would allow China to roughly double its year-over-year production. As a result, we could see total global output rise by around 20%.

Get weekly updates on trends in nickel prices and other commodity news with MetalMiner’s free weekly newsletter. Click here.

Future Direction of Nickel Prices

Of course, there is no guarantee the output shift will happen at all or to that extent. Analysts already expect nickel production to rise due to increased efforts in Indonesia. This alone would support a projected global surplus for years to come, and nickel prices would react accordingly. Meanwhile, copper prices are now on the rise. And while the market forecasts a surplus in 2023, rising copper demand will pressure that in the long term.

There is no denying that Tsingshan is a major market player. Moreover, last year’s attempts to add to short positions seem to add some credence to these new reports. Of course, any sharp increase in supply would likely weigh significantly on nickel prices. Many will recall that while other base metals saw sharp retracements last year, low liquidity limited nickel’s downside price movement. Since bottoming out in mid-July, prices have returned to levels above their pre-squeeze highs. This leaves the market ripe for a correction, especially if 2023 brings lower stainless demand. The same would be true if the EV and energy transition sectors lose any momentum.

This story proves that even in a broken market, Tsingshan remains a driving force. Indeed, Xiang Guangda can still shift supply dynamics, even with all the controversy and a more limited trading presence.

GCH Plans Nickel Futures Alternative to LME

Meanwhile, as the LME’s nickel contract remains broken, others are looking to take its place. For instance, Global Commodities Holdings (GCH) will launch a physical nickel trading platform beginning in late February. According to the company, the platform aims to become an alternative to the LME’s nickel futures contract.

Last March’s nickel squeeze caused a mass exodus from the LME’s nickel contract and left many upset about how the LME handled the crisis, as nickel prices were severely impacted. While the contract ultimately survived, it remains plagued by low liquidity and the resulting volatility. Up to this point, market makers have shown no interest in returning. Still, only time will tell whether the traders and investors are willing to make the move or opt out of the nickel market entirely.

Back in May, the CME indicated it was exploring its own nickel contract. If one or both of these take shape in a meaningful way, it could mean the LME is on its way out as the optimal exchange for prices in physical contracts.

Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for stainless steel and 8 other metal industries. Sign up for free.

Biggest Moves in Stainless and Nickel Prices

- Chinese ferromolybdenum lump prices surged, with a 42.74% increase to $41,567 per metric ton as of January 1.

- LME primary three-month nickel prices jumped 25.97% to $30,925 per metric ton.

- Indian primary nickel prices rose 21.23% to $29.05 per kilogram.

- Chinese primary nickel prices rose 17.68% to $33,991 per metric ton.

- Finally, the Allegheny Ludlum Surcharge for 316/316L coil increased by 15.85% to $2.11 per pound.

Leave a Reply