Rare Earths MMI: Rare Earths Market Rattled by Myanmar Earthquake and Tariffs

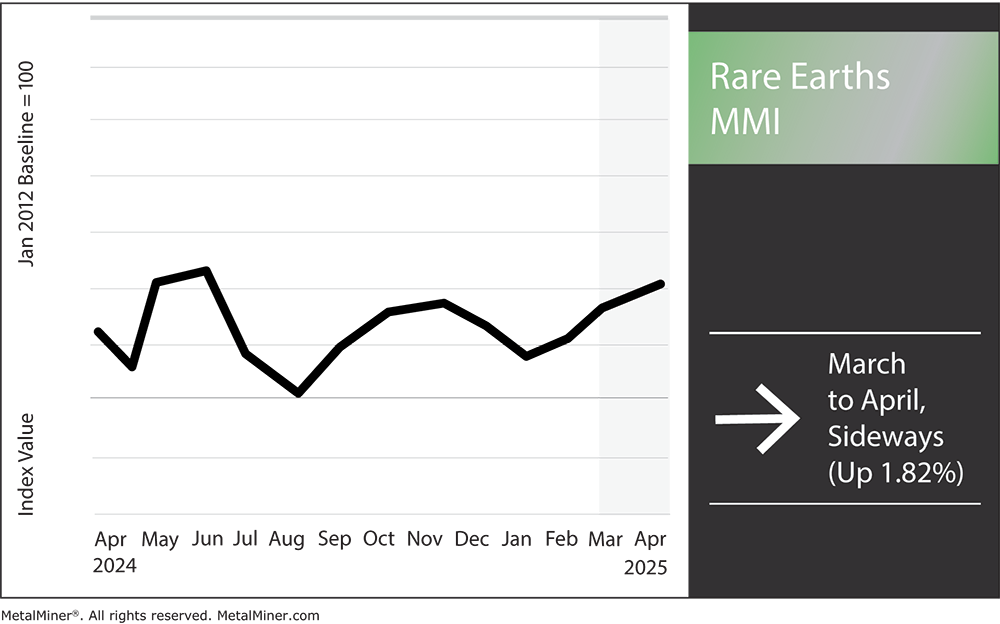

The Rare Earths MMI (Monthly Metals Index) moved sideways, edging up by a slight 1.82%. The global rare earth market has taken a significant hit lately, thanks to a combination of natural disasters and big geopolitical moves. A strong earthquake in Myanmar and the recent wave of U.S. tariffs have thrown this somewhat delicate industry into even more uncertainty.

Make smarter purchasing decisions with indispensable updates on RE price trends, along with a wide range of other commodities when you sign up for MetalMiner’s weekly newsletter.

Myanmar’s Quake: A Jolt to the Supply Chain?

On March 28, a powerful 7.7-magnitude earthquake rocked the country of Myanmar. While the tremors didn’t directly damage rare earth mining operations, the global market still took notice. The quake struck near Mandalay, about 425 kilometers from Kachin State, the location of many of Myanmar’s rare earth mines.

Despite a tragic and still-growing death toll, early reports show those key mining regions were mostly untouched. Mine operators in the Longchuan area confirmed with Metal.com that roads remain open and ore deliveries are continuing without issue.

Why buy price points for every metal type when you only need a few? Only purchase the metal price points you need with MetalMiner Select. Learn more.

Political Turmoil Was Already Causing Problems

Even before the earthquake, Myanmar’s rare earth sector was struggling. Back in October 2024, the Kachin Independence Army (KIA) took over major mining hubs like Kanpaiti, a town near the Chinese border.

That single event disrupted operations in areas responsible for around half of the world’s output of heavy rare earths. Mining ground to a halt, and by February 2025, Chinese imports of rare earth oxides and compounds from Myanmar had dropped by a staggering 89%.

Don’t get caught off guard by rapid fluctuations in commodity prices. Stay ahead of the curve with MetalMiner Insights and make the right purchasing choices at the right time. Click here to learn more.

Why Myanmar’s Rare Earth Supplies Matter

Myanmar isn’t just another name on the rare earth map. The Southeast Asian country is a major supplier, which means it plays a key role in everything from smartphones to electric vehicles to rechargeable batteries. The combination of the ongoing conflict and the recent natural disaster highlights just how risky it is to rely on politically unstable nations for such critical materials.

Enter the Tariffs

Back in the United States, President Donald Trump announced sweeping new tariffs on April 2, 2025. All U.S. trading partners now face at least a 10% tariff, while some countries, particularly China, were hit even harder.

Given prior tariffs, Chinese goods entering the U.S. will now face a total tariff rate of 54%. Considering China dominates the global rare earth supply chain, analysts expect these new tariffs will intensify existing supply problems.

Concerned about volatile metal markets affecting your earnings? Stay informed with MetalMiner’s Monthly Metals Index Report, offering monthly price insights across ten metal industries.

What Comes Next?

Given the news, many American companies are already taking action. Most are working to secure alternative domestic and international sources for rare earths, while the U.S. government ramps up investment in local production to strengthen supply chain security.

In the meantime, experts anticipate that rare earth prices will stay volatile, driving up manufacturing costs, potentially raising consumer prices and weakening the global competitiveness of U.S. products.

Rare Earths MMI: Noteworthy Price Shifts

Stay a step ahead of tariff price increases and industry metals price shifts by breaking out your parts spend to know exactly where you’re being charged the most. Learn more about Insights SV.

- Dysprosium oxide prices dropped by 3.18% to $227.60 per kilogram.

- Cerium oxide prices jumped up significantly, rising 32.39% to $1,754.29 per metric ton.

- Yttria prices went up by 18.32% to $7,471.57 per metric ton.

- Lastly, neodymium prices moved sideways, inching up 0.33% to $75,475.98 per metric ton.