Rare Earths MMI: Ukraine and U.S. Strike Critical Minerals Deal

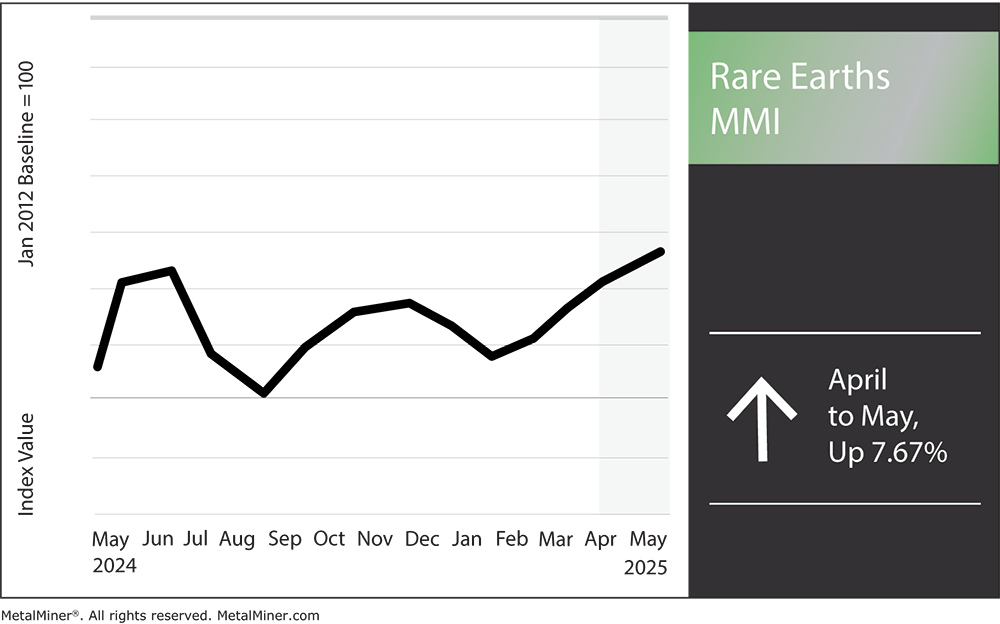

The Rare Earths MMI (Monthly Metals Index) witnessed a significant rise in price action month-over-month, with a total increase of 7.67%. So far, the global rare earths market has been on a springtime rollercoaster. Between April 1 and May 2, 2025, prices for these critical elements saw abrupt swings, supply chains were tested by geopolitics and world powers brokered new alliances over minerals.

Supply Chain Shifts and Demand Drivers

Behind these price movements are major shifts in supply and demand. Some of these are sudden, while others are longer in the making. On the supply side, geopolitics has laid bare the rare earth industry’s vulnerabilities. China’s response made the fragility even clearer. On April 4, Beijing hit the brakes on exports of rare earths, imposing new controls on shipments of critical minerals. According to Reuters, exporters of seven categories of medium and heavy rare earths must now apply for special licenses.

Beijing’s rare earth clampdown is part of a broader tit-for-tat, but its immediate impact was to squeeze global supply chains. Manufacturers worldwide, from electric vehicle makers to defense contractors, suddenly had to worry if their next shipment of magnets or alloys would arrive. For now, China remains the undisputed giant in this space.

Get out in front of price volatility and safeguard your sourcing budget with strategic weekly intel on global metal trends by opting into MetalMiner’s weekly newsletter.

Rare Earth Disruption: Supply Chain Adaptation

Supply chain adaptation is currently occurring on several fronts. For their part, manufacturers are pursuing strategies like diversifying suppliers, recycling and substitution. In some cases, companies are tweaking product designs to reduce reliance on the scarcest heavy rare earths.

For example, some are using magnet designs that minimize the need for terbium and dysprosium (though often at some cost to efficiency). Recycling is another piece of the puzzle. According to Reuters, EU firms are gearing up to recover rare earths from old wind turbines and EV batteries.

This is a big reason why the latest U.S.-Ukraine agreement (and others like it) have the market’s attention. For stakeholders in the critical minerals market, they hint at future new supplies. It’s also why companies are paying close attention to trade policy moves, hoping for any signs of relief or negotiation that might reopen Chinese supply taps before stockpiles run dry.

Facing cash flow and supply chain challenges due to tariffs? Insights SV helps you model these impacts, aiding in better financial planning and risk management.

Ukraine-U.S. Critical Minerals Pact: A New Alliance in the Making

One of the most significant recent critical minerals developments is the landmark deal between Ukraine and the United States. On April 30, Washington and Kyiv signed a long-awaited agreement to jointly invest in developing Ukraine’s mineral wealth. In essence, the pact creates a joint investment fund for Ukraine’s reconstruction, to be funded in part by revenues from new mineral extraction projects. Ukraine, even amid war, sits on sizable deposits of rare earth elements, lithium, cobalt, graphite, titanium and more.

As far as terms go, the agreement is purposely structured as an equal partnership. Ukraine retains full ownership of its natural resources and will decide what gets extracted. The jointly managed fund will invest in new mining and processing projects. Profits from new projects will be split, with 50% of revenues from new minerals, oil, and gas ventures going into the fund for rebuilding Ukraine.

Of course, any projected market impact is years down the road. In the best case, if peace comes and investments flow, Ukraine could emerge as a significant source of rare earths and battery metals in Europe’s backyard.

U.S. Tariffs on Chinese Rare Earths

No discussion of today’s rare earth market is complete without examining the U.S. tariffs that sparked China’s retaliation. Over the past few months, the United States has aggressively raised tariffs on Chinese goods, rare earth materials very much included. By April, the trade war had reached a fever pitch, with President Trump hiking tariffs on most Chinese products even further.

The direct effects of these tariffs have been painful for some and paradoxical for others. MP Materials, the operator of America’s only active rare earth mine (Mountain Pass, CA), complained that with China’s new export restrictions, sending their ore to China for processing no longer makes sense.

They claimed the same applies to selling refined product back to the U.S. under a 125% tariff. “Selling our valuable critical minerals under 125% tariffs is neither commercially rational nor aligned with America’s national interests,” MP Materials said bluntly.

Facing challenges in tracking rare earth price movements? Access monthly price trends for 10 different metal industries by signing up for MetalMiner’s Monthly Metals Index Report, ensuring you’re always ahead in your sourcing strategy.

Additional Costs, Consequences and Surprises

For downstream manufacturers (think makers of motors, electric drivetrains, aerospace components and electronics), the immediate impact of tariffs is higher input costs and looming supply uncertainty. A Washington, D.C. trade lawyer quipped that sourcing rare earth magnets now comes with both a customs bill and a headache. Meanwhile, price increases continue to filter through.

“Manufacturers that rely on rare earth elements… will see price increases,” reported AP News. Still, for now, there’s enough global stock in the pipeline to keep production running.

Another side effect to consider is how the tariffs have injected new urgency (and funding) into rare earth projects outside China. Suddenly, mining firms in places like Australia, Canada and Africa are seeing eager investors and customers knocking. India, sensing opportunity, reportedly sent a delegation to Myanmar’s rare earth regions in late 2024, possibly with the hopes of striking supply deals as China’s involvement wanes.

Rare Earths MMI: Noteworthy Price Shifts

Struggling to align your buying strategy with the right market data? MetalMiner helps you match your exact metal types, forms and gauges with actionable market intelligence. View our full metal catalog.

- Yttria prices dropped 6.44% to $6,990.32 per metric ton.

- Terbium oxide prices rose significantly, increasing by 10.04% to $996.86 per metric ton per kilogram.

- Cerium oxide prices dropped by 5.78% to $1,657.21 per metric ton.

- Lastly, neodymium oxide prices moved sideways, dropping by 1.21% to $59,557.33 per metric ton.