Stainless MMI: Stainless Mill Hold Prices Ahead of Contracting

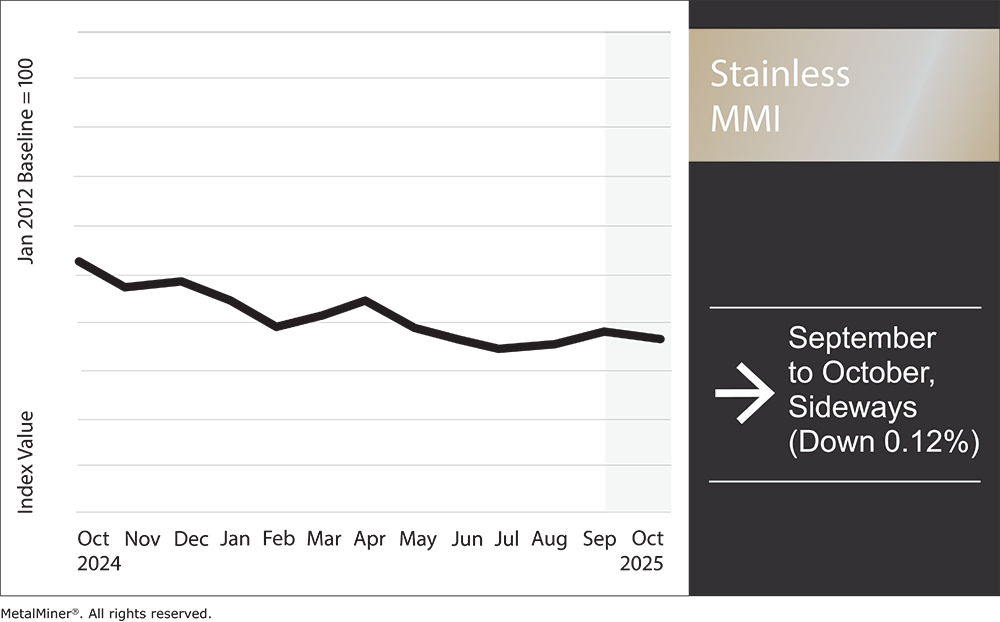

The Stainless Monthly Metals Index (MMI) showed little volatility during the month as all of its elements, including nickel prices, moved sideways. This translated to an overall 0.12% increase from September to October.

U.S. Stainless Steel Prices, Market Holds Flat

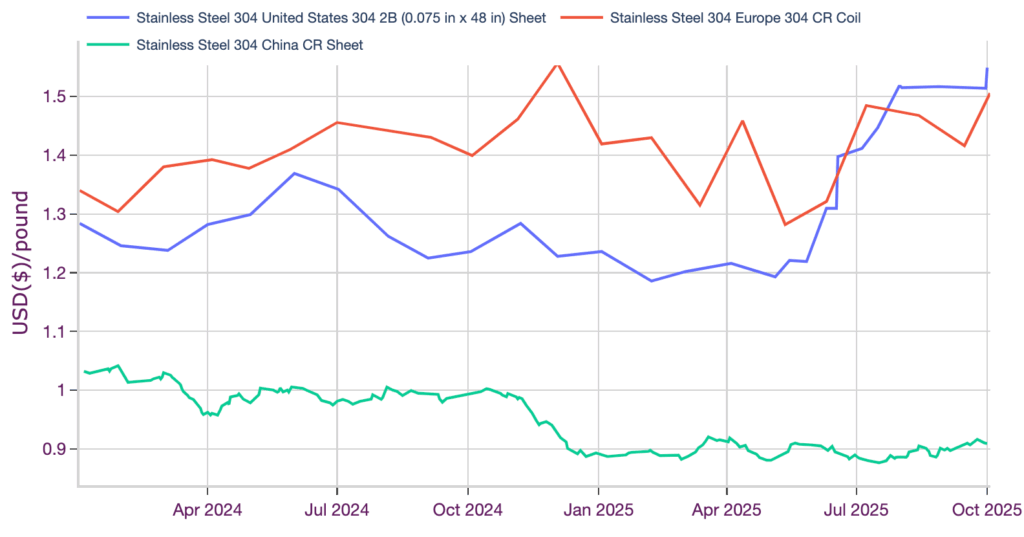

U.S. stainless prices maintained their sideways trend as mills continued the base price increases instituted over the summer. While mills have made no attempts to raise prices further, there is also no evidence of price erosion despite otherwise lackluster demand conditions.

Despite flat pricing, the market has begun to show a few cracks. Roughly 60% of respondents from MetalMiner’s stainless market survey characterized demand as stable, while around 40% noted weaker demand. Despite slower conditions among procurement organizations, around 80% of respondents saw no change in mill lead times, suggesting that there is not yet any meaningful evidence of oversupply or undersupply conditions. To receive our survey and results in your inbox, click here.

The Market Looks Toward Q4

Q4 will likely begin to test the market. Historically, demand conditions tend to slow during the final months as buyers have little incentive to rebuild inventories. Meanwhile, the opening of NAS’s Ghent facility will add additional domestic capacity to the market. Absent a meaningful increase in demand, NAS may have to weigh whether or not to lower prices to secure business or operate at a lower capacity utilization rate.

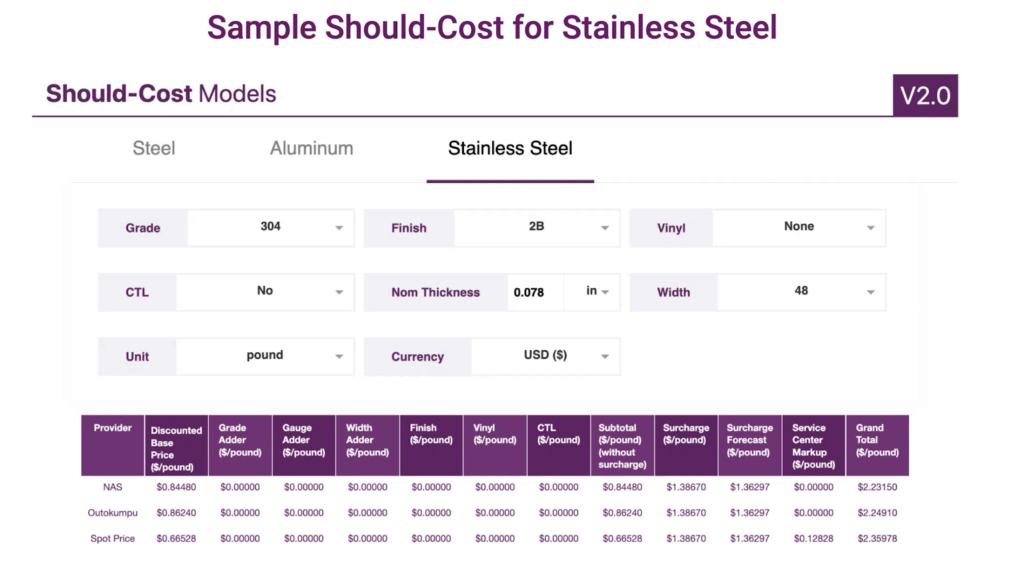

We know what you should be paying for stainless. MetalMiner should-cost models are the ultimate savings hack, showing you the “should-cost” price for gauge, width, polish and finish adders. Explore what value they can add for your organization.

EU Eyes Steel Tariffs

The European Commission has proposed a major tightening of steel import rules to protect its struggling steel industry. Under the proposal, duty‐free steel import quotas would be cut from about 30.5 million tonnes down to 18.3 million tonnes annually.

Any steel imports beyond that quota would face a tariff of 50%, a significant increase from the current 25% rate for “out‐of‐quota” imports. A “melt and pour” rule is also part of the plan. This would require steel to be melted and processed in the exporting country to qualify under a quota, thus reducing circumvention through third countries.

The main benefits appear largely two-fold:

1. Protectionism

As other nations institute trade barriers, markets like the EU become vulnerable to increased dumping efforts. Prime examples include the latest U.S. steel tariffs and potential duty hikes in Mexico.

Regarding the proposal, Industry Commissioner Stephane Sejourne told journalists, “The European steel industry was on the verge of collapse—we are protecting it so that it can invest, decarbonize and become competitive again.”

In a September press release calling for increased safeguards, Outokumpu highlighted the pressures facing Europe, stating, “Currently, European producers are struggling with low-capacity utilization levels due to low demand, high share of low-priced Asian imports and 50% export tariffs to the U.S.”

EU tariffs would create a higher price floor for stainless steel prices, similar to what has happened in the United States. European 304 prices are currently trending similarly to U.S. prices, but remain at a premium to 304 imports from Asia.

Missing out on valuable stainless and nickel market trends? Subscribe to MetalMiner’s Monthly Metals Index Report and gain a competitive edge with comprehensive analysis across the stainless industry and 6 other metal sectors, ensuring you’re always informed.

2. U.S. Trade Concession

Although its stated aims suggest that the tariffs are meant to counter the flood of low-priced imports and protect the viability of domestic production, the move also puts the EU more in line with U.S. ambitions to address Chinese steel overcapacity. Meanwhile, the EU continues to negotiate its own tariff agreement with the U.S., with the goal of allowing at least some volume of EU steel and aluminum to enter at a reduced rate or free of duties altogether.

Trade barriers in the EU could make such a deal more attractive to the U.S., as it would give the latter nation some assurances regarding dumping efforts. President Trump had previously criticized tariff rate quotas employed under the Biden administration, suggesting that the high number of quota arrangements with trade partners eroded the value of the original tariffs.

Market Reactions

So far, the reaction to the proposal has been mixed. Given global overcapacity (notably from China), low utilization rates in Europe and the risk of import flooding, EU steel producers welcome the measure. However, those industries that rely on steel inputs, such as automotive, machinery and construction, warn of inflationary pressures, higher costs and potential disruptions in supply chains.

The EU also faces diplomatic friction, notably with the UK, whose steel exports to the EU could be severely affected. Meanwhile, U.S. tariffs have complicated the overall context of the policy. The U.S. has raised steel import duties to 50% as well, which both exacerbates market distortions (with excess steel possibly redirected toward Europe) and strengthens the EU’s argument for stricter protection measures.

Tariffs keeping you up at night? With Insights SV, you can model various scenarios and understand their impact on your part costs. Learn more.

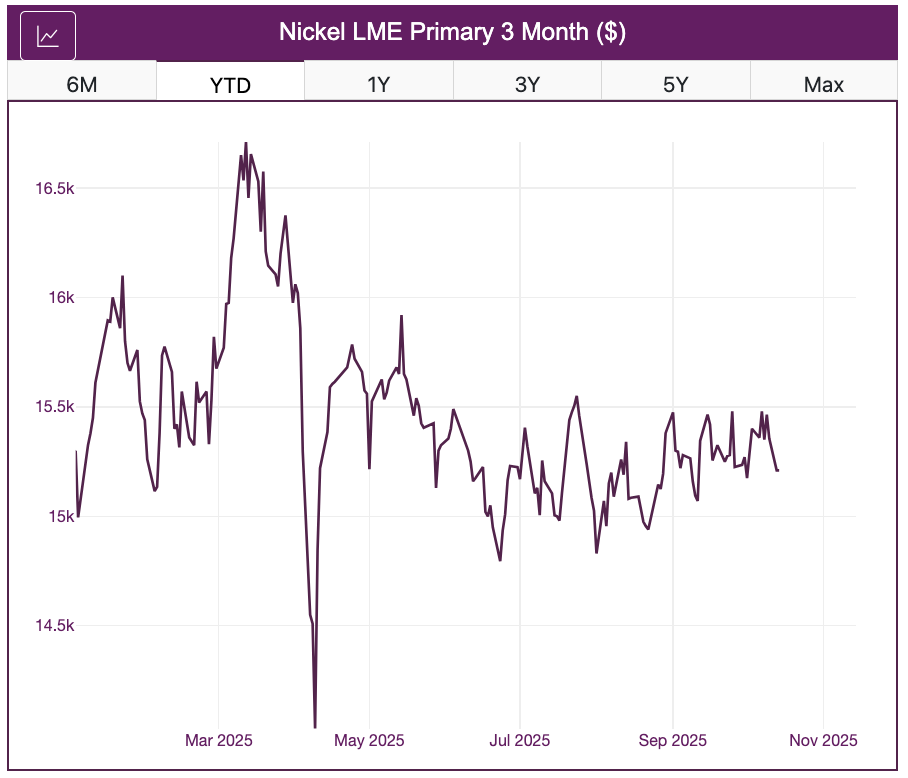

Nickel Price Bottom Holds for Now

Nickel prices continued to trend within range during September and October. While sideways, prices managed to drift higher from their summer lows.

However, the upward drift may not last for long. From a fundamental perspective, little has changed regarding oversupply, as LME and SHFE inventory stocks continue to grow. While some mining cuts have been instituted around the world, they have thus far proven too small to meaningfully address the ongoing supply glut.

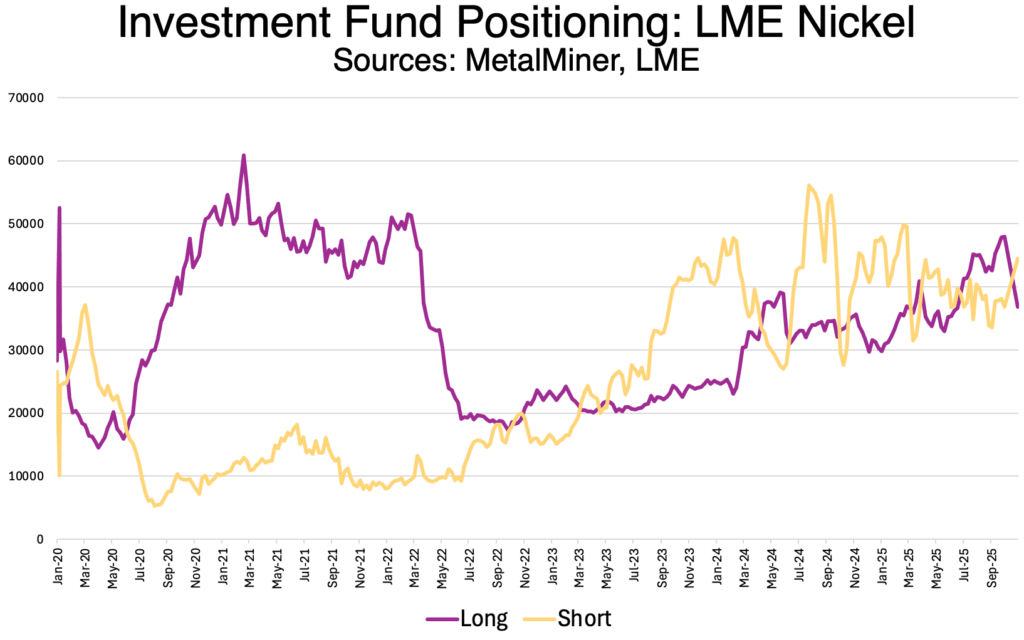

Seemingly detached from market fundamentals, the current upside in nickel prices was supported by increased bets among investors. Investment funds, whose large positions offer a strong influence over prices, showed a steady bullish bias during Q2 and Q3.

More Downside Risk Coming?

However, funds returned to net short positioning by Q4 as they dumped long positions and built short positions. While funds are not the investors influencing prices, the conviction shift nonetheless poses a downside risk for the current range in nickel prices. Amid numerous global economic headwinds, there appears to be little to suggest that demand conditions are on the verge of a turnaround, at least in the short term.

Meanwhile, with ample supply and recent upside in the U.S. dollar index, few if any factors seem to support meaningful strength in the nickel market. For stainless steel buyers, a decline in nickel prices would invariably weigh on surcharges, offering some relief amid currently elevated base prices. (Base price estimates are available to MetalMiner subscribers).

Biggest Moves for Stainless Steel and Nickel Prices

- Chinese ferrochrome prices maintained an upside bias, although the pace slowed. Prices rose by a modest 2.63% to $1,272 per metric ton as of October 1.

- The Allegheny Ludlum Surcharge for 316L cold rolled stainless coil prices trended higher, with a 2.45% increase to $1.53 per pound.

- Korean 304 cold rolled coil prices stabilized, rising 1.34% to $2,335 per metric ton.

- Meanwhile, Indian nickel prices slipped 1.86% to $15.22 per kilogram.

- Chinese ferromolybdenum prices retreated after a sharp increase the previous month. Prices fell 3.47% to $38,518 per metric ton.