Aluminum MMI: How Have Aluminum Tariffs Impacted the Market?

The Aluminum Monthly Metals Index (MMI) remained sideways with an upward bias. Overall, the index rose 1.16% from February to March, supported by modest increases in global aluminum prices.

Midwest Premium Futures Stall after Aluminum Tariffs

The aluminum market has started to settle following a sharp uptrend in U.S. premiums that began late last year. Since the start of Q4 2024, the aluminum Midwest premium and its three-month futures contract rose by 107% and 90%, respectively. The premiums’ bull trend came as markets began to price in the election of President Trump.

An even sharper spike followed the White House announcement of 25% steel and aluminum duties as well as a 25% tariff on Canadian imports, which saw buyers rush back into the market to secure material free of duties.

As tariffs neared, Midwest Premium three-month futures began to stall, losing momentum by mid-February and finding at least a short-term peak by mid-March at $0.40/lb. However, spot aluminum prices continued to trend upward during that period. This saw the premium market shift from contango to backwardation by February 28, with spot prices surpassing futures. Expert-driven aluminum market insights like these are covered weekly in MetalMiner’s weekly newsletter.

Measuring Tariffs Against Demand

While backwardation can mean different things depending on the market context, the recent shift suggests waning bullish sentiment. Investors seemingly lack optimism about where prices will stand over the coming months, particularly whether demand will be strong enough to maintain prices after tariffs. While buyers previously rushed into the market to rebuild inventories, once tariffs are in play, demand conditions will determine the trajectory of the premium.

Don’t panic about tariffs. Learn how to manage tariff threats with MetalMiner’s free comprehensive steel & aluminum tariff guide.

After the imposition of the Section 232 tariffs in 2018, the Midwest Premium did not rise forever. Instead, it eventually found a peak, which was followed by a retracement. As it appears markets have found or at least neared their peak, the next question is when the downside will occur and what to expect from it?

Trump Warns No Aluminum Tariff Exemptions

Carveouts and exemptions saw the impact of aluminum tariffs erode in the years that followed 2018. This time around, that appears unlikely to occur. Trump maintained his strong approach when asked about exemptions. Addressing reporters on March 16, the president stated, “I have no intention of it.”

It can be difficult to determine what to take seriously and what to take literally with regard to statements from the current president. Over a week ago, Trump injected chaos into the market with a Truth Social post threatening 50% tariffs on Canada in response to the country’s subsequently retracted decision to add a 25% tariff on electricity coming into the U.S. The threat saw Midwest Premium three-month futures jump in the following days as major aluminum suppliers projected a near doubling of the premium.

Tariffs Likely to Remain “Sticky”

While the additional 25% tariff never came to be, the threat exemplified the uncertainty that comes with the administration’s tariff plans. Sometimes they are used as a negotiating tool to force concessions from the opposing side, and sometimes they are made permanent to shift trade balances and support domestic production and manufacturing.

For now, it appears that metal tariffs and other forthcoming duties are likely to remain sticky. While demand conditions will remain the leading driver for aluminum’s Midwest Premium, firm tariffs will continue to offer support.

Aluminum Prices: Impact of Ukraine-Russia Ceasefire

While tariffs have largely overshadowed market news in recent months, they are far from the only topic impacting aluminum prices. Although a broader pause to the conflict has yet to occur, President Trump and Putin agreed to a pause on Russian strikes against energy infrastructure on March 18. The White House characterized the development as a “movement to peace,” which could eventually lead to an end to the conflict altogether.

A broad ceasefire would have several implications for the aluminum market, as Russia’s initial invasion and the ensuing sanctions from the West severely disrupted supply chains. An end to the war would likely stabilize and normalize those supply chains, reducing production costs and potentially lowering aluminum prices. Both Russia and Ukraine are significant producers of aluminum and related raw materials. Therefore, the potential resumption of normal operations in Ukraine and an end to sanctions against Russia could exert further downward pressure on prices.

To some extent, these bearish impacts will be offset by reconstruction demand and renewed investor confidence, both of which could offer support to aluminum prices. While it remains unclear when the conflict will end and what ongoing negotiations will ultimately determine regarding Ukraine’s resources and sanctions against Russia, the overall event provides a volatility risk to sideways aluminum prices.

Biggest Aluminum Price Moves

- Indian primary cash aluminum prices witnessed the largest increase of the overall index for the second consecutive month, rising 2.79% to $2.97 per kilogram.

- Chinese primary cash aluminum prices increased 1.81% to $2,828 per metric ton.

- Chinese aluminum billet prices witnessed a 1.72% increase to $2,980 per metric ton.

- LME primary three month aluminum prices saw a modest 0.82% rise to $2,643 per metric ton.

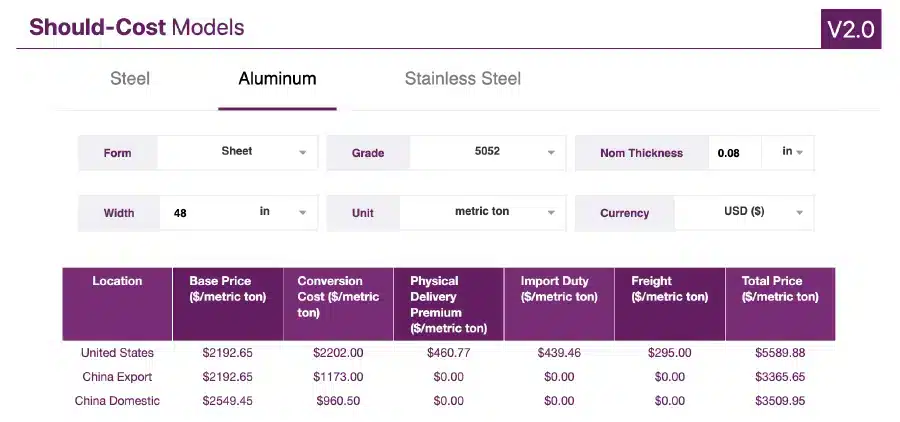

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.