Stainless MMI: Stainless Mills Hold Prices Ahead of Contracting

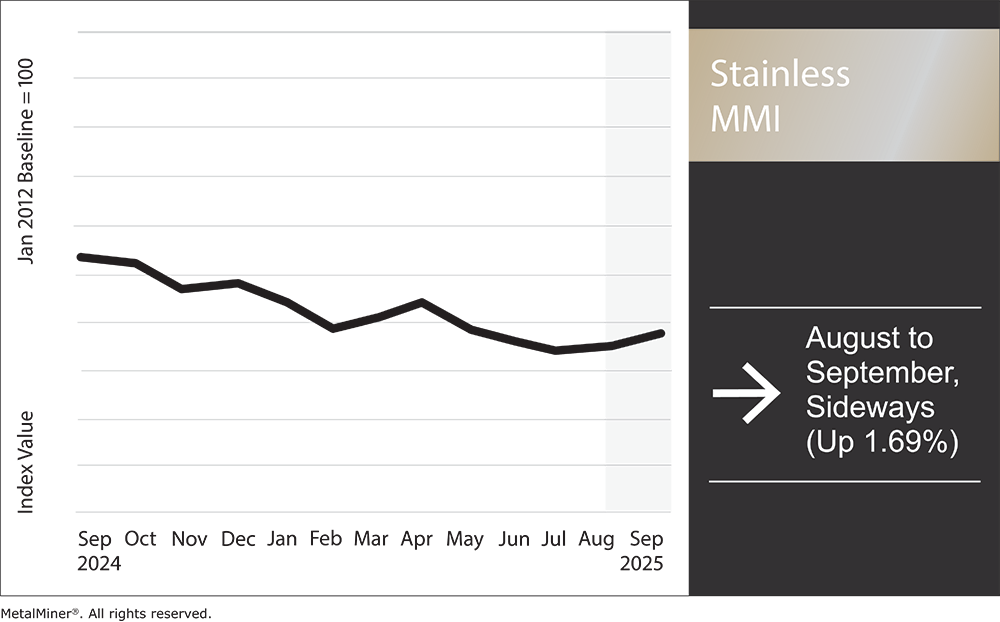

The Stainless Monthly Metals Index (MMI) moved sideways, with a modest 1.69% increase from August to September. Interested to learn how stainless steel sourcing companies and food equipment manufacturers reduce procurement costs? Opt into MetalMiner’s free weekly newsletter.

U.S. Stainless Steel Prices Flat in August

U.S. stainless steel prices moved sideways during August. Since their series of announcements in the past months, mills have proven successful at maintaining base price increases. Those same price hikes unwound the historically high discounts that had been witnessed over the past few years.

Although they were longer than at the start of the year, stainless mill lead times also appear stable, suggesting no month-over-month change within the market. While bright annealed products and ferritics supply appear relatively tighter compared to austentics, buyers have reported no significant material shortages to date, particularly with common grades like 304.

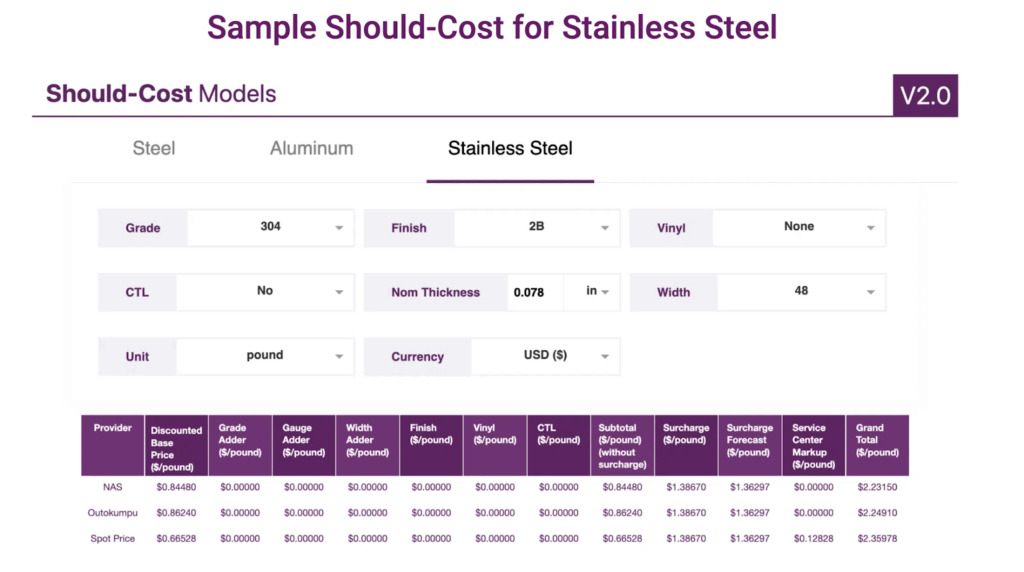

We know what you should be paying for metals. MetalMiner should-cost models are the ultimate stainless savings hack, showing you the “should-cost” price for gauge, width, polish and finish adders. Explore what value they can add for your organization.

Although little has changed from a demand perspective, 50% tariffs on steel and steel-containing products have given domestic mills a significant advantage within the U.S. market, allowing them to increase capacity as a result. This comes despite the long-standing contraction of the U.S. manufacturing sector. While numerous manufacturers have announced reshoring efforts in response to trade barriers, the results will take time to materialize in terms of U.S. stainless steel consumption.

Q4 Could See New Market Shifts

For now, mills have taken advantage of a higher price floor and the increased preference among procurement organizations to source material domestically. Despite soft market conditions in the U.S., manufacturers aim to derisk sourcing efforts in the event that evolving trade policy or geopolitical events trigger another rapid market shift.

While this has kept prices firm in Q3, the balance of power could shift by next year. Suppliers largely agree that there is little likelihood that mills will increase discounts as contracting season approaches. While conditions do not currently justify further price hikes, mills are keen to keep their present position as procurement organizations lock in 2026 contracts.

However, there is some disagreement as to what will happen after contracts are signed. U.S. trade agreements with both the EU and the UK suggested that tariff rate quota agreements are possible. As Outokumpu noted, the European stainless market was exceptionally weak during Q2, a development recently covered in the Monthly Metals Outlook. Tariff-free stainless shipments from the region would offer a more competitive landscape for buyers needing to secure material. Meanwhile, trade negotiations with both Canada and Mexico remain ongoing. Agreements with those nations could offer another headwind for U.S. stainless mills.

Beyond Trade Policy Shifts

It remains worth noting that none of the countries that could potentially secure quota arrangements are among America’s cheapest offshore sources for stainless. For example. material from both Vietnam and Taiwan will remain heavily levied.

Beyond trade policy shifts, North American Stainless also made significant investments to expand capacity. Announced in 2023, the mill’s Ghent facility will include a new cold rolling mill, roll grinders, temper mill, upgrades to its annealing and picking lines and expansion of its melt shop building. Although no official completion date was provided, construction is expected to be completed by the end of 2025. Absent a rebound in demand or meaningful restocking efforts, the combination of potential quota deals and increased U.S. capacity could offer buyers more leverage over pricing.

Struggling to forecast stainless prices for budgeting and contracting? MetalMiner’s Monthly Metals Index Report includes seven metal price indexes and can be used as an economic indicator for contracting.

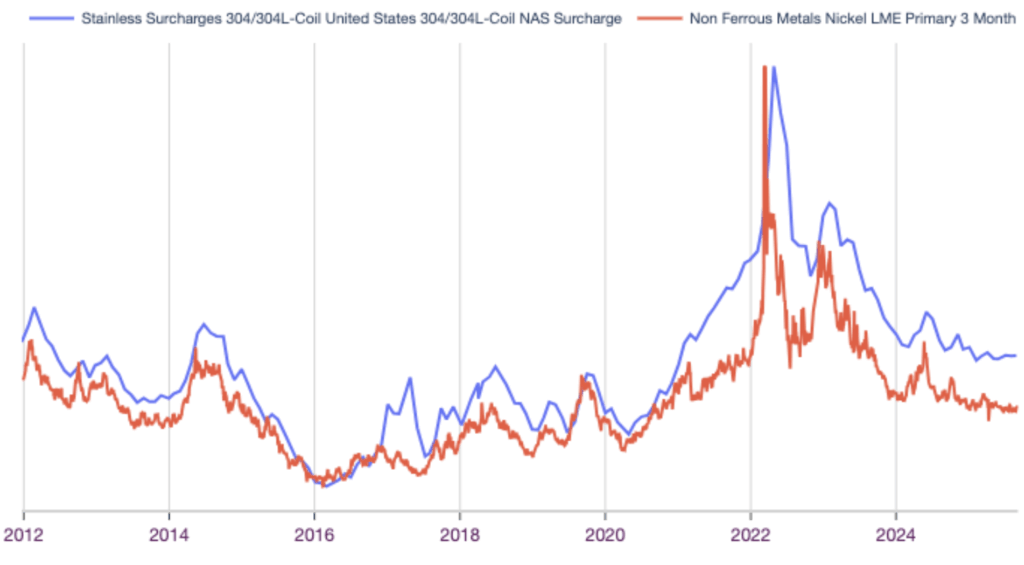

Nickel Prices Remain Stable

Offering a counterweight to the increased volatility witnessed in stainless steel base prices during the year, nickel prices remain sideways. This has translated into a relatively calm surcharge since the start of 2025.

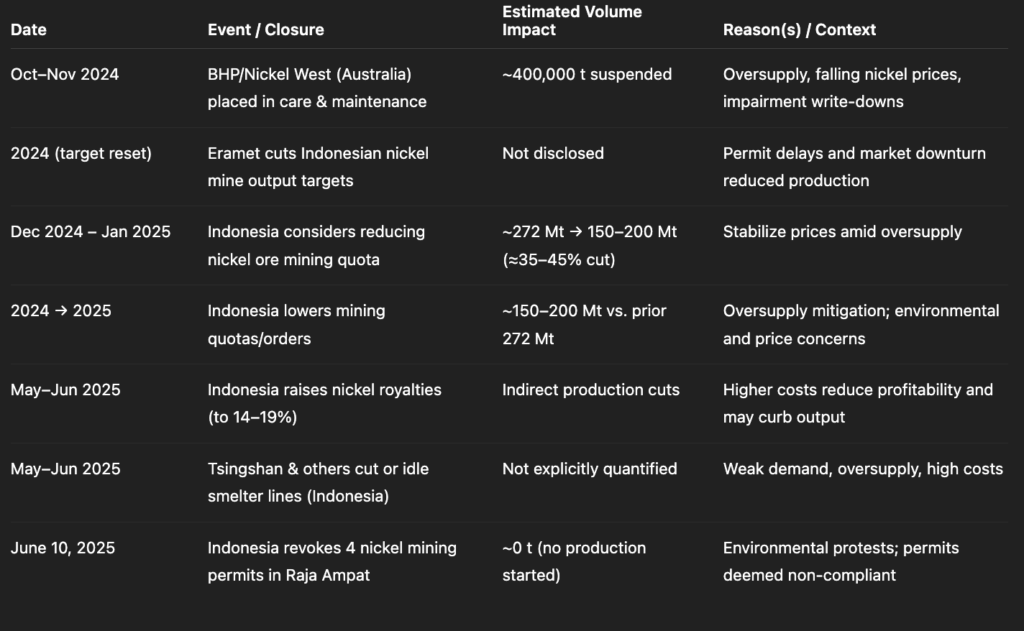

While the nickel market remains oversupplied, there is no evidence of strong bearish momentum which helped drive prices lower over the last two years. Low prices and environmental violations have forced a number of closures within the nickel market, and further price declines would likely force capacity cuts.

The robust expansion of Indonesia’s nickel industry has provided significant fuel for global overcapacity. The nickel market largely overestimated demand from the EV sector, a fact that, combined with lackluster global stainless steel demand, has caused exchange inventories to continue to rise. LME stocks sit at a 4-year high, while SHFE inventories also appear abundant. These factors are likely to inhibit any meaningful uptrend in nickel prices for the foreseeable future.

Biggest Nickel and Stainless Steel Price Moves

Maximize your stainless procurement budget by using MetalMiner Select’s unbundled price point solution lets you pay exclusively for the stainless grades and forms you need, avoiding expenditure on extra data you don’t.

- Chinese ferromolybdenum prices remained bullish, with an 8.71% rise to $40,141 per metric ton as of September 1.

- Chinese ferrochrome prices rose 4.25% to $1,234 per metric ton.

- Chinese primary nickel prices witnessed a 4.03% increase to $17,430 per metric ton.

- The Allegheny Ludlum Surcharge for 316L cold rolled stainless coil prices increased 2.90% to $1.5 per pound.

- Korean 304 cold rolled coil prices saw the only decrease of the overall index, falling 7.68% to $2,304 per metric ton.