Global Precious MMI: Higher Platinum, Palladium Prices May Have to Wait for 2019

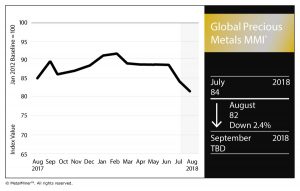

Last month we noted that record-low prices characterized the Global Precious Monthly Metals Index (MMI) monthly reading and posed the question: will there be more price drops to come?

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

From the looks of it, the short answer to that is … yes.

Here’s What Happened

Going by the August 2018 reading of MetalMiner’s Global Precious MMI, which tracks a basket of precious metals from across the globe, the subindex suffered a loss of 2.4%, falling to a value of 82.

The last time we saw the Global Precious MMI at that level was February 2017.

Platinum and palladium seemed to drive the loss this month, yet all major forms of precious metals across geographies ended up lower this month.

For example, the U.S. platinum bar price dropped 1.8% to $837 per ounce. Palladium is still transacting at a premium to platinum in the U.S. market, but not in the China or Japan markets (although exchange rates may ultimately be affecting that relationship). The U.S. palladium bar price dropped for August as well, down 2.1% to $928 per ounce.

Yet the U.S. silver price ended up lower than $16 per ounce to begin the month for the first time since January 2017, clocking in at $15.50 on Aug. 1. The gold price dropped as well, with U.S. gold bullion taking a 2.3% hit to end up at $1,223.40 per ounce.

All of these metals appear to be in a long-term downtrend since the tail end of 2017 and first couple months of 2018.

What Buyers Should Consider

- A strong dollar still keeping the platinum price low. Along with supply surplus and the ever-looming threat of a global trade war, the dollar’s strength is a strong indicator of platinum’s fortunes for the rest of 2018. A recent Reuters poll of 29 analysts and traders showed that the platinum price looks to remain historically depressed for the balance of the year, with a slight rebound in 2019. “The diesel scandal remains a drag on demand … Meanwhile, currency weakness provides a lifeline to the South African platinum industry, cutting dollar-denominated costs and reducing the risk of mine closures,” said Carsten Menke, analyst for Julius Baer, as quoted by Reuters.

- Palladium to remain at a premium? “We expect a rebound in palladium prices [in 2019] amid a growing market share of gasoline vehicles and healthy demand growth in emerging markets. Fundamentals are tight amid a widening deficit,” Intesa Sanpaolo analyst Daniela Corsini told Reuters.

- Your latest preferred supplier — Sears? In the current economic climate that retailer finds itself in, it’s strange to hear that the company has added several brand lines sold by third-party sellers to “bolster its online marketplace,” according to a press release. Additions include “gold, silver, platinum and palladium bars, rounds and coins, as well as premium bullion products,” the release stated. So if you’re looking outside the box to source your precious metal volumes for industrial applications, take note: “Sears.com and Shop Your Way® are currently offering a $20 CASHBACK in Points when members spend $100 or more on APMEX [the online retailer of the metals] products until August 11.”

Want to a see Cold Rolled price forecast? Get two monthly reports for free!

One Comment

In the Asian markets, gold rose by about 25% from

2010 to 2011 because in the fluctuations inside the global oil market and the financial markets.

Although the advertisements may exaggerate the values and safety a bit, these are

fundamentally legit: you are going to receive handsome compensation for the old gold jewelry.

The secret’s in simply how much gold and silver will likely be available within the future, and for that reason if increasing gold and silver coins prices could

support the same relationship as today.