The Automotive MMI (Monthly MetalMiner Index) rose slightly higher than in previous reports. Month-over-month, the index went up by 5.08%. Automobile inventories may be rising, but consumers are much more reluctant to purchase than they were six months ago. With interest rates still climbing, more and more consumers continue to steer away from vehicle purchases. […]

Renewables/GOES MMI: Sideways Trend Continues, “Green Steel” Gains Momentum

The Renewables MMI (Monthly MetalMiner Index) traded sideways in January, dropping a mere 1.28%. A significant drop in grain oriented electrical steel had the largest impact on the index month-over-month. Other parts of the index, particularly steel forms, managed to hold up better, trading sideways or rising slightly. Overall, the world continues to push for […]

Rare Earths MMI: Different Countries Racing for Global Rare Earth Dominance

The Rare Earths MMI (Monthly Metals Index) rose considerably over the past month, climbing by a total of 7.05%. The primary factor influencing the rare earth price forecast over the past several months was zero-COVID. Now, the focus is on those restrictions being lifted. Currently, China reports that the country’s COVID cases are dropping. China’s […]

Aluminum Inventories Still Historically Low, Prices Edge Upward

As with many base metals, aluminum prices rose at the beginning of January. While it is true that China raising aluminum export taxes could have impacted aluminum prices, the market has witnessed somewhat volatile conditions since late September of 2022. And though prices are nowhere near their March 2022 historic rally levels, they still remain […]

Grain Oriented Electrical Steel Demand Expected to Keep Growing

No matter where in the world you go and what energy source you’re using, energy transfer requires transformers. Be it a nuclear power facility, a power plant running on natural gas, a wind field, or a plant running on hydropower. The energy generated in these facilities cannot light up homes, businesses, and schools without transformers. […]

Is the Face of the Steel Industry Changing?

After weathering a bumpy ride throughout 2022, one of the world’s most traded commodities still isn’t out of the woods just yet. Though steel prices rose across the board over the past few weeks, mills around the world remain shuttered, and demand continues to fluctuate. Zero-COVID and limited energy across places like Europe are just […]

Renewables/GOES MMI: Wind Turbine Production Threatened by Steel Price Hikes

The Renewables MMI (Monthly MetalMiner Index) began showing signs of a possible reversal month-over-month, edging up 3.42%. Renewable resources, meanwhile, continue to see significant global investment. MetalMiner noted in its Raw Steels MMI that steel prices found a bottom month-over-month. This impacted the renewable resources index heavily. After all, much of the index consists of […]

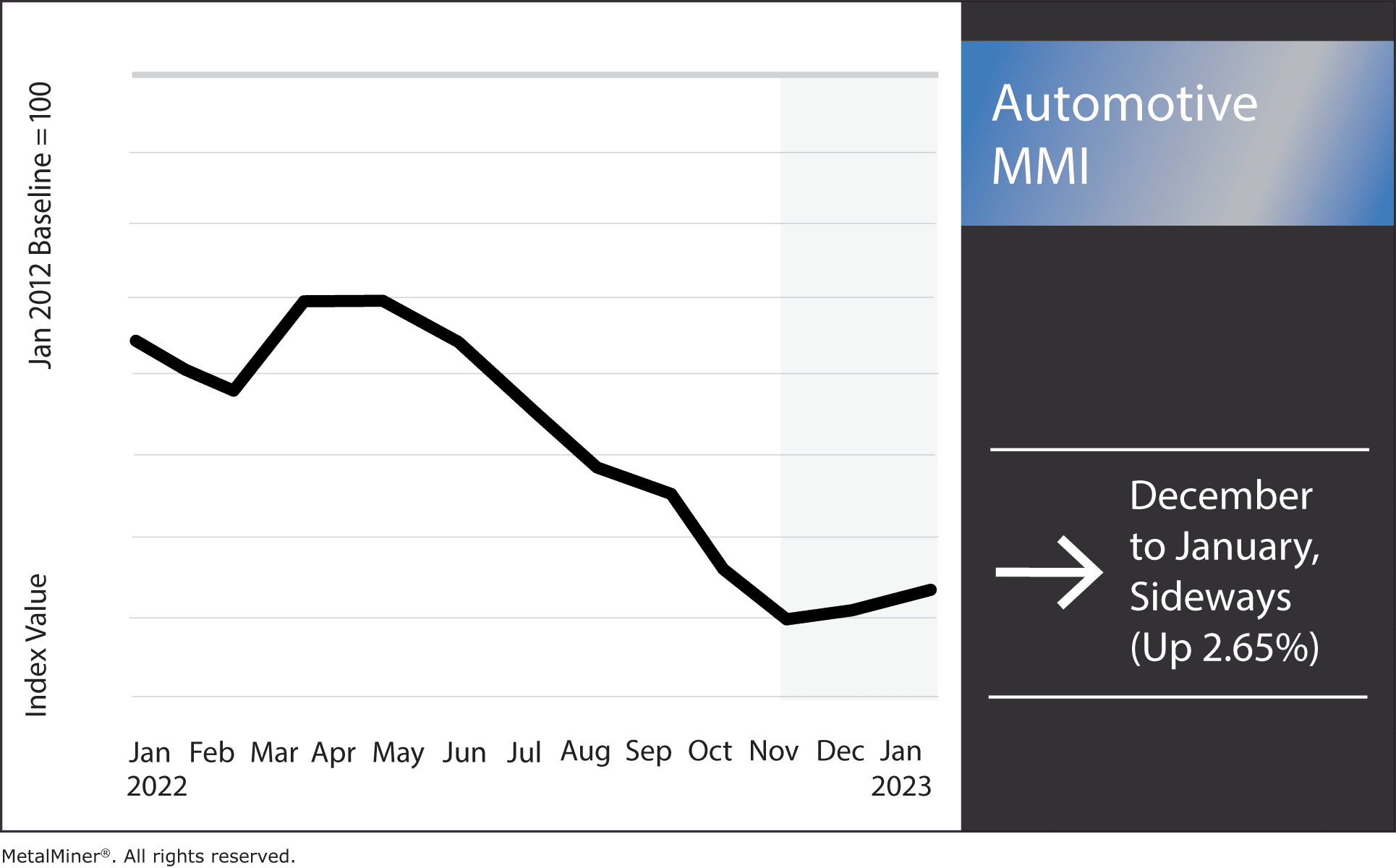

Automotive MMI: 2023 Could Bring More Car Parts Shortages

The Automotive MMI (Monthly MetalMiner Index) traded sideways for the second month in a row, rising by just 2.65%. The automotive index was impacted heavily by China rescinding zero-COVID restrictions, which caused a spike in cases. However, Chinese-sourced lead and HDG steel prices rose significantly, pulling the index upward. The overall volatility in metals used […]

Construction MMI: Chinese Sourced Steel Prices Spike, Supply Pinches Possible

The Construction MMI (Monthly MetalMiner Index) rose considerably by 7.68%, with Chinese steel prices getting a significant boost. In fact, all facets of the index related to China (except for iron ore) increased. The movement came in the wake of zero-COVID restrictions lifting, which resulted in a sharp rise in coronavirus cases. While this was […]

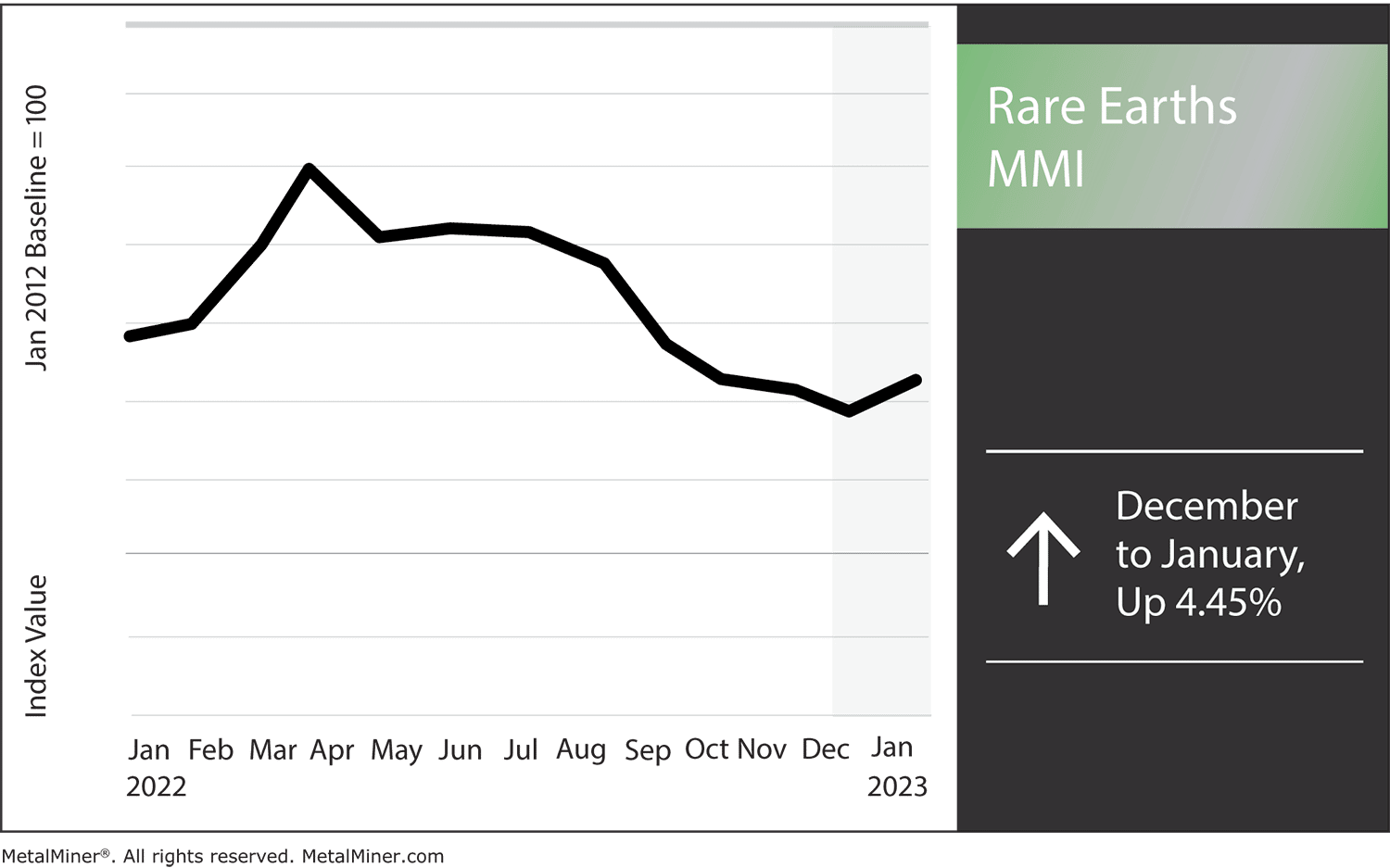

Rare Earths MMI: Surge in China’s COVID Cases Impact Prices

The Rare Earths MMI (Monthly MetalMiner Index) jumped slightly more than in the past six months, rising 4.45%. All month, geopolitical factors, mostly involving China, significantly impacted the index. For instance, production still proved low in the wake of zero-COVID. Then, once zero-COVID restrictions were lifted, the spike in cases across China kept the drag […]