Rare Earths MMI: Surge in China’s COVID Cases Impact Prices

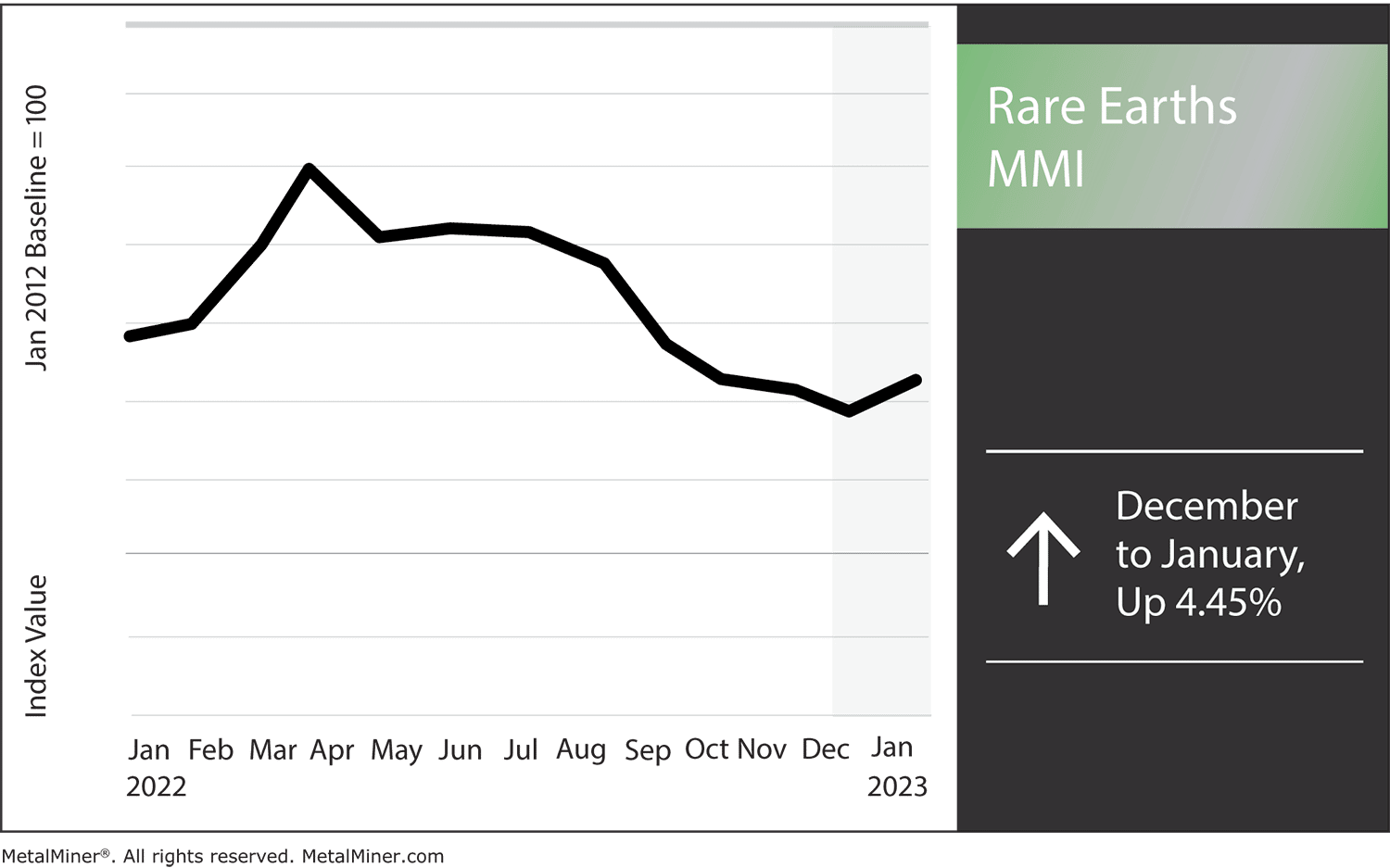

The Rare Earths MMI (Monthly MetalMiner Index) jumped slightly more than in the past six months, rising 4.45%. All month, geopolitical factors, mostly involving China, significantly impacted the index. For instance, production still proved low in the wake of zero-COVID. Then, once zero-COVID restrictions were lifted, the spike in cases across China kept the drag on rare earth supplies.

Alternatively, the price increase could signify increasing fears of further slowed production in China. The surge means that until the spike in COVID cases slows down, production and mining of rare earths could continue to struggle. Therefore, we advise buyers and investors to continue searching outside China for rare earth sources.

Alternatives to Chinese Rare Earths

In the past 3-6 months, MetalMiner covered the world’s dependence on Chinese rare earth supplies rather extensively. We also discussed how recent geopolitical events exacerbated that dependence. During to the country’s zero-COVID initiatives, Chinese production and mining of rare earth elements reduced drastically. This made many countries realize that having just one primary source of rare earth elements could quickly prove disastrous.

According to a recent article, the U.S. and its allies should continue seeking alternatives to Chinese rare earth elements. Indeed, these elements are crucial to the global electronics mark, especially with the push for things like EVs. Therefore, no single country can afford to find itself without a viable rare earths source. Another article noted that China is unlikely to restrict the flow of rare earth trading for political reasons. Even so, that doesn’t erase the need for increased trading diversity.

All the rare earths intelligence you need in one user-friendly platform with unlimited usage – Request a MetalMiner Insights platform demo.

Japan Paving its Own Route

Japan is taking rare earth supply pinches head on. In fact, Japanese excavation teams plan to start digging for rare earth elements in the seabed surrounding Minamitorishima Island by 2024. This would go a long way towards breaking Japan’s dependence on other countries for rare earths like yttrium. This rare earth is a common element in large display screens, ceramics, and industrial lasers. For Japan, having a domestic source of yttrium would prove a huge advantage.

That said, Minamitorishima Island is a fairly small area, about 0.58 square miles. If Japan were only to scout the seabeds around the island for elements like yttrium, it would quickly run out of supply. Furthermore, the country’s estimated start date is still a year away at least. Since mining excursions like this require a lot of time and resources, results will be far from instantaneous. However, if Japan were to extend its vision beyond the seabed surrounding Minamitorishima Island, it could potentially find more abundant yttrium sources.

Stay up to date on MetalMiner and rare earth trends with weekly updates – without the sales pitch. Sign up for MetalMiner’s weekly newsletter.

COVID Surge in China Weighing Down on Rare Earths

Many predicted a widespread outbreak of COVID after the end of the China’s zero-COVID lockdowns. The lifting of zero-COVID measures brought both good and bad news. On the one hand, there is renewed hope that Chinese manufacturing will pick up again. This would include both the mining and processing of rare earths. On the other hand, the post-lockdown case surge continues to drag on Chinese production.

Last month, Reuters reported that China’s trading market suffered its worst drop in 2 1/2 years. This happened around the time when cases began to surge, which also saw exports contract by about 8.7%. Obviously, this could easily have big ramifications for both rare earth exports and imports.

Rare Earths MMI: Notable Price Trends

- Neodymium not only traded sideways but completely flat. Prices remain at $130,258.38 per metric ton.

- Yttrium traded flat alongside Neodymium. Prices currently sit at $34.06 per kilogram.

- Terbium metal went up in price by 3.29%. At month’s start, prices sat at $2356.04.

Did you enjoy this article? MetalMiner’s monthly MMI report gives you price updates, market trends, and industry insight for rare earths and 8 other metal industries. Sign up here!

Leave a Reply