The Global Precious Metals MMI (Monthly Metals Index) saw a strong rally from mid-May to mid-June. Precious metals prices like gold, silver, platinum and palladium all climbed on a potent mix of safe-haven investment flows and robust industrial demand. Geopolitical tensions, notably the recent flare-up in the Middle East between Israel and Iran, have only […]

Construction MMI: New 50% Aluminum and Steel Tariffs Squeeze U.S. Construction

The Construction MMI (Monthly Metals Index) moved sideways, dropping by 2.0% month-over-month. In early June 2025, new Trump tariffs doubled pre-existing steel and aluminum duties from 25% to 50%. As buyers scrambled, U.S. aluminum premiums immediately hit a record 60¢/lb. Meanwhile, the tariff surge is already squeezing the U.S. construction industry. Construction Input Inflation Construction […]

Automotive MMI: Automakers Scramble as Rare Earths Crunch and Tariffs Impact Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 0.70%. This comes as auto industry executives in the U.S. are confronting a whirlwind of trade and supply chain disruptions, not to mention the effects of the recent round of Trump tariffs. In the past month alone, high-stakes U.S.–China trade talks, critical mineral export […]

Hedging Copper Prices and Smoothing Volatility in H2 2025

There are many hedge fund strategies organizations can employ to generate returns and manage risk. Now, metal buyers are looking to apply these same concepts to certain metals. Base metals like copper have seen notable swings so far in 2025. According to the CME group, copper oscillated in a roughly $4.55–$4.80 per pound range throughout […]

Copper Market Outlook, H2 2025: Why Are Inventories Still So Uneven?

The copper market outlook for the second half of 2025 has seen significant debate in recent weeks. On the supply side of the equation, new production is coming online. However, this may not happen fast enough to flood the market. According to mining.com, the ICSG projects global mined copper output will rise about 2.3% in […]

Price of Copper Braces for H2 2025: Are Demand Jitters on the Way?

Copper prices are entering the second half of 2025 on a knife’s edge. After a roller-coaster first half that included soaring to record highs in March only to plunge weeks later, the outlook for the price of copper remains clouded by dueling forces. On the one hand, robust long-term demand drivers like electrification and EVs […]

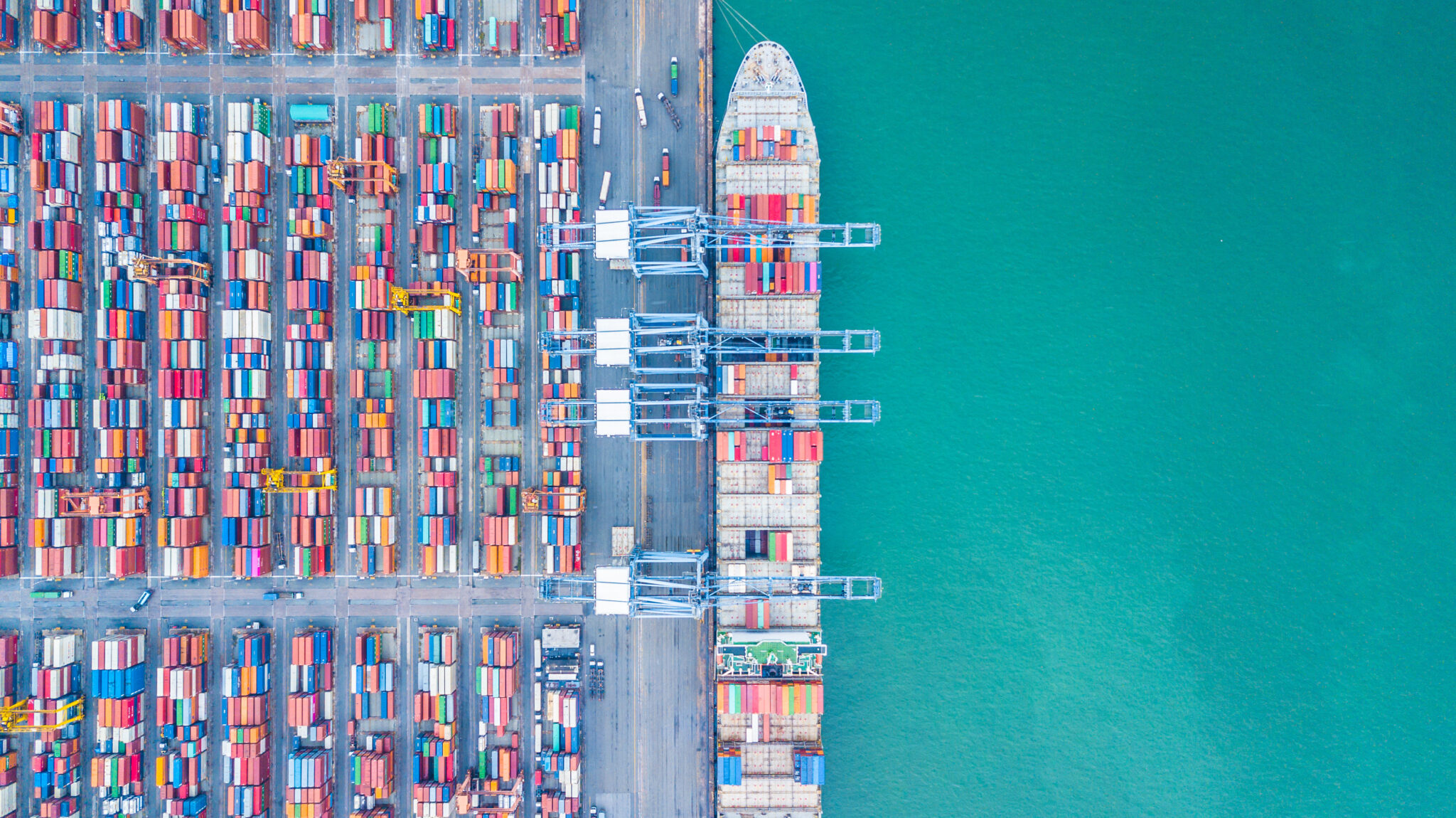

China’s Metal Anti-Dumping is Back. What You Need to Know

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

Renewables MMI: Buyers Stock Up Ahead of 10% Tariff Deadline

The Renewables MMI (Monthly Metals Index) moved sideways, rising a slight 2.83%. Metals prices, including those for copper, steel, lithium and cobalt, have seen significant swings in recent weeks as U.S. companies scramble to source material before tariffs are imposed. For instance, U.S. copper prices surged in Q1 as buyers raced ahead of potential import […]

Construction MMI: Construction Market Braces Itself as Recession Fears Loom

The Construction MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 2.72%. In the wake of fresh federal policy moves this spring, construction news reports indicate that the industry is navigating a sudden spike in material costs. Over the past month, new government tariffs and trade measures have caused significant price fluctuations in critical inputs […]

Automotive MMI: Volatile Steel and Copper Prices Shake U.S. Auto Industry

The Automotive MMI (Monthly Metals Index) moved sideways this past month, dropping a slight 1.74%. The US automotive industry faces a bumpy ride as key metal prices continue to swing wildly. In recent weeks, critical inputs like hot-dipped galvanized steel, copper and lead have seen rapid price shifts amid new tariffs and supply chain jitters, […]