This morning in metals news, aluminum and steel compete in the electric vehicle (EV) market, copper stocks on the Shanghai Futures Exchange are surging and the list of Chinese products that could be subject to tariffs might include aerospace components. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Aluminum vs. Steel […]

Category: Automotive

BMW Caught Cheating Emissions Tests

If you thought allegations of emissions rigging were a thing of the past, think again. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook It appears what’s good for Volkswagen is probably good for BMW, too. According to an article in The Telegraph, BMW’s Munich office has been raided by German authorities […]

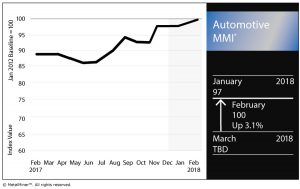

Automotive MMI: Sales Lag, Auto Stocks Drop After Tariffs Announcement

The Automotive MMI (Monthly Metals Index) stood pat this past month, holding at 100 for the second consecutive month.

Within the basket of metals, U.S. HDG steel rose 5.8% on the month, while U.S. shredded scrap steel jumped 8.4%. Palladium continues to outpace platinum — atypical of the two metals’ historical relationship — and Chinese primary lead dropped 3.8%.

Section 232 buying strategies – grab your copy of MetalMiner’s Section 232 Investigation Impact Report for only $74.99!

Meanwhile, LME copper continued to cool off, dropping 3.5% month over month as of March 1.

U.S. Auto Sales

February was a slow month for a lot of U.S. automakers.

General Motors saw its U.S. sales drop 7.0% year over year, while its year-to-date sales (i.e. through the end of February) are down 3.2%, according to recently released Autodata Corp sales data.

Ford Motor Company, too, had a slow month, posting a 6.8% drop year over year and a 6.6% year-to-date decline.

Fiat Chrysler‘s numbers dropped 1.4% year over year and are down 6.8% in the year to date.

Toyota, on the other hand, had another good month in 2018, posting a 4.5% increase year over year. Toyota’s sales are up 10% in the year to date. Volkswagen also had a strong month, increasing 8.4% year over year and 7.7% in the year to date. Albeit on smaller volumes, Mitsubishi (18.8%) and Mazda (12.7%) also managed strong year-over-year sales jumps in February.

Light trucks continue to be a favorite in the U.S. market. Light truck sales jumped 3.8% year over year, and are up 5.9% in the year to date. Meanwhile, sales of passenger cars dropped 12.6% year over year last month, and their year-to-date sales have dropped 11.9%.

Tariffs Talk

President Donald Trump’s announcement Thursday that his administration plans to impose tariffs of 25% on steel imports and 10% on aluminum imports have sent shock waves throughout the world. Downstream producers, trading allies (like Canada and the European Union) and even U.S. politicians have expressed the hope that the president might reconsider. (For the MetalMiner team’s full analysis of the Section 232 announcement, visit our dedicated Section 232 Investigation Impact Report page).

Naturally, downstream producers, including major automakers, reliant on imports of steel and aluminum are apprehensive. In the marketplace, investors are apparently feeling the same way.

As CNBC reported, a number of automakers saw their stocks drop after Trump’s announcement (which has yet to be officially enacted as policy). GM closed 4% lower, while Ford and Toyota closed 3% lower apiece, according to the report.

The U.S. Motor and Equipment Manufacturers Association (MEMA) came out in strong opposition to the tariffs proposal.

“The tariffs announced today will be detrimental to the motor vehicle parts supplier industry and the 871,000 US jobs it directly creates,” said Steve Handschuh, MEMA president and CEO, in a prepared statement. “We have voiced repeatedly that while we support the administration’s focus on strong domestic steel and aluminum markets, tariffs limit access to necessary specialty products, raise the cost of motor vehicles to consumers, and impair the industry’s ability to compete in the global marketplace. This is not a step in the right direction.”

While those in the steel and aluminum industries have argued price increases that would arise as a result of the tariffs would not be severe, downstream producers, including automakers, have balked at that suggestion.

In another policy arena, the tariffs announcement also has an effect on the ongoing renegotiation talks focusing on the 24-year-old North American Free Trade Agreement (NAFTA). Throughout the proceedings, which began last August and have now gone through seven rounds, the U.S. has sought to win tighter rules on rules of origin for automotive materials, among other concessions.

Canada, the top exporter of steel and aluminum to the U.S., has expressed significant concern about the prospective tariffs. The Washington Post reported that Canada is “flabbergasted” at the tariffs proposal, according to Douglas Porter, the chief economist at the Bank of Montreal.

Wondering how your stainless steel prices compare to the market? Benchmark with MetalMiner

Actual Metal Prices and Trends

Week in Review: Aluminum Prices, Section 232 Analysis and the VIX

Before we head into the weekend, let’s take a look back at the week that was and some of the stories here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook What’s up with aluminum? After a strong 2017 the metal hasn’t seen as much upward movement as some other […]

Is it a Vacuum? Is it a Hairdryer? No, it is a Dyson Car

Initially, electric and now the development of autonomous cars has been a major disrupter for the auto industry, the effects of which we have only just begun to see. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Traditional auto manufacturers were initially written off as having too much legacy investments in […]

European Railways Eye Plans for More Environmentally Friendly Fuel Sources

The automobile frequently comes in for criticism for its role in environmental pollution, not just in contributing to Co2 levels but more often for the output of carcinogenic particulate matter emissions, sulphur dioxide and nitrogen dioxide, all of which contribute to an estimated 29,000 deaths in the U.K., according to Public Health England, 200,000 in […]

SMDI Makes Case for Steel Over Aluminum During Chicago Auto Show

Use of aluminum in automotive bodies has gained steam in recent years — and the metal’s rivalry with steel has heated up in the process. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook For example, Ford Motor Co. shook up the marketplace when it announced its all-aluminum body F-150 2015 model. […]

This Morning in Metals: Aluminum Industry Testifies to ITC on Foil Imports

This morning in metals news, aluminum industry officials testified to the U.S. International Trade Commission regarding the ongoing aluminum foil investigation, Mexico’s economy minister says automotive rules of origin will change as part of the ongoing renegotiation talks surrounding the North American Free Trade Agreement (NAFTA) and copper is on track for its biggest weekly […]

This Morning in Metals: Voestalpine Chief Executive Warns of European Steel Overcapacity

This morning in metals news, the chief executive of Austria’s Voestalpine says Europe’s steel industry has excess capacity, copper picked up as the dollar’s gains paused and automotive aluminum use is picking up according to one survey.Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Aluminum Autos The aluminum sector is becoming […]

Automotive MMI: General Motors Starts 2018 on Strong Sales Note

The Automotive MMI got off to a hot start in 2018, picking up three points en route to a February reading of 100. The February reading marked the first triple-digit performance for the MMI since it posted a 101 in January 2014.

As for the basket of metals, a majority of the bunch posted price increases this past month.

Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need

U.S. HDG steel jumped 2.7% as of Feb. 1, while U.S. platinum bars rose 6.2%. Fellow platinum-group metal (PGM) palladium fell for the month, however, by 5.8%.

U.S. shredded scrap jumped 7.7% and Korean aluminum 5052 coil rose 6.7%.

U.S. Auto Sales

January proved to a be a mixed bag for automakers vis-a-vis their U.S. sales.

According to data from Autodata Corp released Feb. 1, topping the charts in January was General Motors Corp., with 198,386 units sold, up 13% year over year. Sales of light trucks carried the day, as they increased 12.6% to soften a 30.2% drop in car sales. (General Motors is expected to announce its fourth-quarter 2017 and full-year earnings Tuesday, Feb. 6.)

In mid-January, GM forecasted 2018 would be another good year. According to a GM release, the company benefited from “continued strength” in North America and China, plus improvement in South America.

“GM had a very good 2017 as we continued to transform our company to be more focused, resilient and profitable,” GM Chairman and CEO Mary Barra said in the release. “We are positioned for another strong year in 2018 and an even better one in 2019.”

GM touted its growth in truck sales in a release last Thursday.

“All of our brands are building momentum in the industry’s hottest and most profitable segments,” said Kurt McNeil, U.S. vice president, sales operations, in the prepared statement. “Chevrolet led the growth of the small crossover segment with the Trax as well as the mid-pickup segment with the Colorado. Now, we have the all-new Equinox and Traverse delivering higher sales, share and transaction prices.”

Meanwhile, Ford Motor Company, which called 2017 a “challenging” year during its earnings call last week, didn’t have quite as good of a month. Ford posted a 6.3% year-over-year sales drop, with 160,411 units sold in January.

Down the list, Fiat Chrysler had a rough month, posting a 12.8% year-over-year decline. Toyota sales jumped 16.8%, Honda‘s were down 1.7% and Nissan‘s jumped 10.0%.

Volkswagen, meanwhile, found itself adding to the bad press from its Dieselgate scandal when it was reported last month that the company conducted exhaust tests on monkeys. Volkswagen’s January U.S. sales were down a whopping 32.8% year over year.

China and EVs

Everybody knows about Tesla and Elon Musk — but what about China and its role in what will assuredly become an increasingly electrified automotive world?

According to Bloomberg, one small town in southeast China will house a planned $1.3 billion battery factory that could stymie the global competition.

“The company plans to raise 13.1 billion yuan ($2 billion) as soon as this year by selling a 10 percent stake, at a valuation of about $20 billion,” the Bloomberg report states. “The share sale would finance construction of a battery-cell plant second in size only to Tesla Inc.’s Gigafactory in Nevada—big enough to cement China as the leader in the technology replacing gas-guzzling engines.”

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel