China’s announced restriction on the export of gallium and germanium goes into effect in August. Both of these elements are vital to the microchip industry. Many worry that the move will lead to another major semiconductor shortage. As per the new rule, export of these strategic metals now requires Beijing’s permission. Exporters violating the rule […]

Category: Exports

Democratic Republic of Congo Replaces Peru as the Second Largest Copper Exporter

There’s a new kid on the block in copper production. Media reports say the Democratic Republic of Congo (DRC) continues to put up a tough fight against Peru, the world’s second-biggest copper producer. If the latter does not square up, expects feel the DRC may end up taking its #2 title. Of course, such competition […]

Chinese Steel Prices Dropping Quickly

For the past year or two, steel analysts and experts have talked about how China’s market is now more open. Simultaneously, they discussed how domestic steel demand had surged due to increased infrastructure spending. The way they made it sound, low steel prices would soon become a thing of the past. This week, prices for […]

Rare Earths MMI: Prices Plummet as Rare Earth Demand Drops

The Rare Earths MMI (Monthly Metals Index) suffered yet another significant drop month-over-month. Overall, the index fell 15.81%. These massive drops in prices are the result of several factors. One of the the biggest culprits is rising supply and falling demand. Prices for rare earth metals have also decreased due to new mining initiatives cropping […]

China’s Reform Commission Threatens Crackdown on Iron Ore Hoarders

The global iron ore price may be in for a bit of a ride. Sector analysts foresee high price volatility in the first months of 2023, mainly due to the increasing number of coronavirus cases in China. Adding fuel to the fire is the fact that the government there has warned it will be “paying […]

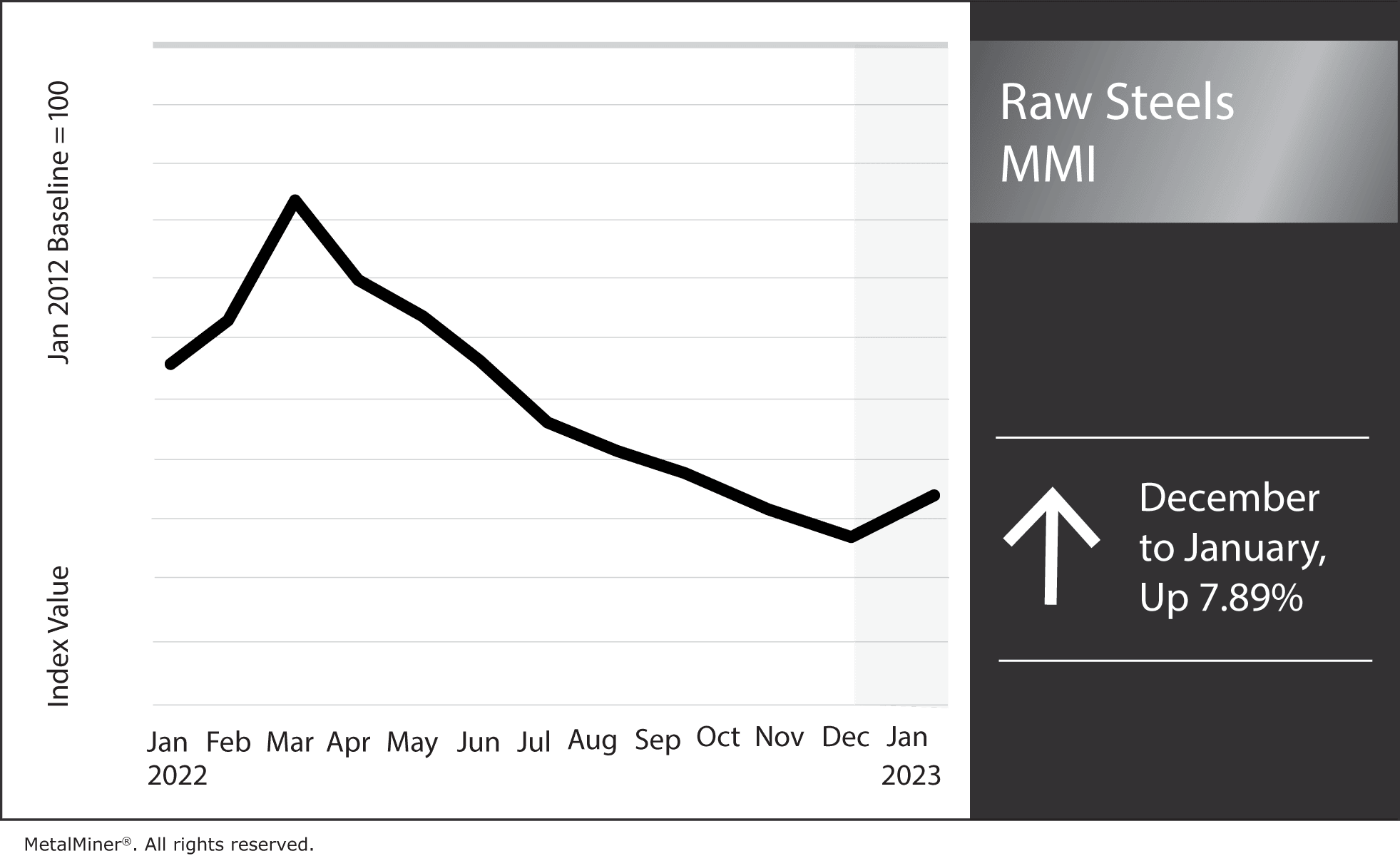

Raw Steels MMI: U.S. Steel Prices Find Bottom, Begin Rising

U.S. steel prices hit a bottom at the beginning of December, then began to climb. Hot rolled coil prices rose over 8% from their December low. Meanwhile, plate prices traded down for the first time since September. Overall, the Raw Steels Monthly Metals Index (MMI) rose by 7.98% from December to January. MetalMiner’s free weekly […]

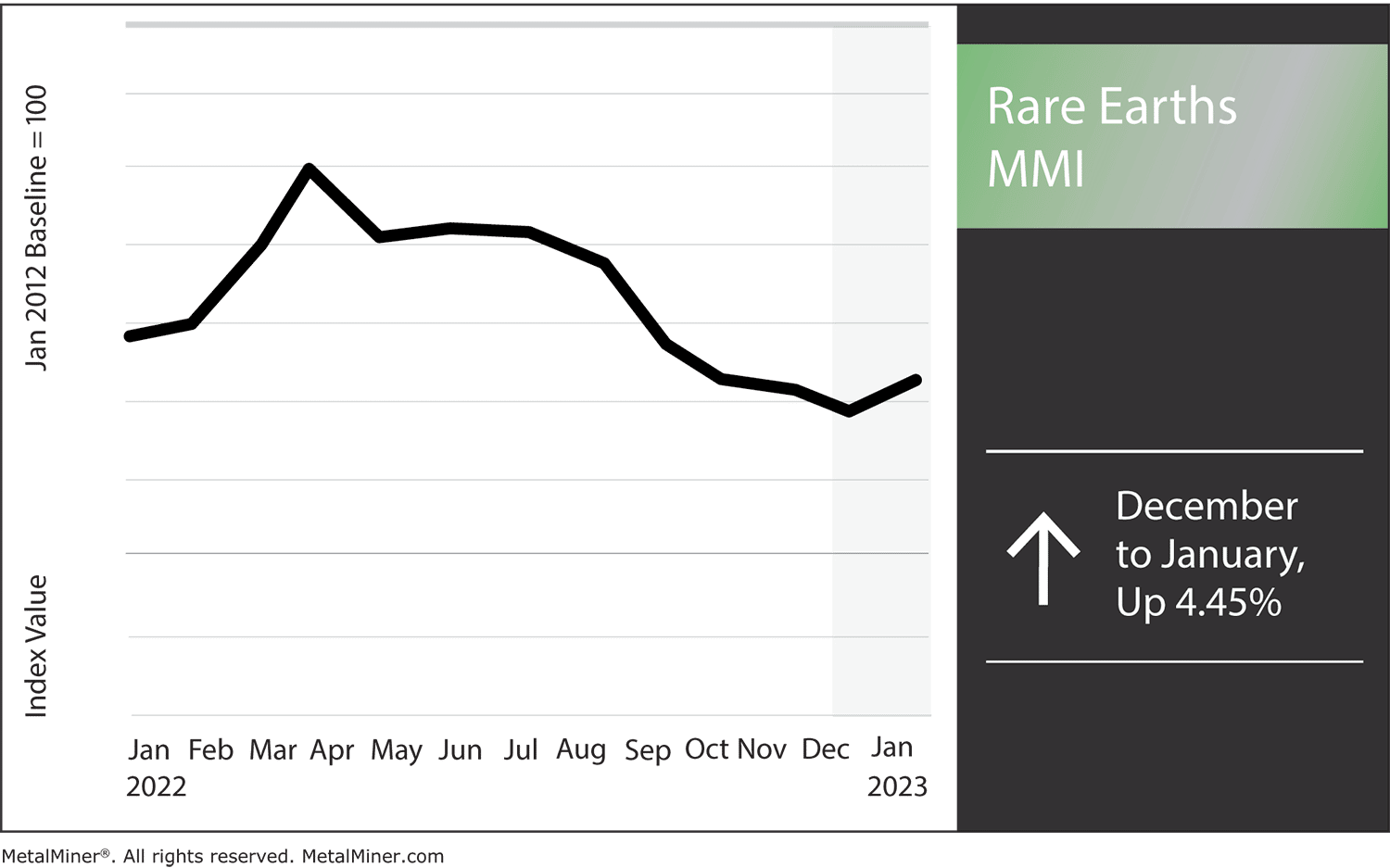

Rare Earths MMI: Surge in China’s COVID Cases Impact Prices

The Rare Earths MMI (Monthly MetalMiner Index) jumped slightly more than in the past six months, rising 4.45%. All month, geopolitical factors, mostly involving China, significantly impacted the index. For instance, production still proved low in the wake of zero-COVID. Then, once zero-COVID restrictions were lifted, the spike in cases across China kept the drag […]

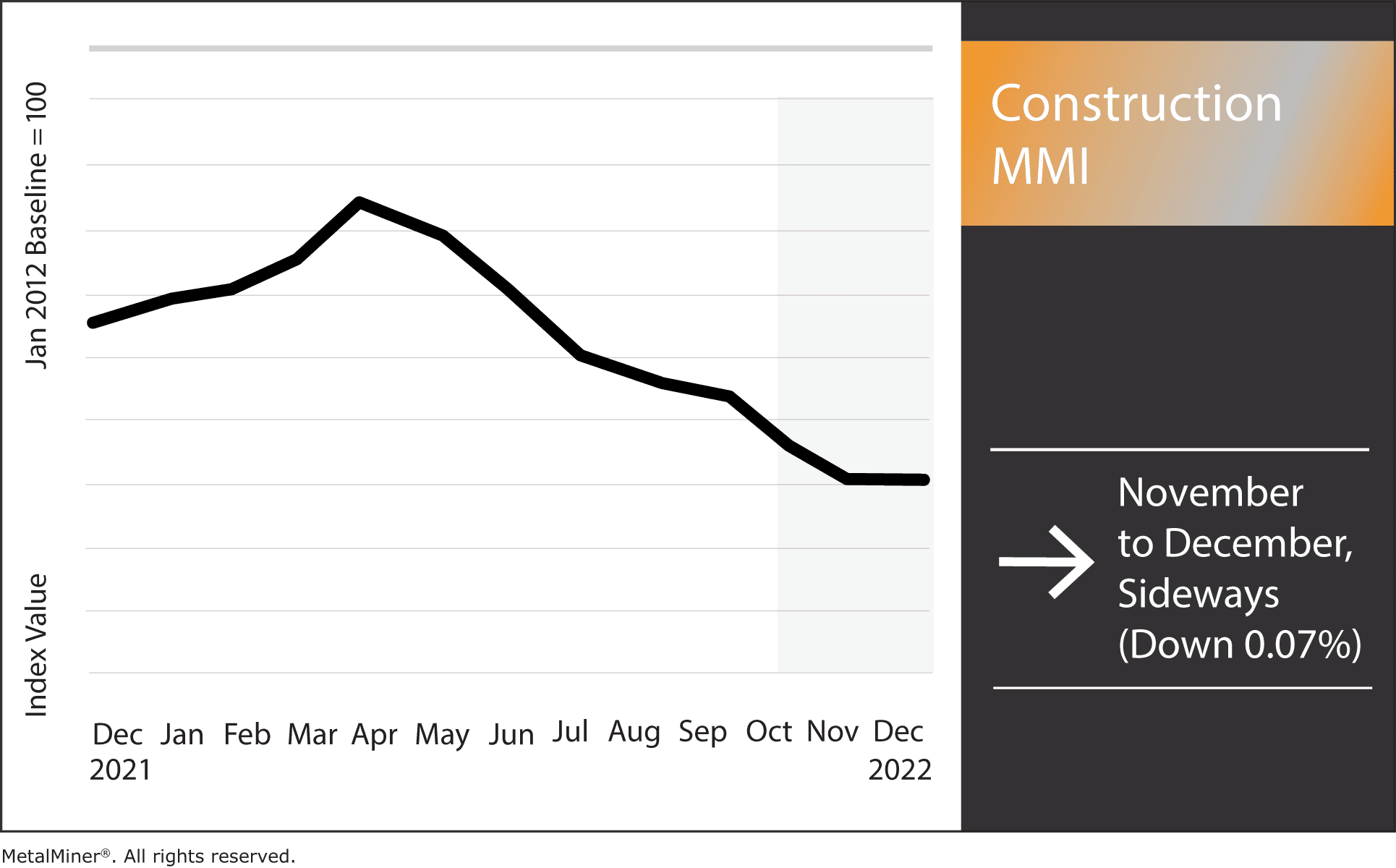

Construction MMI: Aluminum Plate and Steel Rebar Reverse

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index. The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included […]

Stainless MMI: Reduced Stainless Imports Could Cause Shortages, Bullish Nickel Price

The Stainless Monthly Metals Index (MMI) moved up with a 7.32% rise from November to December. Meanwhile, the nickel price index appeared decidedly bullish throughout the month. While nickel prices modestly retraced from their early month rally, upside price action continued to support the short-term range breakout. Sustained increases should foster further bullish anticipation, which […]

With China Failing, Volatile Metal Prices Could Spill into 2023

There have been a number of dynamics driving metals prices this year. They’ve ranged from the strength of the USD to the war in Ukraine to the still-ongoing energy crisis. However, as with the past two decades, the primary recurring theme remains Chinese demand. As both producer and consumer of most of the world’s major […]