Looking at 2022 copper price trends, the market was nearly as volatile as metals like nickel and aluminum. Currently, copper prices are attempting to break prior highs but have yet to get there. As copper taps into short-term resistance levels, the possibility of a pullback in price appears more and more likely. Meanwhile, the copper […]

Category: Global Trade

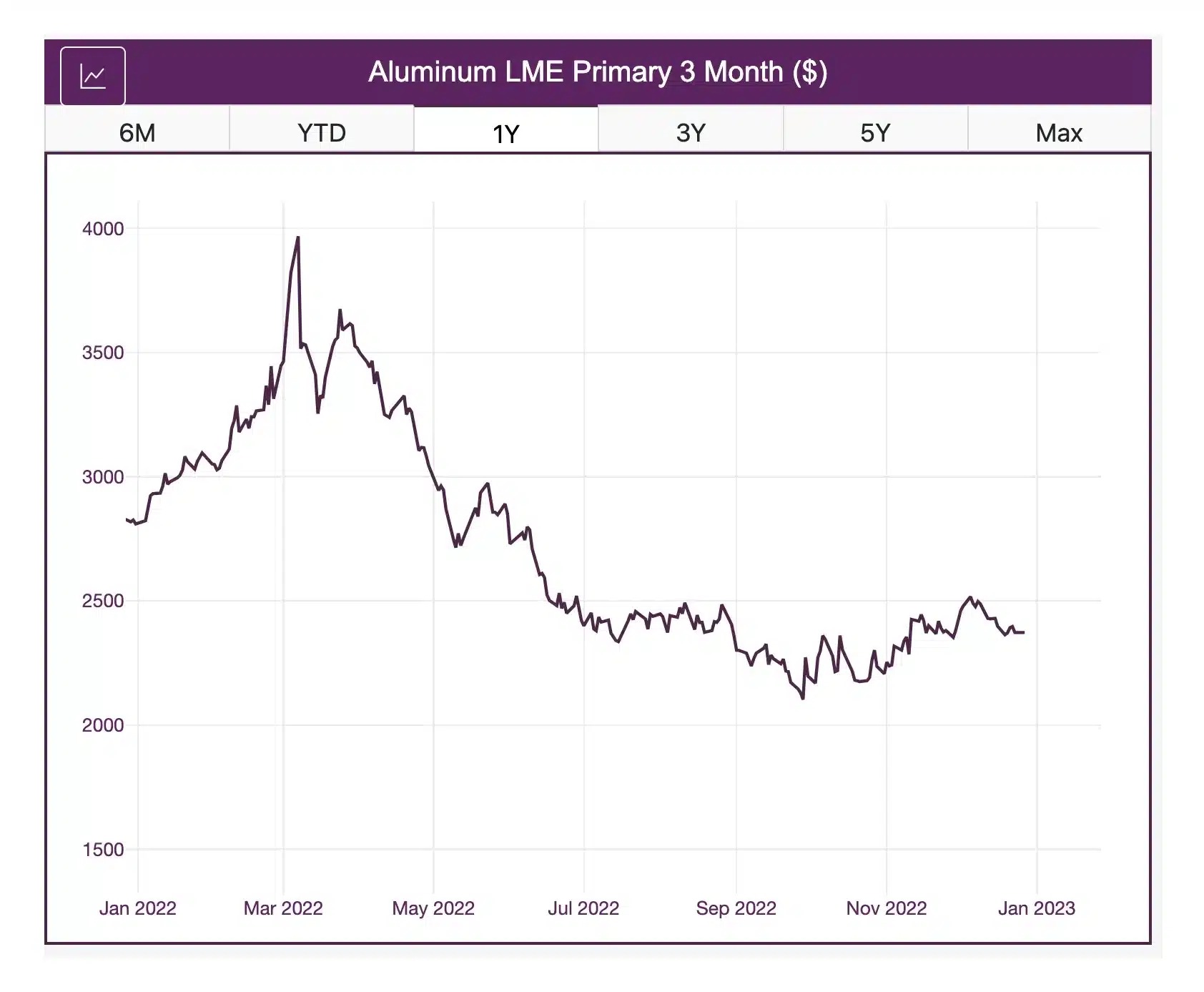

Aluminum Prices and Global Market: a 2022 Review

Aluminum prices reached a high price of almost $4,000 per metric ton on the LME primary 3-month in 2022. However, there were plenty of sales for roughly half that amount, attesting to the wide range of the 2022 index. When March’s rally ended, prices began a decline that resulted in them hitting a yearly low […]

China and Australia to Renew Trading of Iron Ore, Coking Coal, Other Goods

It’s been 50 years since Australia first established diplomatic relations with China. But compared to the relative warmth of the early years, modern relations between the two nations are in a deep freeze. Of course, Australia calling for an international inquiry into the origins of the coronavirus outbreak didn’t help matters. In fact, it led […]

Steel Prices and Global Market: a 2022 Review

Steel prices endured long-term declines throughout 2022. However, with so many geopolitical events and supply chain pinches, it is important to note that the market in general was quite volatile. Steel Prices: Q1 of 2022 Raw steels started the year with a huge bang, rising over 12% between January and February. China’s climate efforts caused […]

Destroyed Ukrainian Energy Grids Impact Steel Production

Steel production in Ukraine took a hit this past week due to the ongoing conflict with Russia. Industry watchers told MetalMiner that several Ukrainian steelmakers are facing production and rolling issues. Energy suppliers are rationing power distribution to major consumers. The rationing is the direct result of missile attacks and other military actions by Russian […]

Copper MMI: Copper Prices Bullish as Year’s End Approaches

The Copper Monthly Metals Index (MMI) rose 3.87% from November to December. As with other base metals, copper prices broke out of range to the upside last month as China began to pivot away from zero-COVID. Copper prices rallied to a peak on November 11 before a brief and modest retracement. Shortly after that, prices […]

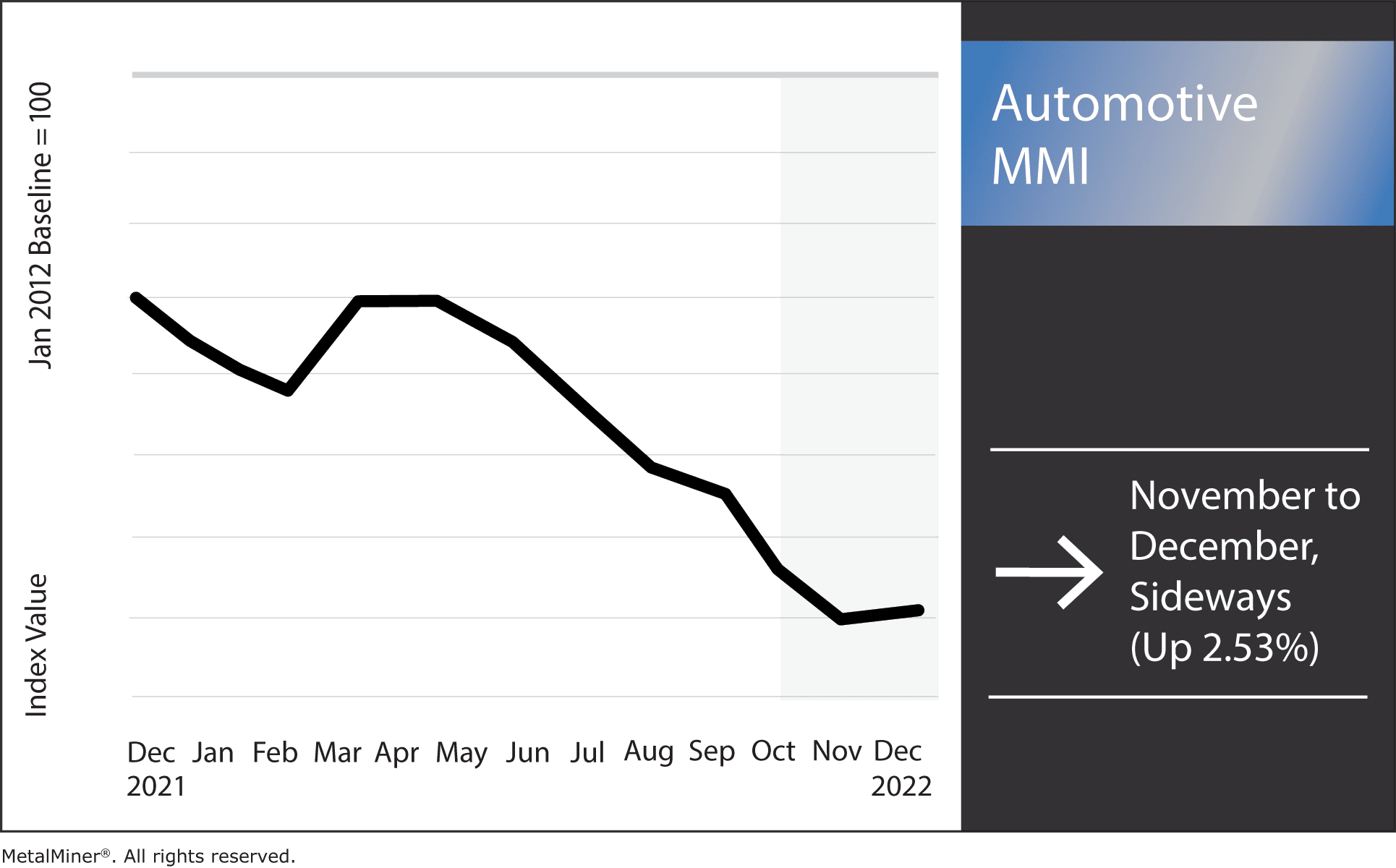

Automotive MMI: Interest Rates Move Up, Consumer Demand Moves Down

The Automotive MMI (Monthly MetalMiner Index) finally broke its downward trend and traded sideways, inching up by 2.53%. Meanwhile, myriad factors continue to pressure metal prices. The demand for vehicles among consumers remains strong. However, low inventories throughout most of 2022 placed a huge strain on the index. Without parts, the manufacturing of new vehicles […]

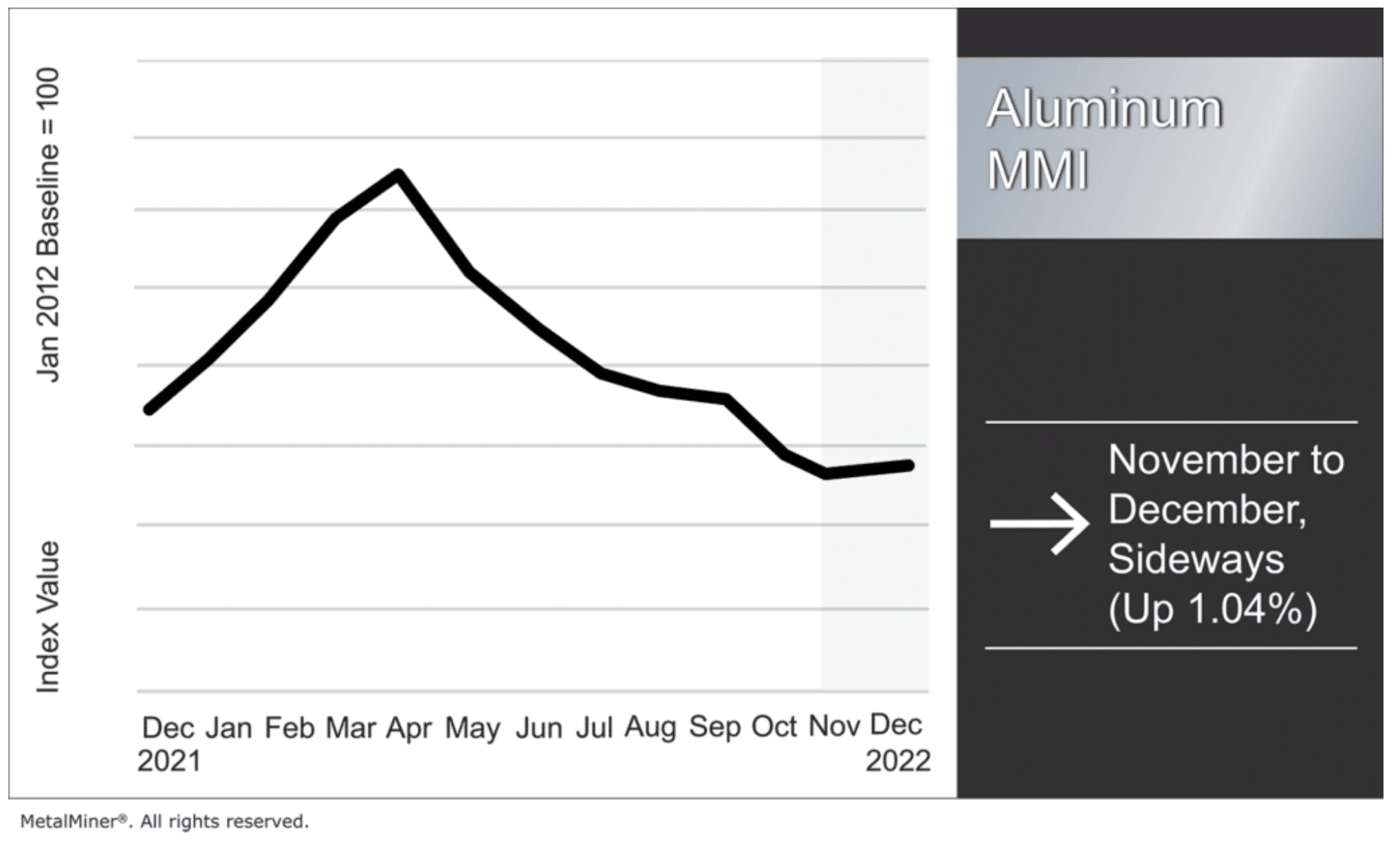

Aluminum MMI: Rally Continues as Aluminum Prices Remain Bullish

Aluminum prices broke out of their sideways trend last month with strong upside price action. Prices rallied during the first half of November, followed by a modest retracement before they continued upward. Overall, the Aluminum Monthly Metals Index (MMI) saw a modest 1.04% increase from November to December. The MetalMiner Insights platform includes global aluminum […]

China Reacts Strongly to WTO’s Ruling of Trump Administration Metal Duties

In the latest US steel news, a WTO ruling has sparked a new war of words between the United States and China. Last weekend, the WTO finally ruled on the 25% taxes on global steel imports and 10% import tariffs on aluminum imposed under former US President Donald Trump. The WTO dispute settlement panel ruled […]

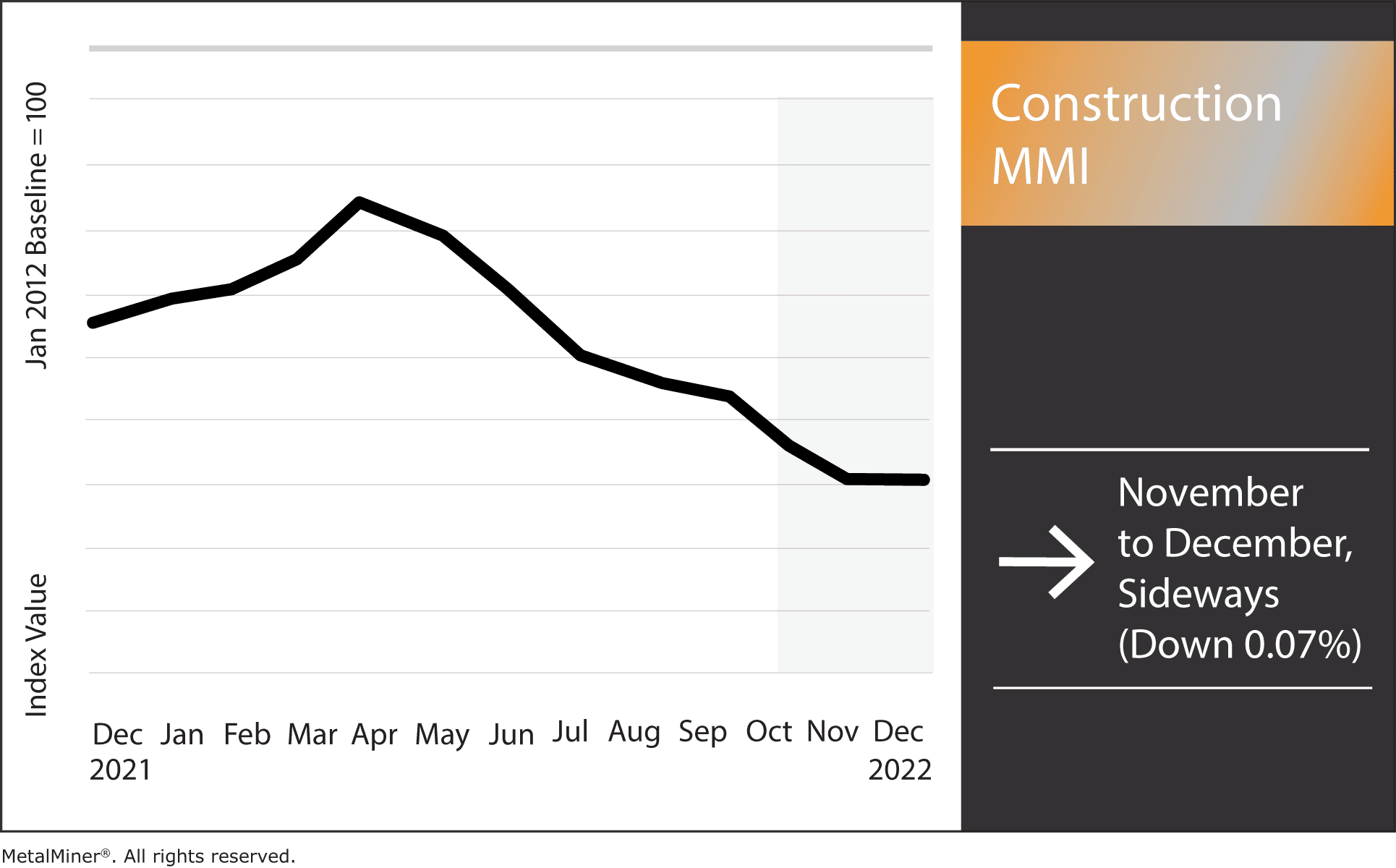

Construction MMI: Aluminum Plate and Steel Rebar Reverse

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index. The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included […]