Aluminum Prices and Global Market: a 2022 Review

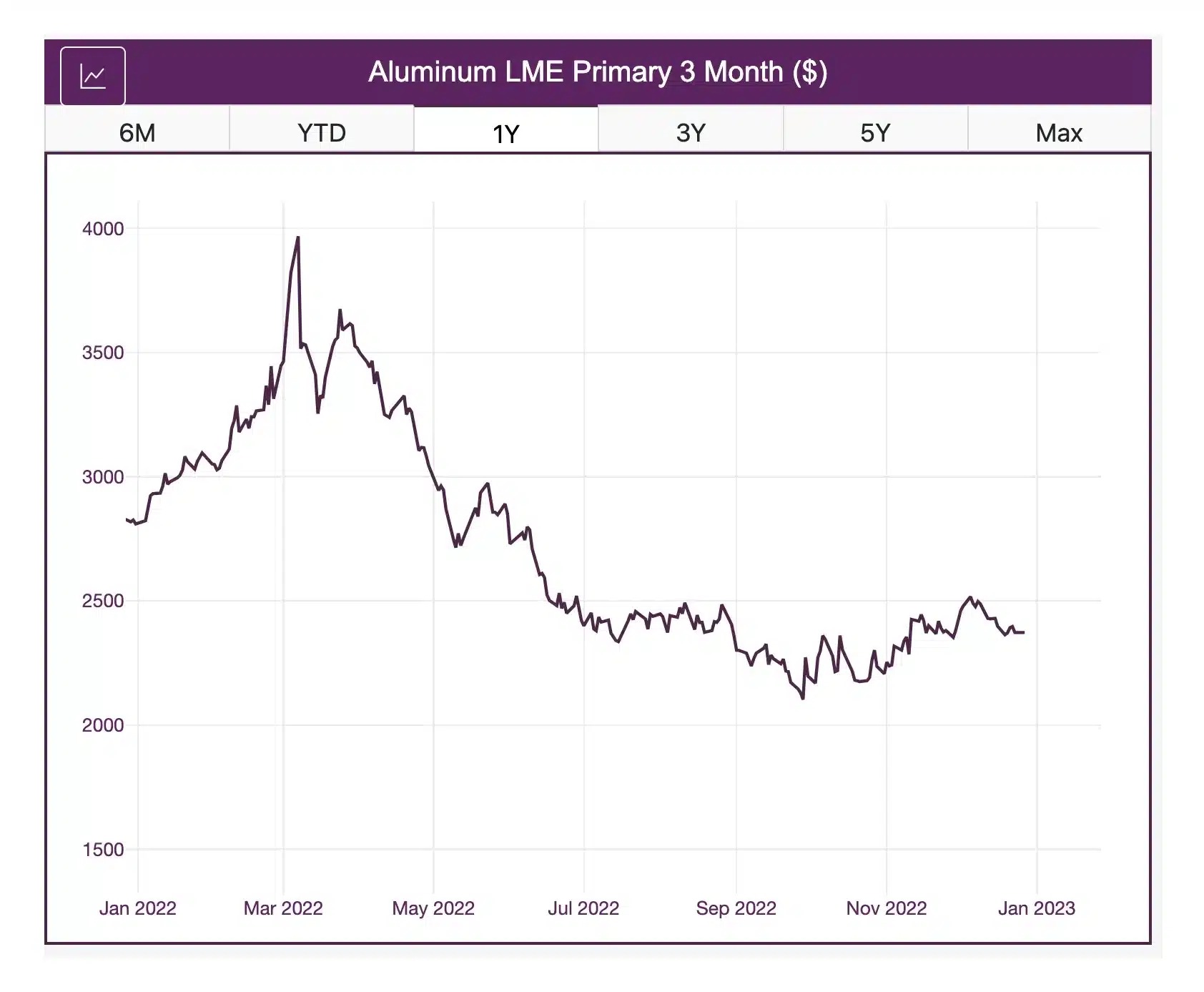

Aluminum prices reached a high price of almost $4,000 per metric ton on the LME primary 3-month in 2022. However, there were plenty of sales for roughly half that amount, attesting to the wide range of the 2022 index. When March’s rally ended, prices began a decline that resulted in them hitting a yearly low in October.

Are you under pressure to generate aluminum cost savings in 2023? Make sure you are following these 5 best practices!

Aluminum Prices: Q1 of 2022

After two consecutive months of decline, aluminum prices broke upward by 4.8% in January. Soon after, the energy crisis in Europe began heavily impacting aluminum production, with smelters across the continent slowing to a crawl. Aluminum prices followed a similar trend in February, initially rising by 6.1%. However, that month also saw Russia amassing troops along the Ukrainian border. The world was uncertain how a potential invasion would impact global metal markets.

Once it became apparent that a Russian invasion was imminent, aluminum prices shot up 8.0%. Russian aluminum producer Rusal also shut down production at the Nikolaev alumina refinery in Ukraine. The three smelters within the facility produced roughly 2.5 million tons of aluminum annually, so the shutdown dealt a considerable blow to the global industry.

Generate hard savings on your aluminum purchases year round and understand where the market is going to avoid margin erosion; trial MetalMiner’s monthly outlook report.

Q2: Prices Begin to Retreat

After reaching an all-time high, aluminum prices began to retreat in April. Despite the sharp rally finally cooling down, the outlook for the long term still appeared bullish. The general outlook for supply levels, however, appeared tight. China’s COVID lockdowns had already impacted global demand and supply.

By May, the entire structure of the global aluminum market began to morph. The index saw a sharp price drop of 8.84% as zero-COVID continued to place a heavy drag on global aluminum prices. Meanwhile, Europe proposed an embargo on Russian oil. This placed even more strain on the energy crisis in Europe and further impacted aluminum production. Suddenly, the long-term aluminum trend started to look more uncertain.

At the end of May, aluminum prices appeared to form a new bottom and began to move sideways. Prices were still down at the beginning of June, but less so than at the beginning of May. Overall, the aluminum price index dropped an additional 6.21%.

This new trend marked a stark difference from March’s rally. Shanghai eased some zero-COVID policies slightly, but only for about a week. When the lockdown returned, hopes of China’s reopening and increased aluminum production faded. Because of this, LME aluminum inventory levels started dropping. Before long, aluminum buyers felt the pain of the squeeze.

Aluminum Prices: Q3

Come July, aluminum prices still showed a macro downtrend. That month, the aluminum index fell an additional 8.06%. Meanwhile, the risk of a US recession began to loom, bringing more uncertainty to the long-term price trend. The US economic contraction caused aluminum demand to shrink.

In August, the aluminum index managed to form a sideways range, falling by only 2.4%. Energy and production shortages in China and Europe also placed a heavy strain on aluminum supplies. Soon after, more smelters began to pause or shut down completely.

In September, aluminum prices finally managed to trade almost completely sideways, falling by only 1.69%. Unfortunately, even more European smelters closed their doors and shut down. For instance, German producer Speira GmbH indefinitely halved production at its Neuss plant, causing the outlook to grow increasingly grim.

Spirits had been low with the Nordstream 1 pipeline at slowed capacity. However, concerns about future aluminum production soon shifted into concerns regarding European energy stores for the coming winter months. Finally, at the end of September, the Nordstream 1 pipeline was bombed. This left little hope that the Russian-German pipeline would be turned on before winter, let alone that smelter production might ramp up again.

By calling a bullish market or calling a bearish market, aluminum buyers can generate large cost savings or cost avoidance. Read MetalMiner’s track record.

Q4: zero-COVID Hits a Fever Pitch

Upon the arrival of Q4 and October, aluminum prices saw another sharp drop of 8.04%. Despite this, aluminum held strong over other metals such as nickel and steel. Meanwhile, global physical delivery premiums continued to slide from their respective peaks earlier in the year. Chinese production largely buoyed global supply.

In November, however, Chinese citizens began voicing their distaste for the ongoing zero-COVID policies. This left the world wondering if the Chinese government would finally lift its strict pandemic regulations. Meanwhile, another important event – the potential ban of Russian metal entirely within the US and the LME – caused more uncertainty about the aluminum price index direction. Such a ban would heavily impact the aluminum market. Were the LME to impose it, the ban would dramatically affect all Russian metals purchased from the UK. However, in the short term, aluminum prices turned upward.

This rally continued into December. And though aluminum prices rose by only 1.04% that month, the long-term outlook appeared bullish. At the same time, the Chinese government faced pressure to ease zero-COVID restrictions amid ongoing protests. As expected, aluminum prices reacted accordingly. Indeed, easing zero-COVID would mean the return of China’s energy demand, which would hopefully bring aluminum smelter production back to a more steady pace.

Buy aluminum with confidence. MetalMiner Insights offers in-depth purchasing advice, price comparison tools, forecasts and comprehensive should-cost models. Click to schedule a demo.

Leave a Reply