Automotive MMI: Interest Rates Move Up, Consumer Demand Moves Down

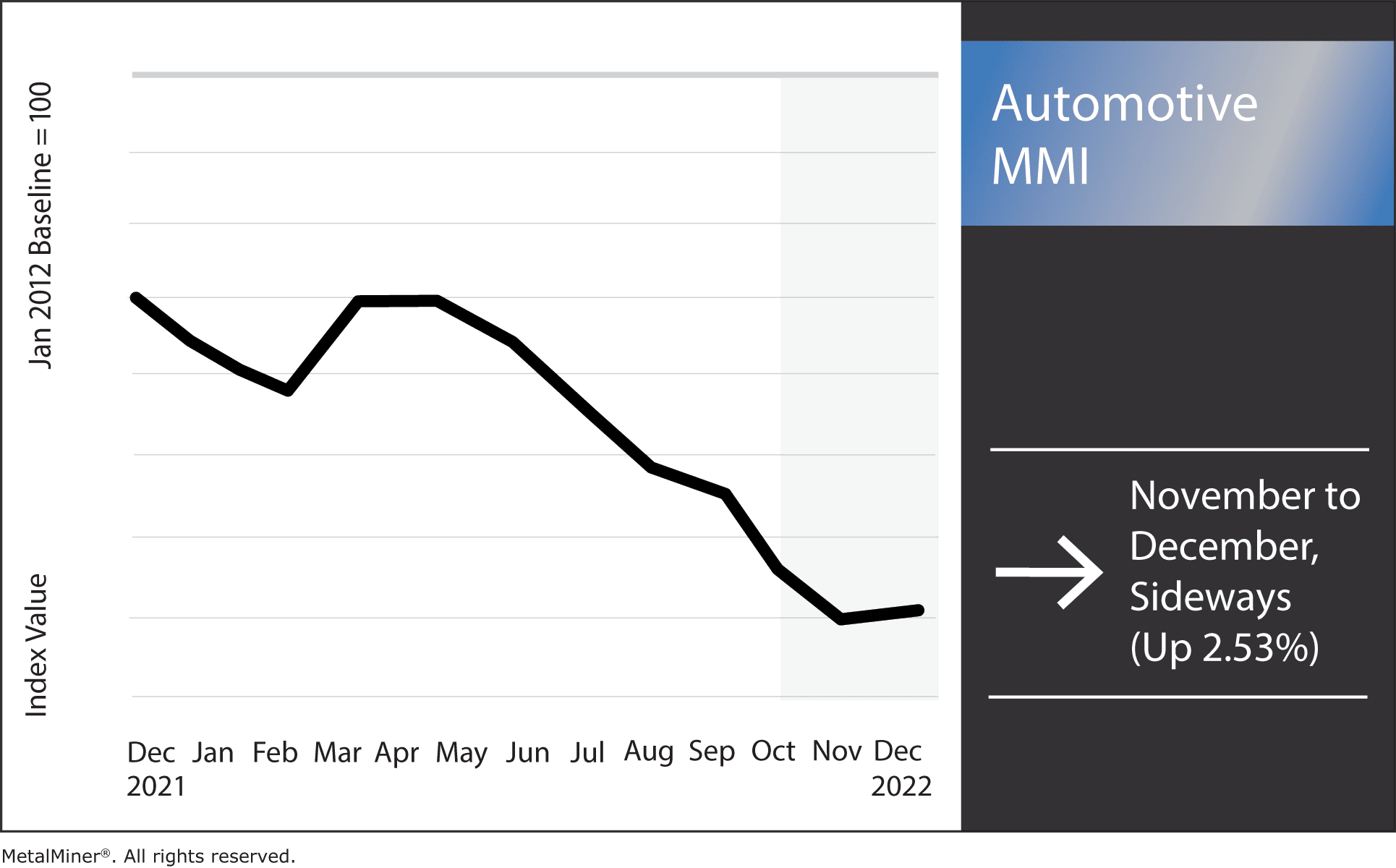

The Automotive MMI (Monthly MetalMiner Index) finally broke its downward trend and traded sideways, inching up by 2.53%. Meanwhile, myriad factors continue to pressure metal prices.

The demand for vehicles among consumers remains strong. However, low inventories throughout most of 2022 placed a huge strain on the index. Without parts, the manufacturing of new vehicles could not and cannot happen.

However, now inventory levels have risen while vehicle prices have dropped. The question MetalMiner continues to ask is: when will high interest rates affect the soaring demand for cars?

Not sure why you should trust MetalMiner’s opinion about metal prices and market direction? Take a look at our track record.

Bears, Bulls, and Interest Rates, Oh My

The automotive industry is in a tough spot. Indeed, vehicle and part production struggled throughout 2022, mainly due to supply chain constraints, energy shortages, geopolitical events like the War in Ukraine, and zero-COVID. However, production did manage to edge upwards slightly month-over-month. The result was low inventories and relatively high consumer demand. Throwing metal prices into the mix only further compounds the index’s issues.

But when will these sky-high interest rates finally impact consumer demand? A recent article by Fortune noted that high interest rates have begun impacting the power buyers have. After all, rates on vehicle loans have risen a staggering 6.6% since March, when the hawkish Fed began their steep interest rate hikes.

After the Fed hiked rates another half a percentage this past week, mortgages, car loans, and credit card debt holders finally took notice. In terms of the automotive market, this should cool down consumer demand. However, this relies on inflation continuing to cool with each rate increase.

MetalMiner’s monthly free MMI report gives trends on ten different metal prices and indices, including copper, steel, and aluminum. Sign up here!

EV Production Still Strong, But Supplies Under Threat

Automobile manufacturers continue to step up their EV production. This could potentially help even out consumer demand in relation to high interest rates. Meanwhile, metals like nickel and lead continue to persevere in demand. Still, even these metal prices may be in for a roller coaster ride.

For example, lead jumped in price month-over-month before retreating again. In the case of nickel’s, fears of a squeeze seem quite prominent. This places some pressure on EV battery producers, as high demand could encounter tight supply.

Lithium, on the other hand, didn’t move outside support and resistance zones month-over-month. While battery metal prices went up slightly, the index remained sideways overall. Indeed, lithium prices managed to avoid the broad impact of zero-COVID. This could be due to most of the world’s lithium coming from Australia and Chile as opposed to China.

MetalMiner’s weekly newsletter provides updates on steel, lithium, and lead price shifts, as well as other tends in metal prices and markets. Sign up here.

Automotive MMI: Biggest Shifts in Metal Prices

- Chinese lead increased by 2.57%, bringing the index to $2,132.01 per metric ton on December 1.

- Hot-dipped galvanized steel dropped sharply by 10.73%, bringing it to $907 per short ton as of December 1.

- Korean 5052 coil aluminum rose drastically in price by 10.18%. Prices at month’s start sat at $3.68 per kilogram.

Leave a Reply