There’s no doubt that China is desperately seeking new markets to hawk its goods and commodities after the U.S. trade tariffs kicked in. This is especially true when it comes to the country’s steel industry. In fact, even prior to the trade war, Beijing was actively looking at expanding its access to steel markets. So, […]

Category: Global Trade

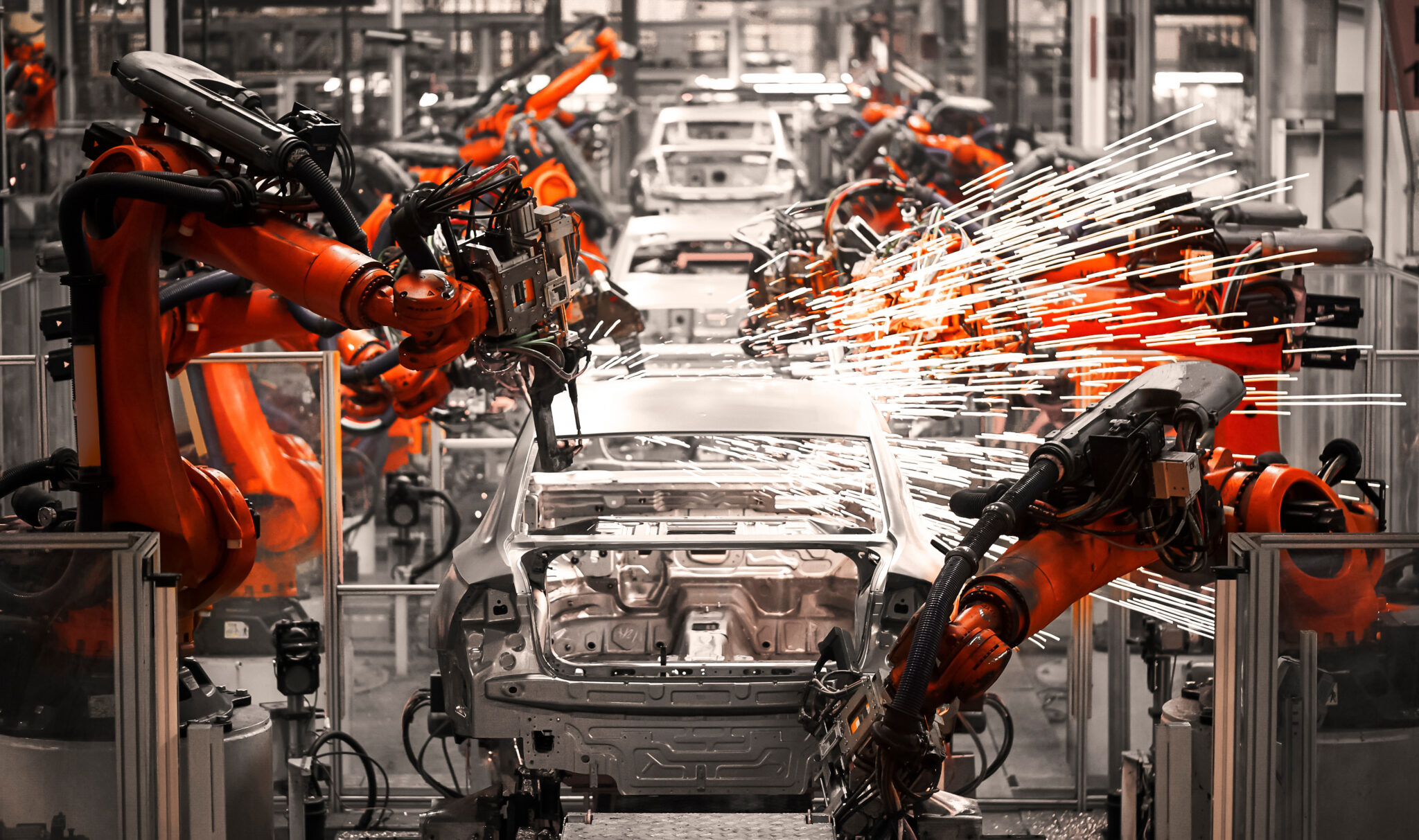

Automotive MMI: Volatile Steel and Copper Prices Shake U.S. Auto Industry

The Automotive MMI (Monthly Metals Index) moved sideways this past month, dropping a slight 1.74%. The US automotive industry faces a bumpy ride as key metal prices continue to swing wildly. In recent weeks, critical inputs like hot-dipped galvanized steel, copper and lead have seen rapid price shifts amid new tariffs and supply chain jitters, […]

Raw Steels MMI: How Far Will Steel Prices Fall?

The Raw Steels Monthly Metals Index (MMI) traded down during the month. Overall, the index fell 3.82% from April to May. While U.S. steel prices moved sideways throughout April, the bias appeared increasingly to the downside as buyers pulled away from the market due to tariffs. Steel Prices Slide Lower As Bearish Signals Mount After […]

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]

Rare Earths MMI: Ukraine and U.S. Strike Critical Minerals Deal

The Rare Earths MMI (Monthly Metals Index) witnessed a significant rise in price action month-over-month, with a total increase of 7.67%. So far, the global rare earths market has been on a springtime rollercoaster. Between April 1 and May 2, 2025, prices for these critical elements saw abrupt swings, supply chains were tested by geopolitics […]

U.S. Aluminum vs. European Aluminum: A Comprehensive Short-Term Market Outlook

A striking aspect of the aluminum premium and the aluminum market turmoil currently unfolding after Trump’s aluminum tariffs is how differently it’s playing out in the U.S. versus other regions. While premiums inside of the U.S. are rising, outside the United States, aluminum premiums are actually falling. With U.S. tariffs shutting out or discouraging some […]

Is Copper About to Spark a Global Commodities Rally?

Copper was touted as the hottest commodity of 2025, as covered in MetalMiner’s weekly newsletter. Capped by April’s tariff-driven turbulence, the last quarter only reinforced that view. Now it seems copper prices are poised to lead other metals in the short term. Many experts believe copper has reached an inflection point. As such, they expect […]

Auto Shock: Trump’s 25% Tariff Sends Europe Reeling

The “Trump Tariffs” continue to shock global markets, affecting multiple major sectors. Recently, European auto manufacturing ombudsmen reacted with alarm to President Donald Trump’s imposition of a 25% import tariff on auto imports into the United States. EU Auto Leaders React to Trump Tariffs Hildegard Müller, president of the German Association of the Automotive Industry, […]

Is China Using Rare Earths as Its Most Powerful Trade Weapon Yet?

China is once again weaponizing rare earths elements in the tariff war with the United States. According to media reports, China recently suspended the export of certain rare earth minerals, ostensibly while re-drafting the regulations covering such exports. MetalMiner’s weekly newsletter states that if the issue is not resolved soon, both the halt in rare […]

Global Precious Metals MMI: “Yellow Metal” Come Out Once Again as Hedging Safe Haven Amidst Tariffs

The Global Precious Metals MMI (Monthly Metals Index) saw a significant bullish action month-over-month, rising by a total of 8%. The U.S. precious metals market (and precious metals prices in general) saw dramatic swings over the past five weeks amid a backdrop of stubborn inflation, evolving interest rate expectations, new tariffs and geopolitical tensions. All […]