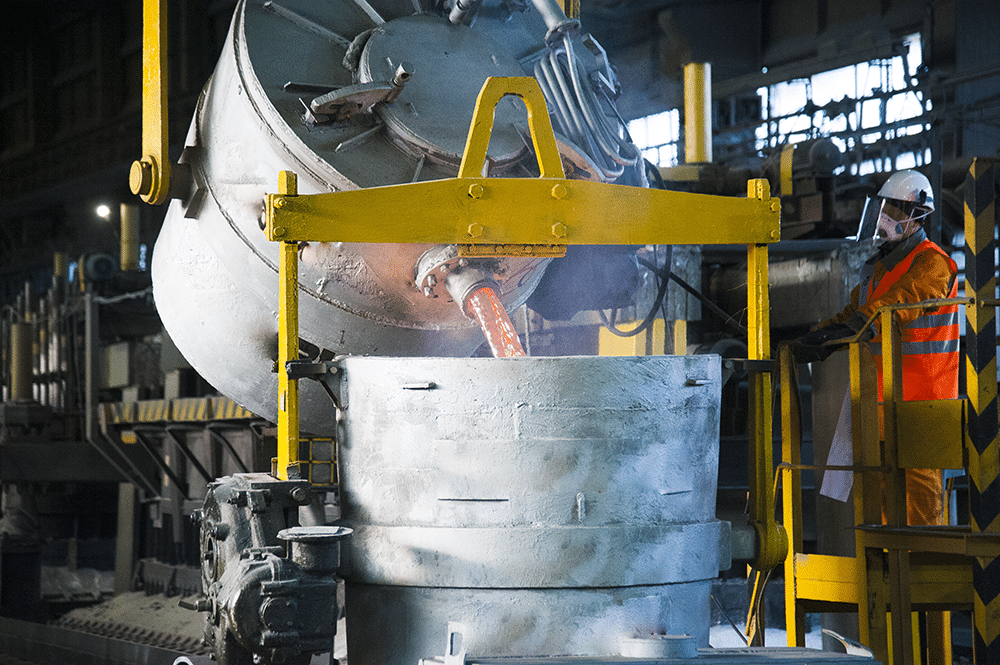

Conflicting reports continue to emerge from China regarding aluminum supply, demand, and production. Some information notes that the downturn in the country’s economy is largely due to the ongoing real estate crisis. As demand wanes, this poses questions regarding the internal pickup of aluminum and other base metals. However, other reports talk of the country […]

Category: Supply & Demand

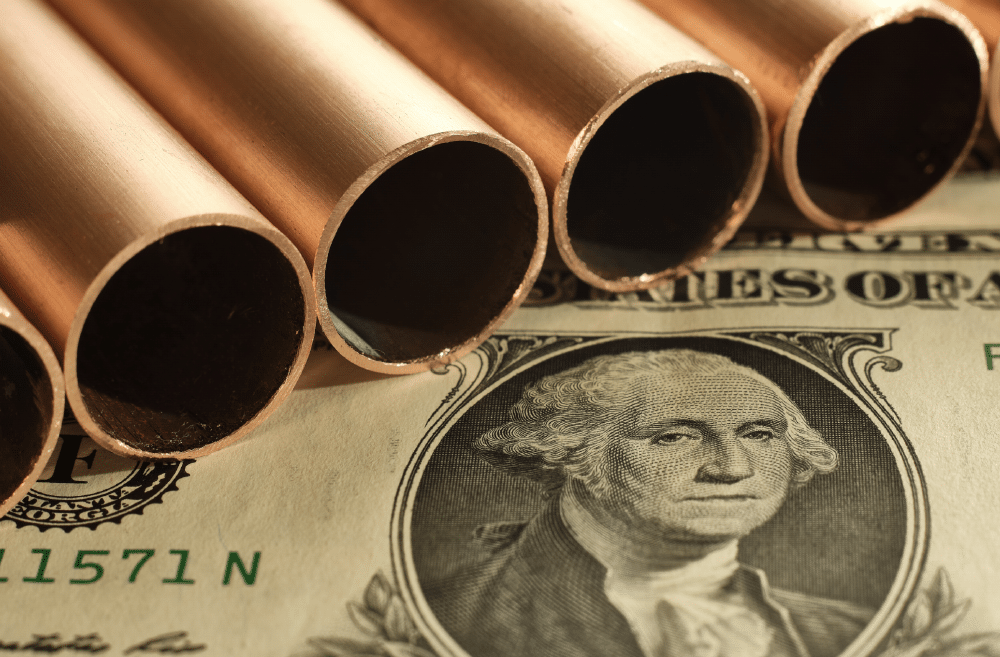

Copper MMI: Possible Deficit Shifts Copper Price Outlook

Still short of a breakout, current copper prices lifted off their October lows during November and have yet to see a major downside correction. Nonetheless, copper prices remain sideways and sit only 1.5% above where they stood at the start of 2023. An increase among all of its components helped the Copper Monthly Metals Index (MMI) […]

Rare Earths MMI: Prices Move Sideways Amid Potential Rare Earth Magnets Trade War

The global rare earth magnets game continues to heat up. Indeed, China, the top global rare earths supplier, seems eager to tighten its hold on the marketplace, especially with trade tensions rising between the country and the West. Meanwhile, the U.S., Australia, and many other nations continue to look for homegrown solutions to rare earths […]

Cobalt Crash: The Cobalt Price Index Hits Record Low Amid “Perfect Storm”

Analysts once hailed cobalt as a commodity whose price would rise forever. Used in the cathodes of many lithium-ion batteries to extend the life of the battery cell, investors and mine operators eagerly anticipated high returns on all cobalt investments. However, cobalt prices recently dropped to record lows amid global oversupply and a widespread slowdown […]

Renewables/GOES MMI: Index Goes Up, Lithium-Ion Battery Dilemmas

The Renewables MMI (Monthly Metals Index) saw a welcome boost month-on-month, rising 6.27%. Grain-oriented electrical steel, silicon, and neodymium were the main factors that increased the index, while the lithium-ion battery market remains a point of contention. In the case of silicon, futures initially rose back in June due to production cuts within China, the […]

Copper Price Roller Coaster a Wild Ride in 2023: From Highs to Lows and Back Again

It’s safe to say that the copper price index witnessed an interesting 2023 thus far. Indeed, the market’s been volatile, so there were more than the usual ups and downs. Mid-year, prices registered a major tumble because of the fumble in China’s economy. However, soon after, they began clawing back to a respectable level. Prices […]

U.S. Lithium Startups Turn to Uncle Sam as Corporate Funding Dwindles

For years, lithium startups have enjoyed easy funding. But as the global lithium price plummets, that all seems poised to change. Indeed, the aforementioned funds mainly stemmed from battery users hoping to secure a reliable source of lithium and venture capitalists looking to score big while helping close the gap on domestically produced lithium products. […]

Construction MMI: Chinese Manufacturing Still Slumping, Impacting U.S. Construction

The Construction MMI (Monthly Metals Index) continues to experience pressure from both sides amid conflicting global construction news. For instance, U.S. scrap steel prices recently dropped due to more vehicles being manufactured (car manufacturing always produces ample scrap). However, Chinese steel product prices went up at the same time. Ultimately, metal markets witnessed more movement […]

Rare Earths MMI: Will Chinese Stimulus Help Support Rare Earth Magnets?

Month-over-month, the Rare Earths MMI (Monthly Metals Index) broke its short-term sideways trend and once again spiked down. Overall, the index witnessed a 10.03% decrease as reduced short-term demand continues to cause more and more supply to build up. This leaves rare earth prices struggling to find support. However, the prospect of China offering a […]

Renewables/ GOES MMI: Cobalt Rallies, Renewable Energy Storage Facilities Expanding

The Renewables MMI (Monthly Metals Index) saw little movement month-over-month. The index held sideways and only dropped a mere 0.12%, just narrowly missing trading flat. Moreover, the main factor which pushed the index sideways instead of down (according to renewable energy news) was cobalt rallying. It’s the first significant price rise cobalt has seen since […]