The Construction Monthly Metals Index (MMI) lost three points this month, hitting 90 for our August MMI reading. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook U.S. Construction Spending, Employment According to U.S. Census Bureau data, U.S. construction spending in June fell 1.1% from the previous month. Spending in June hit $1,317.2 billion, […]

Tag: Construction MMI

Construction MMI: U.S. Construction Spending Up 0.4% in May

The Construction Monthly Metals Index (MMI) dropped two points, falling for a reading of 93 this month. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook U.S. Construction Spending May construction spending rose 0.4% compared with the revised final estimate for April, according to Census Bureau data released this week. Spending in […]

Construction MMI: April Construction Spending Up 7.6% Year Over Year

The Construction Monthly Metals Index (MMI) held flat for the month, posting a 95 for our June reading. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook U.S. Construction Spending Construction spending for April, the month with the most recently available Census Bureau data, picked back up. Total spending during April 2018 hit an […]

Construction MMI: March Spending Up Year Over Year But Down 1.7% From February

The Construction Monthly Metals Index (MMI) increased four points, up to 95 for our May MMI reading. Within the basket of metals, Chinese rebar was down slightly on the month, while Chinese H-beam steel jumped 5.4%. U.S. shredded scrap steel rose 3.0%. European aluminum sheet jumped 4.9%. Chinese aluminum bar jumped 8.2%. Need buying strategies for steel? Try […]

Construction MMI: Spending Flattens as Industry Awaits Tariffs Decision

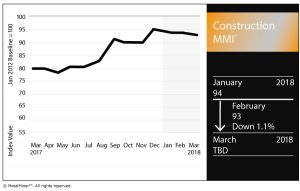

The Construction MMI (Monthly Metals Index) dropped one point this month, falling to 93 for our March reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals for the Construction MMI, Chinese rebar and H-beam steel prices dropped on the month. Meanwhile, U.S. shredded scrap steel rose 8.4% on the month, while European commercial 1050 sheet fell 3.0%.

Chinese aluminum bar also fell, dropping 1.0% month over month.

U.S. Construction Spending

Construction spending during January 2018 was estimated at a seasonally adjusted annual rate of $1,262.8 billion, up minimally from the revised December estimate of $1,262.7 billion, according to the Census Bureau.

The January figure, however, was up 3.2% from January 2017’s $1,223.5 billion.

Under the umbrella of private construction, residential construction was at a seasonally adjusted annual rate of $523.2 billion in January, 0.3% above the revised December estimate of $521.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $439.6 billion in January, 1.5% below the revised December estimate of $446.2 billion.

As for public construction, the estimated seasonally adjusted annual rate of public construction spending was $300.1 billion, 1.8% above the revised December estimate of $294.8 billion.

Within that, educational construction was at a seasonally adjusted annual rate of $76.7 billion, 2.1% above the revised December estimate of $75.2 billion. Highway construction was at a seasonally adjusted annual rate of $92.6 billion, 4.4% above the revised December estimate of $88.8 billion.

Construction and Tariffs

Just like other metal-using sectors, the construction industry would also be impacted by President Trump’s announced steel and aluminum tariffs (especially steel).

Trump’s announcement came just over a month after Trump proposed $1.4 trillion in infrastructure investment over 10 years.

For a construction industry that saw spending flatten in January, a rise in materials costs would not be great news, should the tariffs become the law of the land.

According to Philip Gibbs, an analyst at KeyBanc Capital, the tariffs might give steel stocks a short-term “sugar high,” he told Reuters, but that unsustainable pricing could eat into demand from manufacturers.

The National Association of Homebuilders (NAHB) came out against the tariffs proposal, with the association’s chairman saying the tariffs would hurt consumers and make housing less affordable.

“It is unfortunate that President Trump has decided to impose tariffs of 25 percent on steel imports and 10 percent on aluminum imports,” said Randy Noel, chairman of the NAHB. “These tariffs will translate into higher costs for consumers and U.S. businesses that use these products, including home builders.

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.”

Of course, the metals world is still in wait-and-see mode regarding the tariffs, which have yet to become actual law.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Construction MMI: 2017 U.S. Construction Spending Rises 2.7%

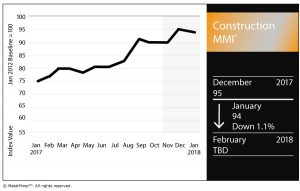

The Construction MMI stood pat this past month, holding at 94 for our February reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap steel jumped 7.7%. European 1050 sheet aluminum dropped marginally (by 0.05%), while the Chinese aluminum bar price jumped 1.7%.

U.S. Construction Spending

According to the most recently available Census Bureau data, U.S. construction spending in December 2017 amounted to $1,253.3 billion, up 0.7% from the revised November estimate of $1,245.1 billion.

December 2017 spending was up 2.7% year over year, compared with the $1,221.6 billion spent in December 2016.

By value, the value of construction in 2017 was $1,230.6 billion, up 3.8% from $1,185.7 billion in 2016.

Private construction spending grew more than its public counterpart. Private construction spending jumped 0.8% from the previous month to $963.2 billion, Within that umbrella, residential and nonresidential spending jumped 0.5% and 1.1%, respectively.

Meanwhile, public construction spending jumped 0.3% to $290 billion in December 2017 from the previous month. Educational construction spending jumped 1.6% from November, while highway construction picked up a 0.3% spending gain.

Home Sales Down in December but Up for the Year

According to the National Association of Realtors, existing-home sales dropped in December but were up 1.1% for 2017.

The 5.51 million sales executed in 2017 marked the highest total since 2006 (6.48 million).

“Existing sales concluded the year on a softer note, but they were guided higher these last 12 months by a multi-year streak of exceptional job growth, which ignited buyer demand,” said Lawrence Yun, the NAR’s chief economist, in a prepared statement. “At the same time, market conditions were far from perfect. New listings struggled to keep up with what was sold very quickly, and buying became less affordable in a large swath of the country. These two factors ultimately muted what should have been a stronger sales pace.”

New housing starts, however, were down significantly in December.

According to jointly released data from the Census Bureau and the U.S. Department of Housing and Urban Development, new home starts in December dropped 8.2% compared with November totals. The 1,192,000 housing starts in December also marked a drop compared with December 2016, falling by 6.0%.

The Future of Construction

According to an article in Forbes, three trends could have a significant impact on the construction industry: robotics, drone imagery and digital project collaboration tools.

“Construction will benefit from robotics in work that is dangerous, is repetitive, and where heavy lifting is required,” Zak Podkaminer, of Construction Robotics, told Forbes. “[In] high precision work such as complex designs and patterns, robotics will provide a significant time savings allowing for more digital fabrication and provide architects more creative flexibility.”

Actual Metal Prices and Trends

Construction MMI: Architecture Billings Index Hits 2017 High

The Construction Monthly Metals Index (MMI) lost a point for our January reading, falling to 94 from 95.

Two-Month Trial: Metal Buying Outlook

In terms of metals prices, it was a mixed bag for this group. The Chinese rebar price fell 4.8%, while Chinese H-beam steel rose 3.1%. U.S. shredded scrap steel also dropped 3.5%. European commercial 1050 aluminum sheet posted gains of 1.1%, while Chinese aluminum bar fell 6.3%.

U.S. Construction Spending

According to U.S. Census Bureau data for November (the most recently available month), total construction spending amounted to $1,257 billion, up 0.8% from the revised October estimate of $1,247.1 billion.

Meanwhile, public construction spending, at $964.3 billion, was 1.3% above its October total.

Strong Growth for Architecture Firms

As tracked by the Architecture Billings Index (ABI), put out monthly by the American Institute of Architects, November proved to be a strong month for architecture billings.

Per the November ABI report, the billings ABI rose to 55 from last month’s 51.7 (a score of 50 indicates no growth).

“New project inquiries, as well as new design contracts coming into architecture firms, also signified healthy growth,” the report states. “As such, indicators broadly point to very solid business conditions at architecture firms as 2017 winds down.”

The uptick in design activity is in large part attributable to the strength of the economy, the monthly ABI report indicates: “GDP has grown at a 3 percent annualized rate through the second and third quarters this year. In the fourth quarter, our economy is likely to grow at about this same pace, and 2018 looks to see overall domestic economic gains in the 2.5 to 3.0 percent range. Strong consumer sentiment scores suggests that households are getting more comfortable with the direction of the economy as well as with their own financial situation.”

The report adds a strengthening labor market as another factor behind the rise in design activity. According to the report, there was a net gain of 228,000 payroll positions nationally in November, and annual 2017 numbers likely will hit at least a 2 million net gain for the sixth straight year. In terms of construction, specifically, there was a net gain of 24,000 construction positions in November, with 2017 gains “potentially as high as 200,000.”

By region, November was a strong month for the West, which led the four regions tracked in the ABI. The West region tallied a score of 54.8, ahead of the South and Northeast (each at 52.8) and the Midwest (50.4).

Free Sample Report: Our Annual Metal Buying Outlook