Global Precious MMI: Is Palladium Price High Enough to Make GM Flirt With Substitution?

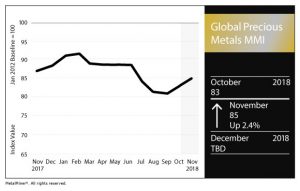

MetalMiner’s Global Precious Monthly Metals Index (MMI), tracking a basket of platinum, palladium, gold and silver prices in several geographies across the globe, is now officially in a two-month uptrend this November after several months of declines.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

The Global Precious MMI came in at a value of 85 for its November 2018 reading, up 2.4% from 83 last month, continuing a steady upswing (the sub-index’s level this past September had not been seen since January 2017).

The U.S. platinum bar price sustained its own bounce-back with another spike this November. As my colleague Fouad Egbaria mentioned earlier this week, the platinum-palladium spread narrowed slightly this past month. U.S. platinum bars rose 2.6% to $835/ounce, while palladium bars fell 0.3% to $1,067/ounce.

Notably, platinum continues to stay above the $1,000 per ounce threshold, which is quite significant.

Palladium Looking Up

A couple weeks ago, palladium hit a record high — so high, in fact, that it nearly achieved parity with the gold price, something for which the platinum price has usually been in the running as the lead candidate … but not lately.

The U.S. gold price, as tracked by our MetalMiner IndX, gained slightly over last month to begin November at $1,214 per ounce.

As we’ve been continued to report in this monthly column, “a combination of factors, from tight supplies and large deficits to resurgent interest from speculative investors, has kept the platinum group metal (PGM) on the boil,” as a recent Reuters piece put it.

However, more specifically it looks as though geopolitics have been in play.

According to Reuters, fears that Russia “could restrict supplies in response to the United States’ plans to withdraw from the Intermediate-Range Nuclear Forces Treaty,” as well as the promise that a recent economic stimulus package in China will inject life into the auto markets, has contributed to spiking palladium prices.

Speaking of the auto markets, when it comes to the U.S. automakers, the platinum-palladium price differential has got analysts using the “S” word: substitution.

But even with the sustained reversal in the price relationship, car companies such as General Motors won’t be rushing to swap the two materials anytime soon.

“It’s not a flick of a switch for us,” Rahul Mital, global technical specialist, diesel aftertreatment at General Motors, said in a panel discussion at a London Bullion Market Association meeting in Boston on Monday, as quoted by Bloomberg.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

“Any time you want to make a substitution like that, it is at least 18 months to a two-year cycle if we’re going to switch. We have to be careful that by the time we do all that, price changes don’t negate the benefits,” Mital was quoted as saying.

Platinum’s Tail Already Between Its Legs

According to a different Reuters article citing a poll carried out by the news service, palladium’s price premium over platinum “will widen next year, with palladium set for its best year on record while platinum slumps to its worst performance since 2004.”

Benchmark your current cold rolled coil sheet prices and see how it compares to the market

Palladium is expected to average at $993/ounce this year, and $1,025/ounce next year, while platinum is expected to be averaging $882/ounce in 2018 and $875/ounce in 2019, according to the experts and analysts polled in the article.

Leave a Reply