Renewables/GOES MMI: Despite renewables growth, coal and oil bounced back in 2021, IEA warns

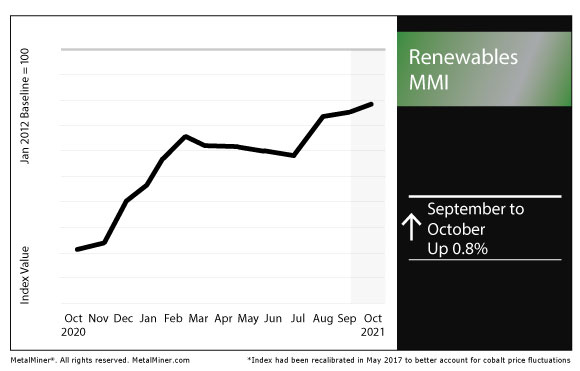

The Renewables Monthly Metals Index (MMI) ticked up slightly for this month’s value.

(Editor’s note: This report also includes the MMI for grain-oriented electrical steel, or GOES.)

Cut-to-length adders. Width and gauge adders. Coatings. Feel confident in knowing what you should be paying for metal with MetalMiner should-cost models.

Renewables make progress, but coal, oil saw 2021 comeback, IEA says

The International Energy Agency (IEA) recently released its 386-page World Energy Outlook 2021 report, in which it notes positive trends in renewable energy but setbacks in the form of recovering coal and oil use in 2021.

“The rapid but uneven economic recovery from last year’s Covid-induced recession is putting major strains on parts of today’s energy system, sparking sharp price rises in natural gas, coal and electricity markets,” the IEA reported. “For all the advances being made by renewables and electric mobility, 2021 is seeing a large rebound in coal and oil use. Largely for this reason, it is also seeing the second-largest annual increase in CO2 emissions in history.”

The IEA emphasized significant further investment is needed to reach the 1.5 degree stabilization goal laid out in the Net Zero Emissions by 2050 Scenario released in May 2021. The IEA said that transition requires “a surge in annual investment in clean energy projects and infrastructure to nearly USD 4 trillion” by 2030.

In many renewables applications, cost is a major obstacle, particularly for critical minerals or metals.

“Higher or more volatile prices for critical minerals such as lithium, cobalt, nickel, copper and rare earth elements could slow global progress towards a clean energy future or make it more costly,” the IEA added. “Price rallies for key minerals in 2021 could increase the costs of solar modules, wind turbines, electric vehicle (EV) batteries and power lines by 5-15%. If maintained over the period to 2030 in the NZE, this would add USD 700 billion to the investment required for these technologies.”

First Cobalt receives permit for battery materials refinery expansion

Toronto-based First Cobalt on Thursday announced it had received the second of three necessary permits for the recommissioning of its hydrometallurgical refinery in Canada.

“Receipt of the Air & Noise Environmental Compliance Approval from the Ontario Ministry of the Environment, Conservation and Parks is yet another key milestone in the advancement of the Company’s North American battery materials strategy,” First Cobalt said.

The permit is the second of three permits it needs, the company said.

Furthermore, the $60 million expansion project is on schedule, First Cobalt said. It is scheduled for commissioning in Q4 2022.

When operational, the refinery will be able to produce 25,000 metric tons of battery-grade cobalt sulfate per year, according to information on the company’s website.

GM, GE Renewable Energy sign MoU

As noted in the Automotive MMI, General Motors and GE Renewable Energy signed a memorandum of understanding to develop a supply chain for rare earths and other materials needed for electric vehicles and renewable energy.

They will initially focus on a Europe- and North America-based supply chain for vertically integrated magnet manufacturing.

Through the MoU, they will “evaluate opportunities to improve supplies of heavy and light rare earth materials and magnets, copper and electrical steel used for manufacturing of electric vehicles and renewable energy equipment.”

GOES

The MMI for grain-oriented electrical steel rose by 4.8% for this month’s reading.

The GOES price rose by 7.6% month over month to $2,706 per metric ton as of Oct. 1.

Actual metals prices and trends

The U.S. steel plate price rose by 5.2% month over month to $1,728 per short ton.

The Chinese steel plate price rose by 1.0% to 5,950 CNY. Meanwhile, the Korean steel plate price fell by 0.8% to 1,235,000 KRW per metric ton.

You want more MetalMiner on your terms. Sign up for weekly email updates here.

Leave a Reply