Raw Steels MMI: Steel prices, demand soften

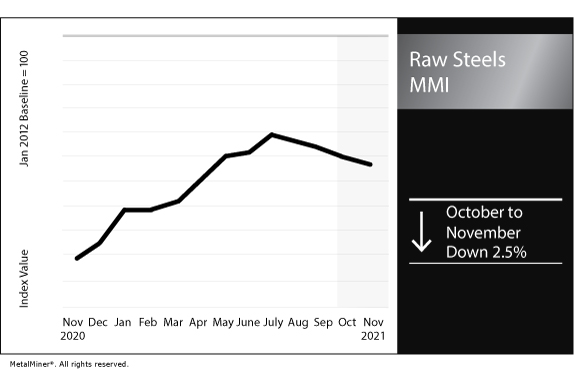

The Raw Steels Monthly Metals Index (MMI) dropped by 2.5% month over month.

Stop obsessing about the actual forecasted steel price. It’s more important to spot the trend.

Auto steel demand shows weakness

Steel prices appear poised for a decline in coming months as auto steel demand shows weakness and new capacity is set to come online.

According to a report by Bloomberg, U.S. Steel Corp. recently offered “excess prime” steel that was previously earmarked for automotive companies. The firm made 50,000 tons of high-end steel from U.S. Steel Corp.’s Gary, Indiana facility — which is among the primary suppliers to U.S. auto companies — available to buyers after automakers declined to take on expected volumes.

While demand for automobiles remains strong, automakers continue to struggle with the ongoing semiconductor shortage.

Lead times for semiconductors have extended far above an average threshold of 9-12 weeks, hitting 22 weeks in October.

According to the Susquehanna Financial Group, power-management components stand at 25 weeks. Microcontroller lead times have ballooned to 38 weeks.

Falling auto production

Due to such shortages, automakers in recent months have either curtailed production or halted assembly lines altogether. Data from the Federal Reserve showed U.S. auto production plummet by 28.3% from August to September. September auto production fell to a seasonally adjusted annual rate of 1.06 million vehicles.

While some automakers have managed to reopen shuttered factories, production is expected to remain far below average.

Meanwhile, as steel demand appears to falter, new capacity is about to come online. Steel Dynamics’ (SDI) Sinton, Texas flat-rolled steel mill is expected to start production at the end of November or early December. The plant will have estimated output of 2 million to 2.2 million short tons of flat rolled products. Also slated for 2021, is Nucor’s Gallatin 1.4 million st/year mill expansion. Into 2022, even more flat-rolled capacity will enter the market following the completion of NorthStar Bluescope’s 900,000 st/year expansion as well as a 1.5 million st EAF from ArcelorMittal and Nippon Steel in Alabama.

Section 232 tariffs resolution

In a move that is expected to advance steel imports, the U.S. and E.U. reached an agreement regarding the former’s Section 232 tariffs on steel and aluminum.

Imposed in 2018 under former President Donald Trump, duties of 25% and 10% were levied on steel and aluminum imports, respectively, from most countries. The deal, which is slated to go into effect Jan. 1, 2022, will end the current retaliatory tariffs placed on certain U.S. goods from the E.U., as well as avoid a doubling of them that set to go into effect Dec. 1.

Under the new agreement, the existing tariffs for steel will be replaced with a tariff-rate quota (TRQ) for historically-based volumes of E.U. steel products. The TRQ is set at 3.3 million metric tons under 54 product categories. Volumes surpassing this limit will continue to be subject to the 25% duty. Imports are required to be “melted and poured” within the E.U. in order to avoid steel from outside countries, most notably from China, from entering the U.S. under such exemptions. Additionally, the TRQ will be allocated on a “first-come, first-served” basis and the quota will be reviewed and adjusted annually based on U.S. steel consumption during the previous calendar year.

Meanwhile, current forecasts from the World Steel Association anticipate total U.S. steel consumption in 2021 will reach 92.1 million tons and further expand to 97.5 million tons in 2022. According to the U.S. Census Bureau, year-to-date steel imports through September 2021 reached 21.6 million metric tons.

Iron ore falls alongside China steel output

China’s steel production continues to shrink. Steel output plummeted to a 33-month low in September, hitting only 73.75 million metric tons for a 21.2% year-over-year drop.

During the final third of October, daily crude steel output hit its lowest level since March 2020. Mills throughout the world’s leading steel producer have faced cuts in recent months in order to meet China’s lofty carbon emissions goals. Additionally, the ongoing power crisis and upcoming Winter Olympics have extended production curbs into the first quarter of 2022.

Pushed downward by muted steel industry demand, iron ore futures in China are currently trading beneath $100 per ton, a low not seen since January 2020. Prices had previously reached more than $200 per ton in January 2021.

Actual metals prices and trends

Chinese slab prices increased 0.86% month over month from $869 to $876 per metric ton as of Nov. 1. Meanwhile, the Chinese billet price fell 4.6% from $804 to $767 per metric ton.

Chinese coking coal dropped by 7.65% from $526 to $486 per metric ton.

U.S. three-month HRC declined 9.7% from $1,619 to $1,462 per short ton. While the spot price declined by 6.77% from $1,934 to $1,803 per short ton. Meanwhile, U.S. shredded scrap steel increased by 0.64% from $467 to $470 per short ton.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply