Automotive MMI: Trump’s 50% Copper Tariff Sends Shock Through Auto Supply Chains

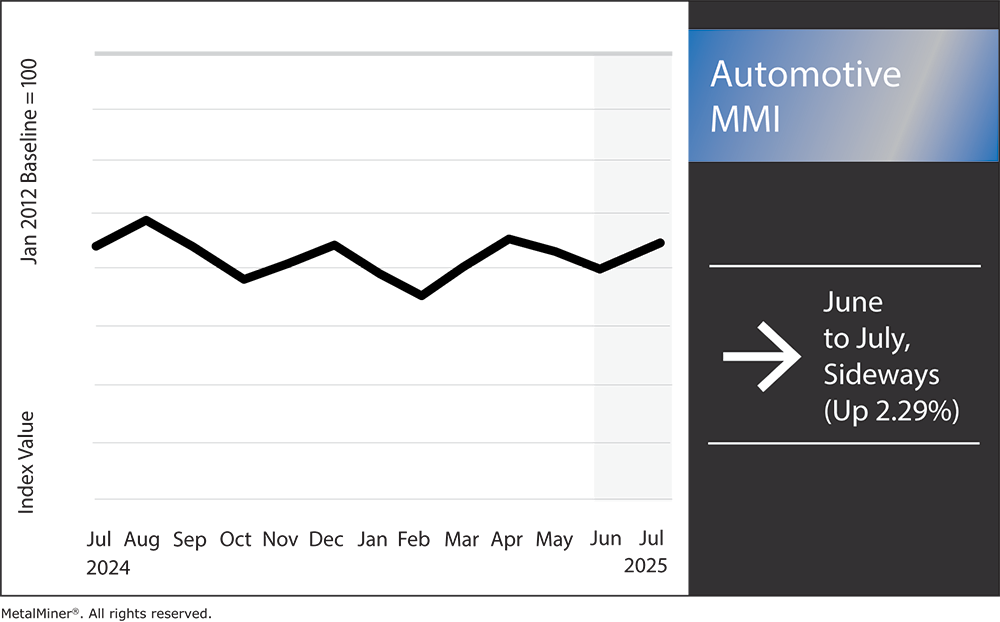

The Automotive MMI (Monthly Metals Index) moved sideways, inching up by 2.29%. While the index has maintained a mostly sideways trend over the past year, short-term volatility may be on the way. President Trump recently announced a 50% tariff on imported copper, a move expected to impact U.S. automotive manufacturing firms that source the red metal.

Trump’s 50% Copper Tariff Stuns Automotive Manufacturing Supply Chain

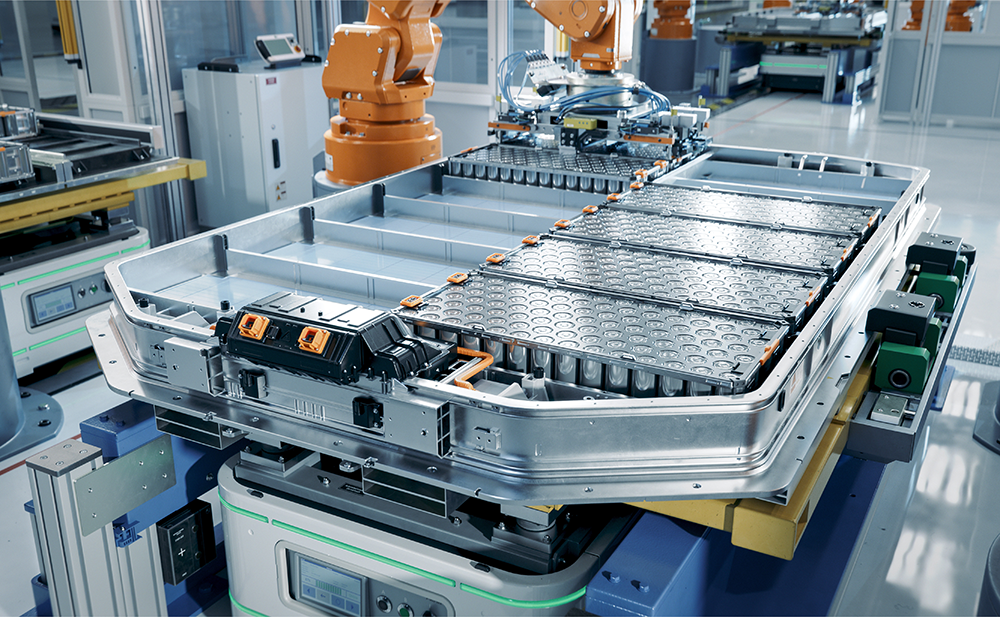

President Trump’s surprise July 8–9, 2025 announcement of a 50% tariff on imported copper (which will come into effect late July/early August) jolted U.S. automakers. Copper futures leaped roughly 15–17% to record highs as buyers scrambled ahead of the deadline, reflecting a new price premium. Copper is vital for EV motors, batteries and wiring harnesses, so the tariff will boost automotive manufacturing costs by hundreds of dollars per vehicle, especially in the case of electric cars.

The sudden move came with little warning. President Trump said the goal is to “bring copper production back home to America,” citing its key industrial role. Meanwhile, traders had already been rushing imports. Bloomberg noted that, in the short term, “the price is going to rise significantly” because markets had expected a lower rate.

In the meantime, procurement teams should brace for higher metal costs and act quickly. We recommend subscribing to MetalMiner’s free newsletter for real-time updates and checking our premium, monthly forecasts for detailed supply-risk analysis.

Auto Supply Chain Are Already Stretched Thin

25% tariffs on steel, aluminum, automobiles and parts have already strained U.S. supply chains. Automakers warn these levies “increase costs on consumers” in North America’s integrated market. Now, copper is being added to the mix. Meanwhile, U.S. buyers already pay approximately $1,250 per ton above average world prices for aluminum due to past tariffs.

Data confirms this strain. For instance, a recent ISM report said tariffs have caused “bottlenecks in the supply chain,” slowing U.S. factories. Many automakers and are now accelerating orders and hedging where possible. MetalMiner provides instant alerts on price spikes. Our advice? Lock in key metal contracts while prices climb using, and update cost models to include the new copper duty.

Check if your suppliers is providing you with price transparency for your copper spend, especially with the incoming 50% copper tariffs.

EU–U.S. Trade Talks, Auto Exemptions in Play

These events also coincide with high-stakes EU-U.S. trade talks. Both sides are racing for a deal by August 1, and EU sources say autos, steel and possibly copper exemptions are being discussed. According to The Guardian, German Chancellor Friedrich Merz says he’s “cautiously optimistic” that an agreement on cars and steel will be struck by month’s end.

Germany has proposed a specific automotive manufacturing deal that allows U.S. cars to be tariff-free in return for more European production on American soil. Reuters reports BMW, Mercedes and VW could earn import credits for vehicles built in the U.S., effectively offsetting duties. This would primarily benefit German brands with large U.S. plants. As such, some EU officials are wary, fearing it could favor only a few exporters.

For U.S. metal buyers, the lesson is clear: stay informed. Any trade outcome will affect both demand and prices.

What Should Automotive Companies in the U.S. Do to Prepare?

The 50% copper tariff has jolted America’s automotive manufacturing sector with price shocks. Copper futures surged as importers rushed to meet the deadline, and production-cost models now indicate significantly higher vehicle costs. For automakers, which often run on tight single-digit margins, even a few hundred dollars of extra cost per vehicle can make a big difference.

Automotive MMI: Noteworthy Price Shifts

Need precise pricing without spending too much? With MetalMiner Select, acquire only the metal price data essential to your business, ensuring cost-effectiveness and better procurement planning.

- Chinese lead prices rose by 3.41% to $2,359.84 per metric ton.

- Hot-dipped galvanized steel prices moved sideways, rising by 1.21% to $1,091 per metric ton.

- Lastly, Korean 5052 aluminum coil premium over 1050 prices traded flat, remaining at $4.44 per kilogram.