Aluminum MMI: MW Premium Futures Stagger, Aluminum Demand Soft

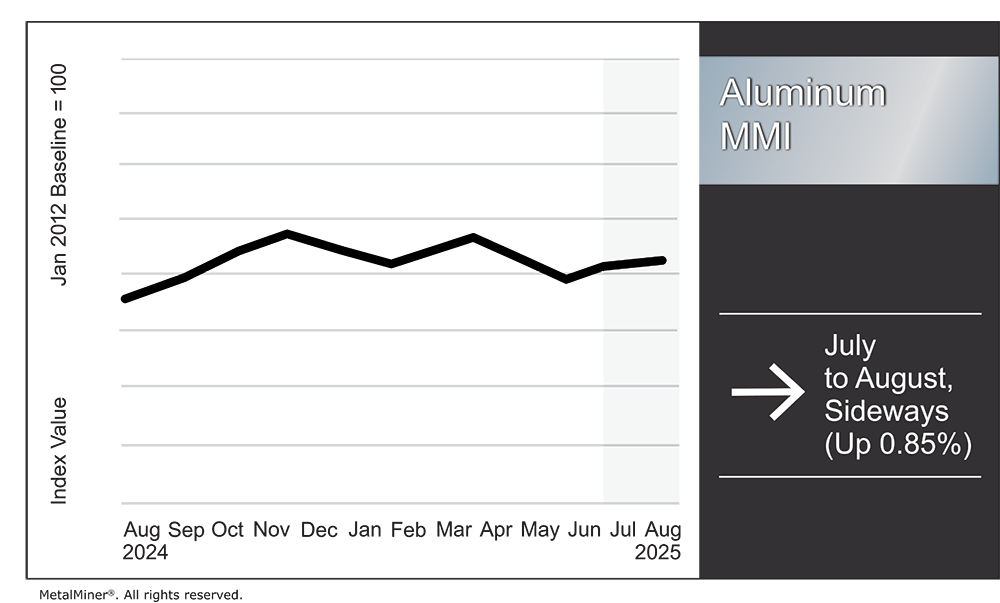

The Aluminum Monthly Metals Index (MMI) edged higher, but the pace slowed. Ultimately, the index saw just a 0.85% rise from July to August as the price of aluminum seemed to enter a period of flux. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing.

Midwest Premium Futures Stagger After ATH

U.S. aluminum tariffs have proven to be a strong driver during the first seven months of the year, pushing the Midwest Premium to a new all-time high of $0.71/lb by early August. This marks a 167% rise since the start of the year, the Midwest Premium’s best year-to-date performance since its inception.

The recent tariff lift has also pulled the premium away from its correlation to LME aluminum prices. Between 2014 and the end of 2024, the two contracts boasted a nearly 80% correlation. However, throughout 2025, that correlation plummeted to -2.8%. While somewhat volatile, LME prices are sideways from where they started the year, only about 3% higher year to date.

While the spot premium remains in search of a new high, its three month futures contract found its peak at the end of July. Investors appear cautious about its next leg up despite tariff pressures that continue to impact the U.S. aluminum market.

Concerned about where the price of aluminum will head next? Gain access to expert-driven market insight, ensuring your company is well-informed and prepared to tackle falling demand. Opt into MetalMiner’s free weekly newsletter.

Industry Calls for Higher Premium, Futures Disagree

Industry speculation regarding where the Midwest Premium should peak to fully price in the new 50% tariffs has ranged slightly higher than current levels. Alcoa, for instance, called for a $0.75/lb peak. This is similar to the $0.73/lb. estimated by major service centers. Meanwhile, consulting firm Harbor Aluminum calculated a more modest $0.70/lb high.

Despite these estimates, the futures market seems reluctant to push higher. Trade negotiations with the leading aluminum suppliers to the U.S. remain ongoing. Leading suppliers like Mexico, the UAE and, most importantly, Canada have yet to secure an agreement with the U.S. Meanwhile, deals with both the EU and UK have left the door open for quota arrangements. That said, they offered little clarity as to when they are expected to take effect or how much aluminum would be allowed into the U.S. at no or reduced duties.

Tired of paying for metal price data you don’t use? With MetalMiner Select, you can access only the specific aluminum price points relevant to your business, eliminating wasteful spending on unnecessary data.

Where Negotiations Currently Stand

These uncertainties have left market sentiment hinging on the news. Positive reports of ongoing negotiations have resulted in notable caution among investors. As of the August 8 close, the market appeared backwardated, with futures at a $0.105/lb discount to spot prices.

The recent bloodbath in the copper market, which saw price expectations upended when refined copper was excluded from the 50% August 1 duties, may have played a role in the apparent caution among investors. Comex copper prices witnessed a sharp drop in a matter of hours, leaving many bulls underwater. Many suppliers had spent the first half of the year stocking up on duty-free material, only to be left stuck with wildly overpriced inventories.

For now, all eyes remain on Canada, the largest supplier of aluminum to the U.S. While the country continues to benefit from previously negotiated agreements that allow USMCA-compliant material into the U.S. duty-free, a further rollback of duties could cut the Midwest Premium significantly.

Estimates suggest this could see the premium drop as much as $0.30/lb, depending on the terms of a trade deal. As the Midwest Premium’s $0.705/lb may not fully reflect current tariff rates, buyers and investors are correct to be cautious when it comes to forward buys.

Don’t panic about the price of aluminum. Learn how to manage tariff threats with MetalMiner’s free guide.

U.S. Aluminum Demand Remains Soft

While the potential for a rate cut at the Federal Reserve’s September meeting has offered some hope to economic conditions, the U.S. aluminum market remains in a lull from a demand perspective. Service centers experienced a disappointing July, with purchasing activity among buyers notably slow.

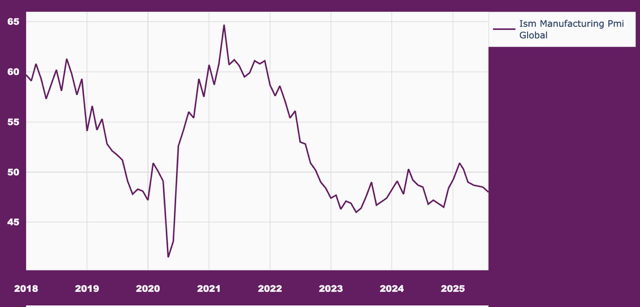

Buyers continued to purchase as needed, showing little interest in restocking efforts. While this is due in part to current market uncertainty, the manufacturing sector has yet to mount a rebound. The ISM Manufacturing PMI contracted at its fastest pace in nine months, continuing its multi-year sub-50 average.

Biggest Moves in the Price of Aluminum

- European aluminum plate prices saw the largest decline of the overall index, with a modest 2.17% drop to $4,484 per metric ton as of August 1.

- Chinese primary cash aluminum prices slid 1.75% to $2,850 per metric ton.

- European 1050 aluminum sheet prices declined by 1.35% to $3,290 per metric ton.

- Indian primary cash aluminum prices fell 1.31% to $2.86 per kilogram.

- Chinese aluminum billet prices dropped 1.13% to $3,042 per metric ton.

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models and stay ahead of the changing price of aluminum.