Global Precious Metals MMI: What’s Driving the Precious Metals Bull Run?

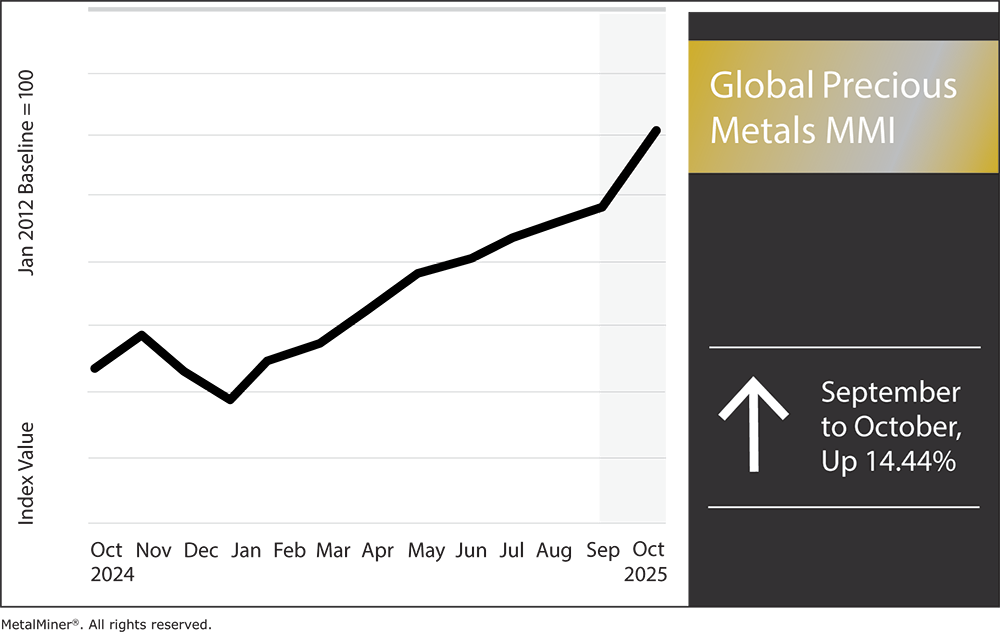

The Global Precious Metals MMI (Monthly Metals Index) saw a sharp rise in price action, jumping by 14.44%. This comes as all four major precious metals prices spiked in early October.

Gold recently notched all-time highs again, while silver briefly hit $54/oz before a steep pullback. Meanwhile, platinum and palladium are also near multi-year highs. The rush in precious metals prices has been fueled by several factors, including the government shutdown, trade-tariff worries and a slowing labor market, which is boosting safe‑haven buying.

What Drove the Recent Palladium Price Rise and Where are Prices Heading?

According to Capital.com, palladium prices have increased about 26% since October began, reaching roughly $1,500 per ounce. This surge has tracked gains in the platinum market and broader easing of financial conditions.

In particular, bets on Fed rate cuts and a weaker dollar have given palladium a lift as part of a “gold + liquidity” rally across precious metals. Palladium’s uses are almost entirely industrial, with heavy use as gasoline-vehicle catalysts. That means U.S. auto makers and electronics firms could face big cost swings.

According to Monex, technical analysis suggests resistance around $1,500–$1,520/oz. Along with this, experts anticipate the overall trend to stay up, but with choppy trading ahead. CPM Group analysts observe that much of palladium’s recent strength has “been tied to strength in the platinum market.” They warn that U.S. labor-market weakness and inflation could “act as headwinds” on demand.

MetalMiner Select covers correlation charts and forecasting for a full suite of industrial and precious metals prices. See our full metals catalog.

Is Platinum Also Hitting Multi-Year Highs?

Yes. In terms of precious metals prices, platinum is leading the pack. According to Monex, the metal is up roughly 30% year-to-date and is approaching levels not seen since 2008. U.S. buyers should note that autocatalysts and fuel-cell tech are key drivers. Platinum use in hybrid and heavy-duty vehicles is rising, and stricter emissions standards are keeping auto demand strong. Meanwhile, mining supply has been constrained, as analysts expect a third straight annual platinum deficit in 2025.

Industry research group CPM notes that platinum just hit its highest mark since 2012 and could climb toward $1,750–$1,850/oz in the coming months. However, they caution that the run-up will not be smooth. For example, periodic retreats and sideways moves are normal, even in a bull market. For U.S. procurement, the message is to expect a bullish bias, but to also hedge in stages.

Why Did Silver Surge in Price and Then Pull Back?

Silver spiked to record highs (~$54/oz) in mid-October, driven by safe-haven demand and booming industrial use. By October 17, it had fallen about 6% to ~$51.90/oz. According to the Economic Times, this represents the largest one-day drop in months.

Analysts attribute this retreat to easing U.S. credit-market fears and trade tensions, which took some urgency out of safe-haven buying. A stronger U.S. dollar and rising bond yields also sapped momentum. Despite the pullback, silver’s fundamentals remain solid.

Year-to-date, silver is up over 70%, underpinned by high industrial demand from electronics, data centers and more. Meanwhile, silver itself remains in tight supply. Notably, the U.S. just designated silver a critical mineral, which may encourage stockpiling and investment to secure additional stock. Looking ahead, many analysts expect silver to resume climbing, especially if volatility returns.

Why invest in unnecessary metal price data when you only need a few price points? MetalMiner Select allows you to purchase just the metal price data you require.

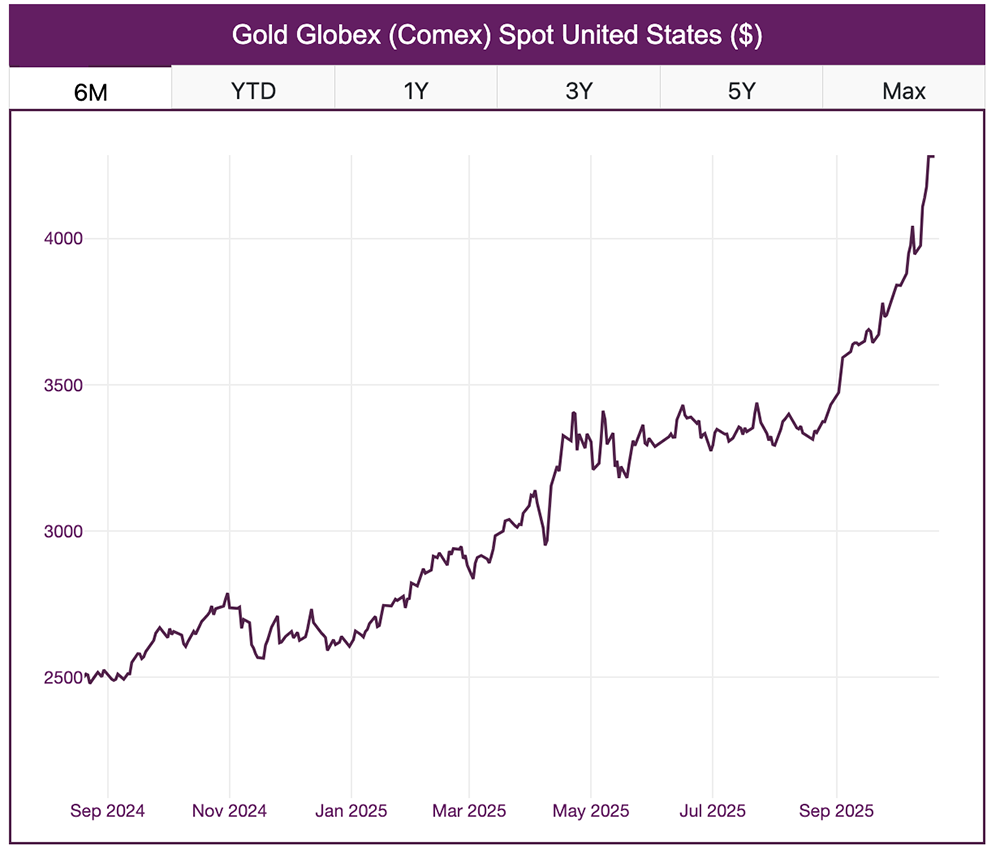

What Drove Gold’s Bullish Run in 2025?

Gold broke through $4,000/oz on October 8 and hit around. That marks a roughly 60% jump since January. U.S. buyers feel that this acute rise will add big costs to hedged metal budgets. As with other precious metals prices, the increase was powered by familiar safe-haven themes. Meanwhile, many Wall Street forecasts remain bullish on gold. Even HSBC recently raised its gold year-end target.

For the next couple of months, most analysts expect gold to stay bid, unless a sudden U.S. economic turnaround drains demand. We’re in a late-stage bull market. Historically, such parabolic runs often see corrections, but experts caution against betting on a crash. In Lisa Shalett’s analysis at Morgan Stanley, gold’s rise is described as unusual because “gold and stocks have been moving together.”

Precious Metals MMI: Noteworthy Price Shifts in Precious Metals Prices

Struggling to stay updated on hedging strategies for precious metals? Download MetalMiner’s Monthly Metals Index Report to receive the latest price trends, market intelligence, and outlooks for precious metals and 6 other metal industries, aiding your strategic planning.

- Palladium bar prices rose by 11.91% to $1,231 per troy ounce.

- Platinum bar prices increased by 16.75% to $1,568 per troy ounce.

- Silver ingot prices jumped 20.86% to $46.99 per troy ounce.

- Lastly, gold bullion prices rose by 13.14% to $40.54 per troy ounce.