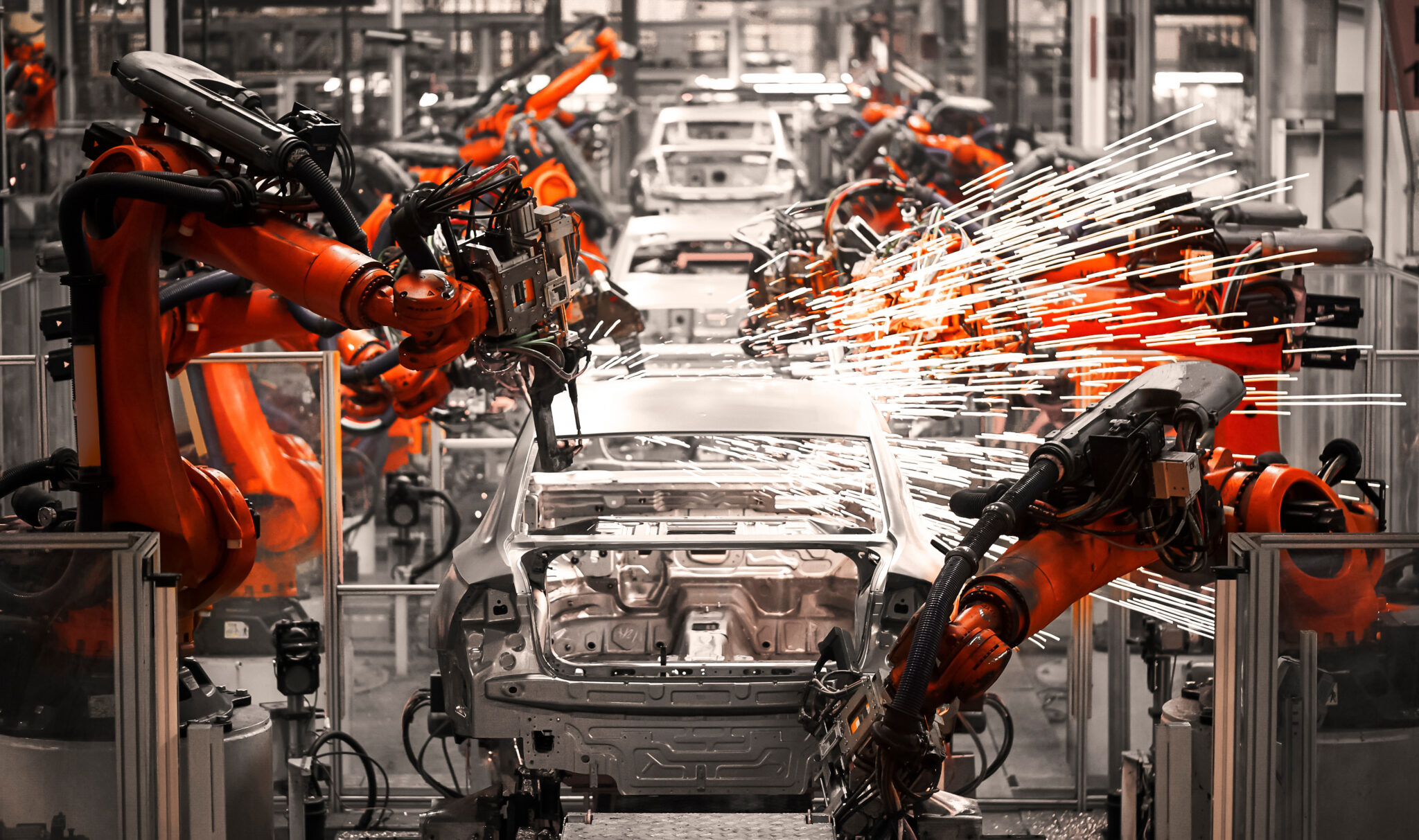

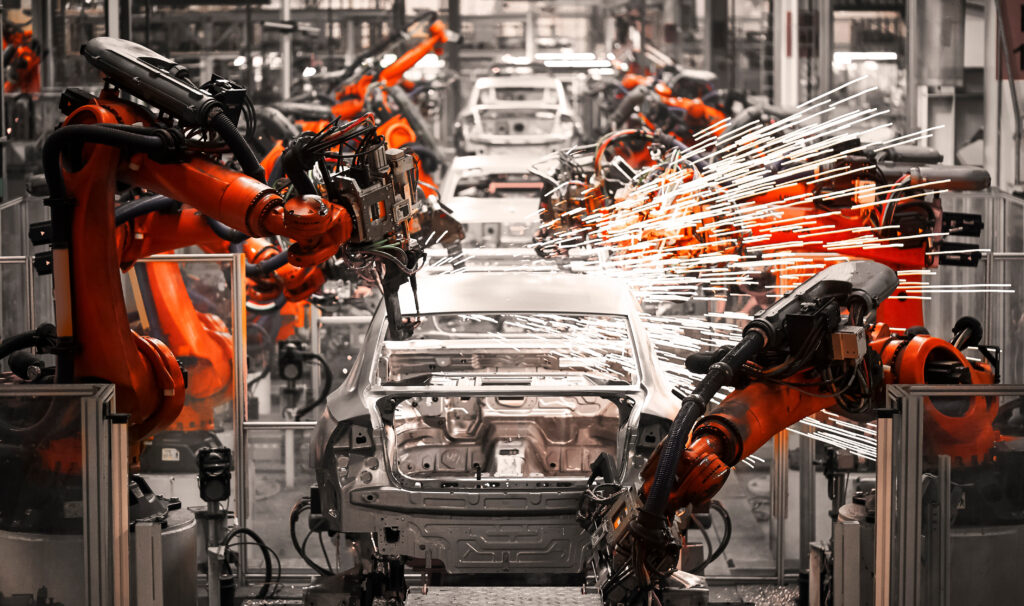

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times as customers rushed to lock in supply.

Many manufacturers recall the 2018 tariff shock as well as the procurement strategies that followed, as covered in MetalMiner’s weekly newsletter. For instance, a Bain & Co. survey from that period found that 40% of executives braced for double-digit cost increases and 80% revised forecasts when metal duties first hit. This time, companies are determined not to be caught flat-footed.

Sourcing Shifts and Supplier Diversification

One of the more immediate procurement strategies focuses on retooling sourcing tactics. Tariffs have made foreign metal pricier, so manufacturers are shifting toward domestic suppliers or tariff-exempt sources wherever possible. Finished steel imports previously made up about 23% of U.S. consumption. However, many buyers are now increasing orders with U.S. mills. Nucor, for example, boosted scrap purchases while pivoting to a primarily domestic supply chain, driving scrap steel prices up 10% in a month.

While such a pivot can secure supply, it comes at the cost of higher domestic prices. “Higher tariffs could push more manufacturers to turn to the domestic steel market, which could drive up prices,” warns trade attorney Greg Husisian. Manufacturers are also broadening their supplier base as a buffer.

Meanwhile, tractor and equipment maker AGCO said it is lining up alternative suppliers in case tariffs hit inputs from Europe. This comes after the company expressed alarm that new duties on EU steel could boost its production costs by up to 7%. In practice, this means qualifying multiple vendors in different regions and maintaining relationships to tap if primary sources become too expensive or slow. Some firms even pre-buy or stockpile metals when prices dip.

Procurement Strategies: Clauses and Hedging to Manage Risk

Beyond sourcing tweaks, manufacturers are rewriting contracts and financial strategies to cope with cost swings. For instance, many firms now insist on tariff and material price escalation clauses in supplier contracts. These provisions allow for adjustments if raw material costs or import duties exceed a set threshold.

According to Reuters, one Illinois components maker told its big OEM customer that any tariff-driven steel cost increase would be passed through entirely. By baking in surcharge mechanisms, companies ensure they won’t be left to absorb upstream cost hikes. Industry lawyers note that well-crafted clauses tie price adjustments to objective indices like a published steel index or the Producer Price Index. This transparency helps buyers and suppliers share the burden fairly when markets gyrate.

Desire precision pricing without the extra expense? Purchase only the price points you need with MetalMiner Select, ensuring your procurement strategy is cost-efficient.

Hedging and Forward Buying

Simultaneously, companies are also turning to hedging and forward buying to tame volatility. For instance, large automakers expanded their commodity hedging programs when metal prices erupted. Ford and General Motors added about $466 million in commodity hedges in Q3 2021 as steel and aluminum costs climbed. This followed the lead of European rivals like Volkswagen, which reaped gains by locking in prices early.

These hedges, ranging from futures contracts on exchanges to long-term fixed-price agreements with mills, act as “insurance,” capping exposure to price spikes. “Regardless of the price direction, the risk of adverse moves is covered with a hedge,” noted one aluminum buyer who used CME futures to stabilize costs.

Practical Outlook for Procurement Professionals

Facing an unpredictable mix of cooling demand and policy shifts, U.S. manufacturers are learning that agility is the best armor. Yet more upside risks, from fresh Chinese stimulus to supply disruptions, could swing prices higher without warning. In this climate, procurement leaders are focusing on what they can control.

That means building resilience through diversification, leveraging index-linked contracts and keeping a close eye on commodity trends, all of these strategies are covered in the 5 Best Sourcing Practices. Moreover, many firms have created internal task forces that meet regularly to review metal price indexes and update sourcing plans in real time.

The Importance of Communication

Communication across the supply chain is key. As such, manufacturers are working closely with both suppliers and customers to share forecasts, negotiate creative pricing arrangements and avoid surprises. Some OEMs are even collaborating with suppliers to jointly source bulk raw materials and then allocate costs, thus betting that combined volumes can secure better terms. Most critically, companies are staying flexible through the use of product and inventory strategies.

In consumer appliances, for example, manufacturers have raised end-product prices when input costs became untenable, albeit cautiously to avoid “sticker shock” that could dent demand. The bottom line? U.S. manufacturers are navigating this era of metal price volatility with hard-won lessons from the past and innovative tactics for the future. In order to lower your COGS more, MetalMiner helps you identify cost-saving opportunities hidden in your current buying habits with its platform, MetalMiner Insights. Explore our full metal catalog to see if we covers your specific metal type.