It’s that time — our latest Monthly Metals Index (MMI) report is in, covering the first month of 2018. Seven out of 10 MMIs posted increases this month. The Renewables MMI was the star of the month, as skyrocketing cobalt and steel plate prices helped push the sub-index up 21 points for a reading of […]

This Morning in Metals: Japan’s JFE Holdings Plans to Spend $6B on Upgrades

This morning in metals news, JFE Holdings Inc. in Japan plans to spend $6 billion on upgrades in the coming years, the Congressional Steel Caucus asked the administration for guidance on the Section 232 action timeline and Shanghai copper posted its biggest price jump since October. Need buying strategies for steel? Try two free months […]

This Morning in Metals: DOC Initiates AD, CVD Probes of Large Welded Pipe From 6 Countries

This morning in metals news, the U.S. Department of Commerce kicks off a new anti-dumping and countervailing duty probe, China urges the U.S. to exercise restraint when it comes to tariffs on steel imports and President Trump plans to meet with lawmakers to discuss tariffs on metals. Need buying strategies for steel? Try two free […]

This Morning in Metals: Metal Firms Line Up to Bid for Distressed Essar Steel

This morning in metals, several companies are looking to buy the distressed Essar Steel India Ltd., copper prices bounced back up and gold prices are up. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Essar Steel on the Market Companies like ArcelorMittal and VTB Group are vying for embattled Indian firm […]

SMDI Makes Case for Steel Over Aluminum During Chicago Auto Show

Use of aluminum in automotive bodies has gained steam in recent years — and the metal’s rivalry with steel has heated up in the process. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook For example, Ford Motor Co. shook up the marketplace when it announced its all-aluminum body F-150 2015 model. […]

This Morning in Metals: Aluminum Industry Testifies to ITC on Foil Imports

This morning in metals news, aluminum industry officials testified to the U.S. International Trade Commission regarding the ongoing aluminum foil investigation, Mexico’s economy minister says automotive rules of origin will change as part of the ongoing renegotiation talks surrounding the North American Free Trade Agreement (NAFTA) and copper is on track for its biggest weekly […]

This Morning in Metals: January Finished Steel Import Market Share Hits 26%

This morning in metals news, the American Iron and Steel Institute (AISI) reported finished steel imports accounted for 26% of the U.S. market, analysts expect the index that measures market volatility to come back down and General Motors reported strong 2017 earnings. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Steel […]

Global Precious MMI: Palladium-Platinum Gap Narrows, Moves Closer to Historical Norm

The Global Precious MMI (Monthly Metals Index) picked up one point this month, rising to 92 for our February reading. Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need Within the basket of metals, Chinese gold bullion and U.S. silver ingot/bars picked up in price. Palladium, which has bucked the historical trend by […]

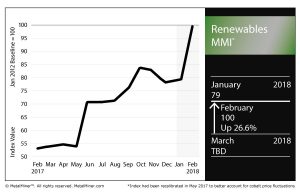

Renewables MMI: Steel Plate, Cobalt Prices Post Sharp Increases

[caption id="attachment_88708" align="alignleft" width="300"]

The Renewables MMI (Monthly Metals Index) skyrocketed this month, gaining 21 points en route to a 100 February reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The basket of metals posted price increases across the board, particularly in the steel plate category.

Japanese steel plate jumped 2.8%, while Korean steel plate rose 2.4%. Chinese plate jumped slightly, by 0.3%, and U.S. plate was up 6.5% as of Feb. 1.

Prices of neodymium, silicon and cobalt from China all posted significant price increases over the past month.

Scarcity of Critical Minerals to Threaten Renewable Industry?

According to a report from Stanford University, a scarcity in rare minerals could undercut the move toward greener forms of energy.

The topic was put forth for discussion at a mineral resources conference hosted by the university last month.

“Due to the rapidly increasing need for mineral resources as Earth’s human population continues to grow exponentially and the need to minimize the environmental and social impacts of mining, it’s essential that Stanford be involved in the field of economic geology — the study of the formation, exploration, and utilization of mineral resources,” said Gordon Brown, a professor of geological sciences at Stanford’s School of Earth, Energy & Environmental Sciences, as quoted in the report.

Uranium, copper, gold, lithium and rare earth elements (REEs) were among the materials cited in the report as critical to the future of renewable energy.

Among the trends impacting the supply of these valuable materials, according to the report, included: humanity’s increasingly growing rate of metal consumption, the concentration of rare elements in a relatively few countries, the quality (or lack thereof) of U.S. mineral mapping and reduction of mineral waste.

Cobalt Price Rises as Congo Seeks More Control of Market

Speaking of the concentration of minerals, the Democratic Republic of Congo is home to more than half of annual global cobalt production each year (in 2016, 66,000 of the 123,000 tons produced worldwide were sourced in the DRC, according to the U.S. Geological Survey).

Prices of cobalt are on the rise, shooting up a whopping 44.8% month over month.

With a number of international mining firms doing business in the DRC, the country’s largest state-owned mining company, Gecamines, is seeking to assert greater control of the market, Bloomberg reported.

“I find it scandalous that when cobalt is discussed, and the explosion of electric vehicles, only the traders and consumers are referenced and Congo and Gecamines are not cited,” Gecamines Chairman Albert Yuma was quoted as saying.

As reported by Reuters, Gecamines wants to renegotiate its contracts with foreign firms in order to work toward asserting further control of that cobalt market.

Cobalt is valuable for, among other uses, its application in electric vehicle batteries.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

This Morning in Metals: China Aims to Hit 2020 Steel Capacity Reduction Goal This Year

This morning in metals news, China is aiming to meet its 2020 goal for steel capacity cuts this year, a new bottle technology makes aluminum bottles feel like plastic and copper output in the Democratic Republic of Congo rose significantly in 2017. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Chinese […]