All components of the Automotive MMI moved sideways or down month-on-month. Moreover, January saw prices flatten out across the steel market, causing hot-dipped galvanized steel prices to trend close to support zones. Meanwhile, China’s wavering economy continues to prove a concern for global markets because the country is such a large steel demand driver. Many […]

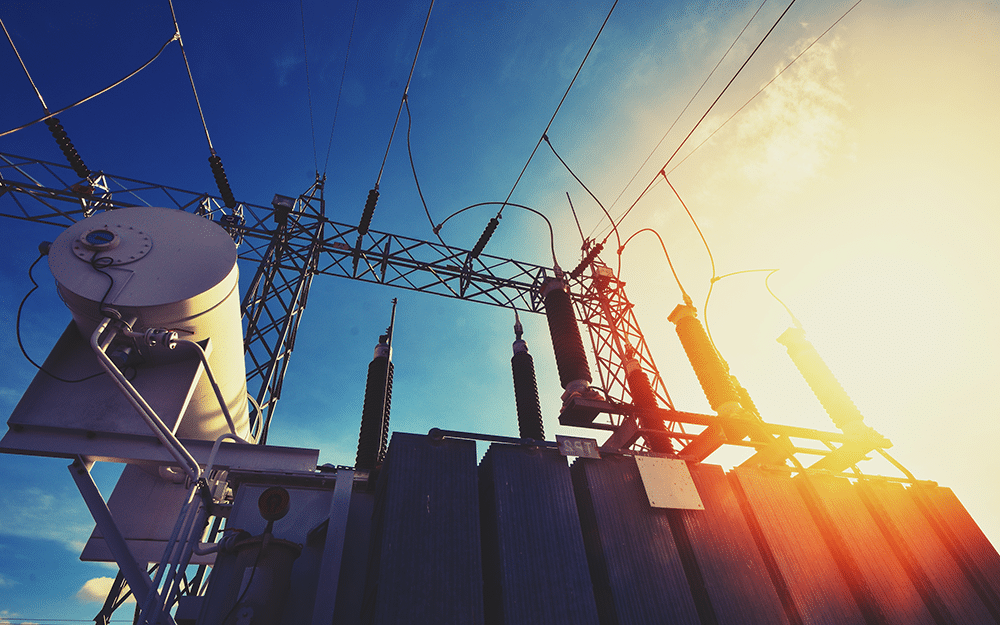

Renewables/GOES MMI: U.S. Transformer Shortage Pain Continues into 2024

The Renewables index began 2023 fairly sideways. However, it broke that trend in Q3 and Q4 when it edged downward. Numerous components of the index, including silicon and cobalt, experienced market oversupply. This caused prices to drop and pulled the index down with it. Grain oriented electrical steel also experienced market volatility in Q3 and […]

Construction MMI: Construction News Puts Infrastructure on Top for 2023

After a mostly sideways 2023, the Construction MMI (Monthly Metals Index) also entered 2024 sideways with only a small 2.5% increase. Furthermore, all index components except for European aluminum commercial 1050 sheet and shredded scrap steel moved in a sideways price trend. Meanwhile, construction news sources indicate that infrastructure projects proved to be the top-performing […]

Automotive MMI: Index Rises & Outlook for 2024

While the index remained sideways for most of 2023, the automotive industry itself witnessed its fair share of shifts. For instance, the UAW strike forced numerous changes on the automotive industry while impacting automobile sales and production to varying degrees. Meanwhile, steel price hikes also caused the overall index to fluctuate and shift. All in […]

Rare Earths MMI: China Bans Export of Rare Earth Metals Technology

Overall, 2023 proved volatile for the Rare Earths MMI, with the sector experiencing sharp declines at the beginning of the year. This mainly stemmed from decreased Chinese production, supply chain disruptions, and the numerous nations seeking non-Chinese sources of rare earth metals. During Q2 and Q3, price action remained sideways, but global supply dynamics continued […]

Green Aluminum Market: Insight From Hydro’s Duncan Pitchford

Aluminum supply remains a major topic of discussion among metal buyers. Traditional smelting and metal manufacturing remain the most widely used metal manufacturing methods worldwide. However, “green” metal initiatives have witnessed growth in recent years. Recently, I interviewed representatives from Norsk Hydro, a recycled and green aluminum company based out of Norway, to gain insight […]

Major Trading Routes in Pandemonium: Houthi Rebels Attack the Red Sea

The recent surge in assaults on vessels in the Red Sea by Houthi rebels significantly impacted global commerce and maritime pathways. These intensified attacks continue to disrupt one of the busiest trade corridors on the planet, leading to longer voyage time, increased fuel consumption, and a potential need for larger fleets. Moreover, the resulting disruptions […]

Renewables/GOES MMI: Index Drops & Green Energy Faces Challenges

The Renewables MMI (Monthly Metals Index) took a noticeable dive month-over-month, dropping by 10.41%. Indeed, neodymium, cobalt, and steel plate all suffered drops in price, making them the main culprits for the index falling. Meanwhile, the latest renewable energy news sources suggest green initiatives could be in for a rocky ride in 2024. This is […]

Construction MMI: Construction Spending Rises but Construction Index Falls

The Construction MMI (Monthly Metals Index) strayed from its sideways trend to drop 6.84% month-over-month. A drop in European commercial aluminum 1050 sheet prices was the main culprit in the index’s decline. Construction news sources indicate with steel prices finally flattening out in recent weeks, the index could face further bearish pressure. Despite this, construction […]

Automotive MMI: Vehicle Sales Rise Along With Steel Prices, Particularly Hot-Dipped Galvanized Steel

The U.S. automotive industry witnessed several changes month-over-month. For one, the demand for new vehicles went up. However, steel prices, particularly hot-dipped galvanized steel, also rose along with demand. With the UAW strike over, analysts expect new vehicle manufacturing to pick up. However, new vehicle demand overall continues to battle elevated interest rates. Experts do […]