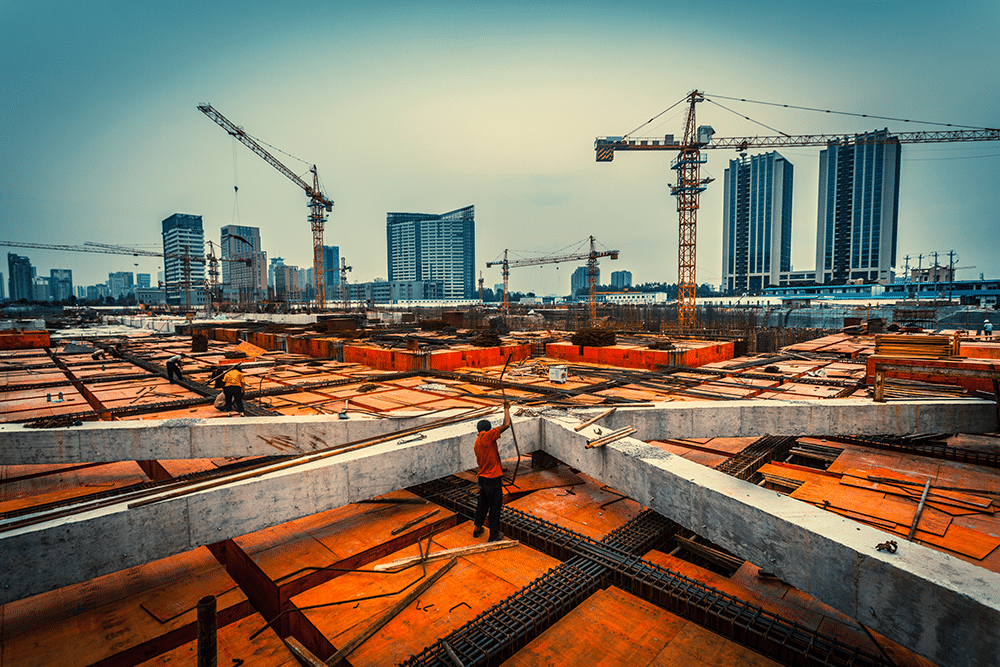

Construction MMI: Construction News Puts Infrastructure on Top for 2023

After a mostly sideways 2023, the Construction MMI (Monthly Metals Index) also entered 2024 sideways with only a small 2.5% increase. Furthermore, all index components except for European aluminum commercial 1050 sheet and shredded scrap steel moved in a sideways price trend. Meanwhile, construction news sources indicate that infrastructure projects proved to be the top-performing U.S. construction sector throughout the year.

Knowledge is key in navigating metal market fluctuations. Don’t miss out on MetalMiner’s expert analysis and up-to-date information. Subscribe to MetalMiner’s free weekly newsletter.

Construction News Reveals Infrastructure Top U.S. Construction Sector of 2023

In 2023, the infrastructure sector achieved the highest performance amongst all U.S. construction sectors. Compared to the prior year, the construction industry exhibited a notable 7% rise in value-added and a 6% boost in overall output.

In August 2023, the infrastructure industry proved incredibly resilient, growing significantly despite challenges from rising interest rates and a protracted labor shortage. The primary driver of this favorable trajectory was a significant boost in nonresidential construction investment, which increased by 17.6% year over year. The bulk of the $1.98 trillion invested in building operations during the month came from this surge in nonresidential construction spending.

Will Infrastructure Keep Up the Pace in 2024?

Construction news and policy sources say 2024 remains poised for a boost in U.S. infrastructure expansion. According to the American Institute of Architects’ Consensus Construction Forecast, nonresidential construction spending continues to rise. Meanwhile, Deloitte’s 2024 Engineering & Construction Industry Outlook says that funding from key legislation passed in 2021 and 2022 will continue to fuel construction in manufacturing, transportation, and clean energy.

The Contractor’s 2024 Economic Forecast predicts a robust year for the construction sector, with overall spending growth predicted to rise by 6%. This surge will mainly stem from strong increases in the commercial, industrial, and institutional sectors.

Meanwhile, the Bipartisan Infrastructure Investment and Jobs Act (IIJA) will keep the pedal to the metal, driving infrastructure investments forward into the coming year. Still, even with sunny skies ahead, challenges still loom. Examples include wobbly building material and labor costs and a persistent struggle to find skilled workers.

Construction news significantly affects prices for metals like steel. Here’s how to check if your service center is providing you with price transparency for your steel spend.

Elevated Interest Rates: How Will They Impact 2024 Construction?

The U.S. construction sector is bracing for a major shakeup from high interest rates in 2024. Despite keeping rates steady in 2023, the Federal Reserve expects to loosen the reins later this year. However, the industry is already feeling the bite of tighter financing conditions and steeper loan costs, which continues to impact multiple future construction projects.

Meanwhile, the National Association of Home Builders predicts that 2023 will be a booming year for single-family construction, with a projected 3.7% increase. Moreover, total residential construction remains primed to contract by 3.4%. Still, rising interest rates continue to squeeze profit margins and raise borrowing costs, potentially throwing wrenches into the viability and profitability of building projects. This makes it critical for industry professionals to stay glued to interest rate fluctuations and understand how they can impact both financing access and overall activity.

Is it time to say screw your suppliers?! Not exactly… however, getting actionable sourcing tactics and notifications about rapid metal market shifts is vital to saving money. Learn more about MetalMiner Insights.

Construction MMI: Notable Price Shifts

- Shredded scrap steel witnessed the largest price shift by far, moving up by 20.21%. This left prices at $464 per short ton.

- European aluminum commercial 1050 sheet also rose in price, this time by 6.56%. This brought prices to $3,220.75 per metric ton.

- Chinese steel rebar moved sideways, only increasing by a slight .45%. This brought prices to $565.02 per metric ton.

- Finally, Chinese h-beam steel also moved sideways, shifting up 1.83% to $535.58 per metric ton.