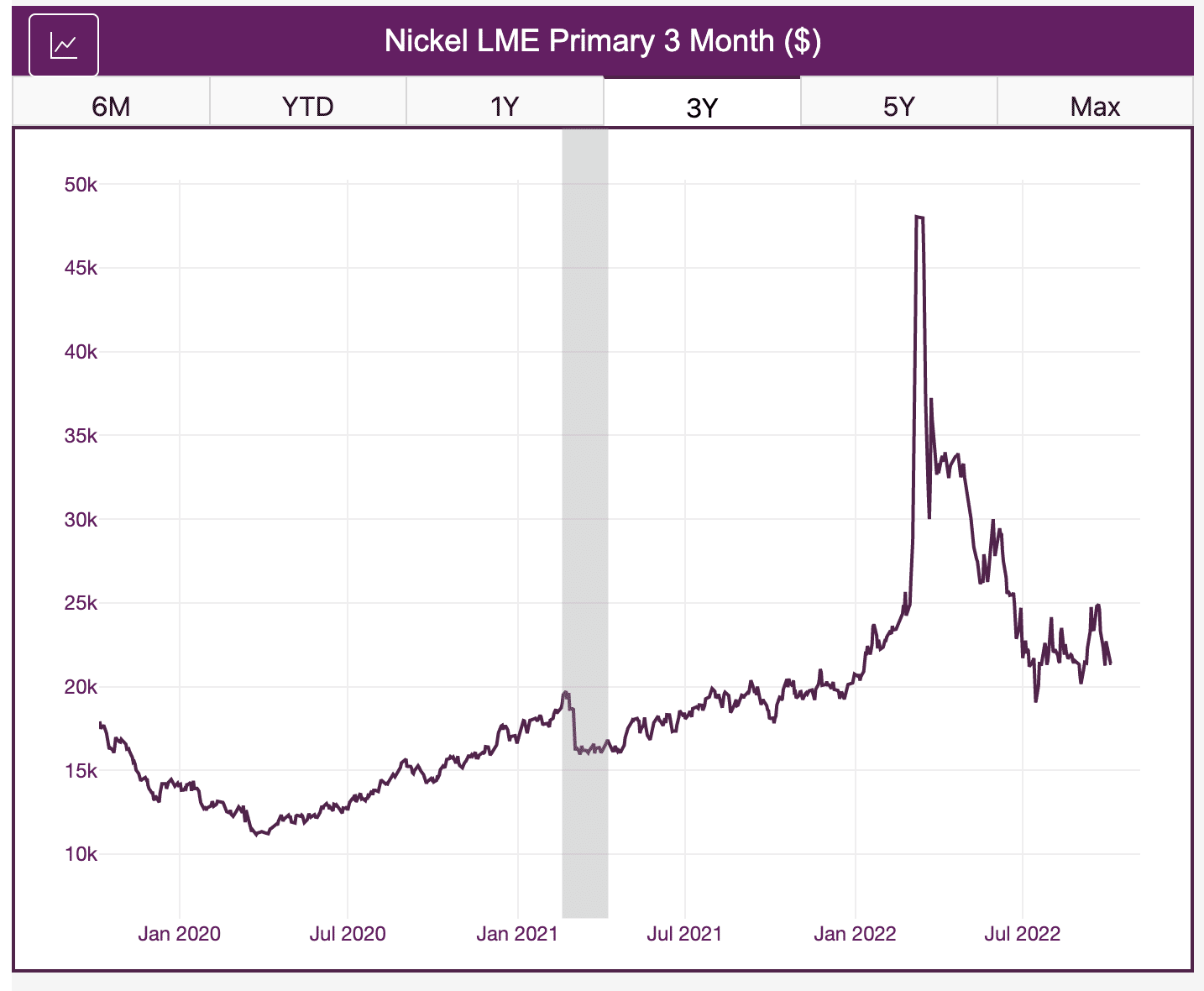

Nickel prices are seeing a lot of attention due to an overall lack of liquidity on the LME contract. But what exactly does this mean? Moreover, what does it mean for buyers looking to mitigate price problems in the face of global supply problems? The metals market moves fast. Sign up for the weekly MetalMiner […]

Rare Earths MMI: Rare Earths Prices Hold Steady Despite Amid Lower Scrap Availability

The Rare Earths Monthly Metals Index (MMI) held flat for a .56 percent change this month. Even so, some rare earths prices have seen significant fluctuation. Praseodymium Neodymium Oxide is one such example. The allow saw a significant price increase over the past month. Check out the MetalMiner forecast track record. By correctly calling the trends MetalMiner […]

Global Precious Metals MMI: Silver Prices Lead Index Lower

The Global Precious Monthly Metals Index (MMI) fell by 0.9% for this month’s index reading, largely due to falling silver prices. Did you know that MetalMiner forecasts for several precious metals in the MetalMiner Insights platform? Rising interest rates tend to dampen investor sentiment toward precious metals. Gold and silver typically act as a store of value, […]

The Best Market Forecast Looks a Lot Like an Aluminum Forecast

MetalMiner avails itself of both Artificial Intelligence (AI) and Technical Analysis (TA) to better understand market direction. In short-term analyses, AI works particularly well. However, when looking for long-term answers, TA is far more insightful. This is particularly true when determining the best market forecast in terms of bullish, sideways, or bearish. Charts, Forecasts, and […]

Buying Strategies in Falling Aluminum and Steel Price Markets

Recent key shifts in macroeconomic indicators could significantly impact both aluminum and steel prices. Historically, the best way for companies to protect themselves during times of uncertainty is to change buying strategies. Most commodities have traded in a bull market for the past one and a half years. This has allowed companies of all sizes […]

Rare Earth Metals MMI: Dramatic price increases last seen in 2012

The Rare Earth Metals Index (MMI) rose by over 17% month over month. MetalMiner launched the entire MMI series in January, 2012. At that time, all of the rare earth metals began with an index reading of 100. By June of 2013, the rare earth metals MMI plummeted to 29 and reached a low in […]

Global Precious Metals MMI: monthly index rises on strong palladium prices

The Global Precious Monthly Metals Index (MMI) rose by 6.8% for this month’s reading. This represents the second month in a row of precious metals inswz increases. Last month the index increased by 4.1%. Palladium, and to a lesser extent, platinum drove the index higher. Most of the other precious metals held flat or fell. The […]

Automotive MMI: Index drops 2% while Stellantis takes a page from the GM supplier handbook

The Automotive Monthly Metals Index (MMI) dropped by 2.5% for this month’s reading, following last month’s 3.4% decline. However, from a historical perspective, the Automotive MMI sits just off its all-time high. For nearly all of 2021, the entire automotive industry has felt pain. That pain has come in the form of high prices, lack […]

How to Adjust a Purchase Strategy in Volatile Markets

Three phrases have dominated market headlines over the past two weeks. The phrases, ‘buy on the dips’, ‘volatility’ and ‘market correction’ have traders and market watchers all abuzz. This tends to happen when a market goes a little wonky. Most recently, market pundits bantered about these phrases over the S&P 500 market selloff. All of […]

What we are watching: aluminum stainless and Tesla rumors

MetalMiner has long held the belief that no super-cycle exists to drive commodities prices. The argument against the super cycle suggests a lack of a 10-year sustained growth trend of new demand to support such a cycle. And despite not having a sustained growth demand cycle, metal prices remain extremely volatile due to supply constraints. […]