In the latest US steel news, a WTO ruling has sparked a new war of words between the United States and China. Last weekend, the WTO finally ruled on the 25% taxes on global steel imports and 10% import tariffs on aluminum imposed under former US President Donald Trump. The WTO dispute settlement panel ruled […]

Category: Commodities

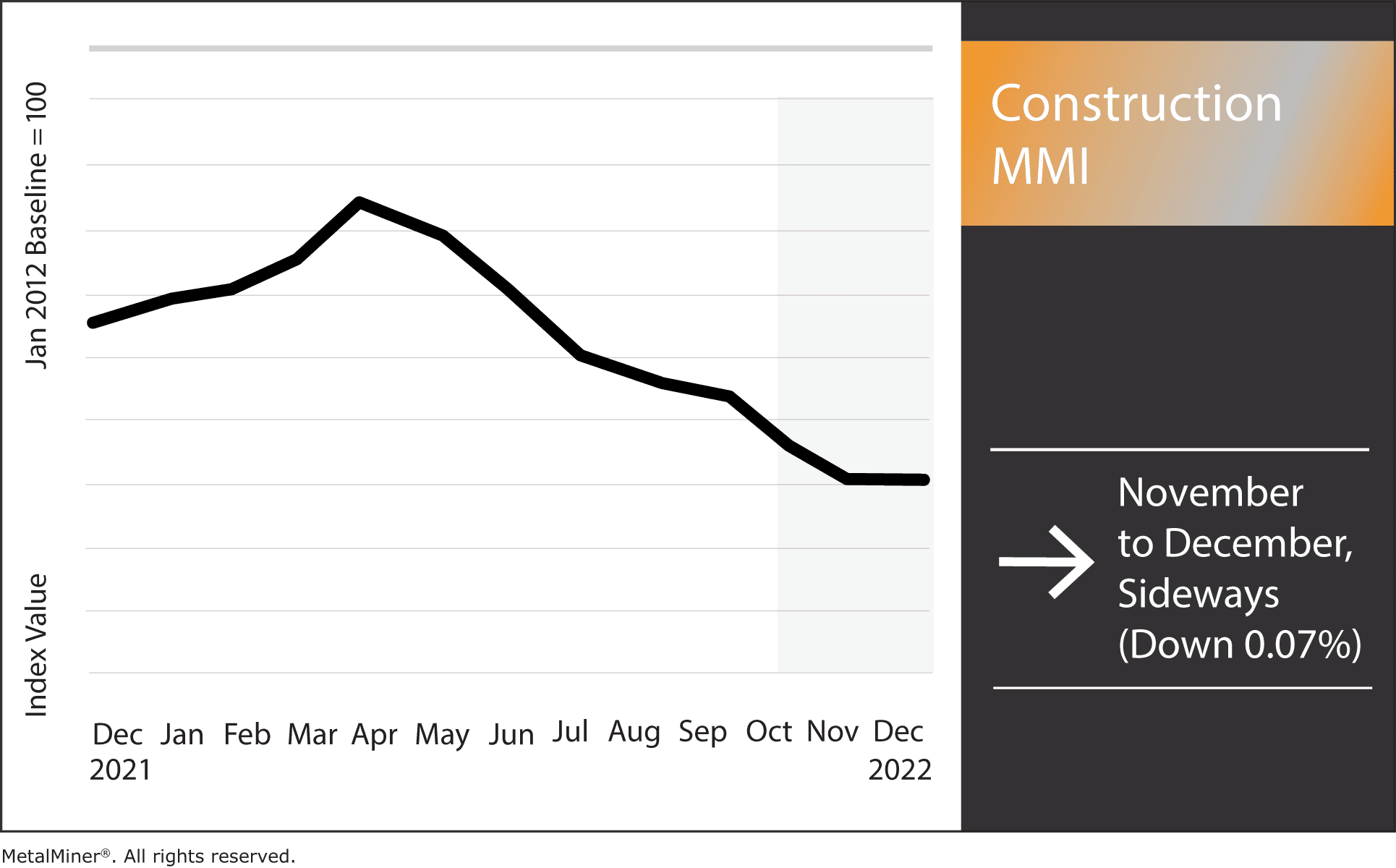

Construction MMI: Aluminum Plate and Steel Rebar Reverse

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index. The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included […]

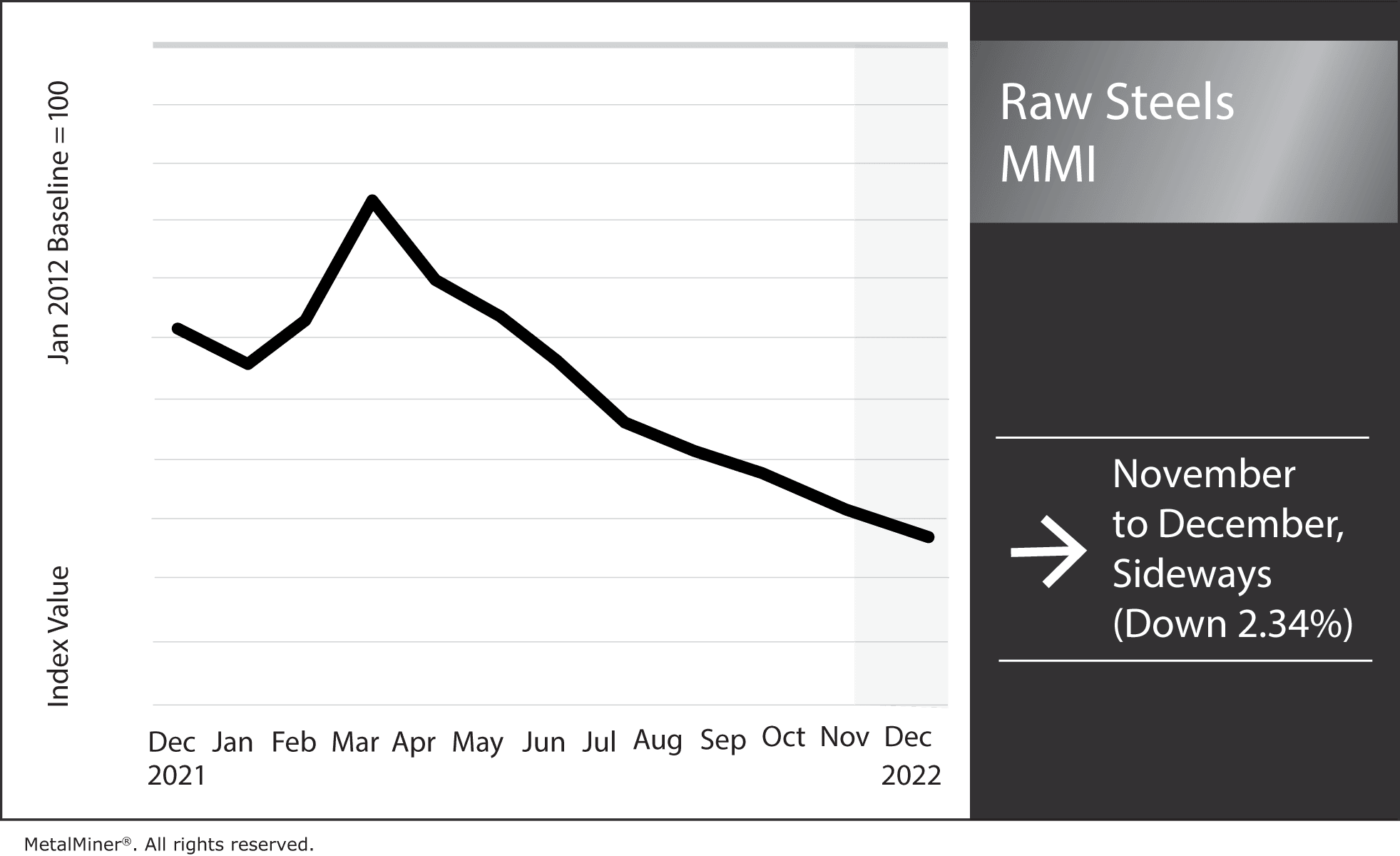

Raw Steels MMI: Where is the Bottom for Falling Steel Prices?

The Raw Steels Monthly Metals Index (MMI) fell by 2.34% from November to December. Ultimately, U.S. steel prices remain decidedly bearish. Meanwhile, hot rolled coil prices saw the most substantial decline, falling 12.6% month over month. Plate prices, on the other hand, mainly remained sideways but continued to edge slowly downward with a 2.9% decline. […]

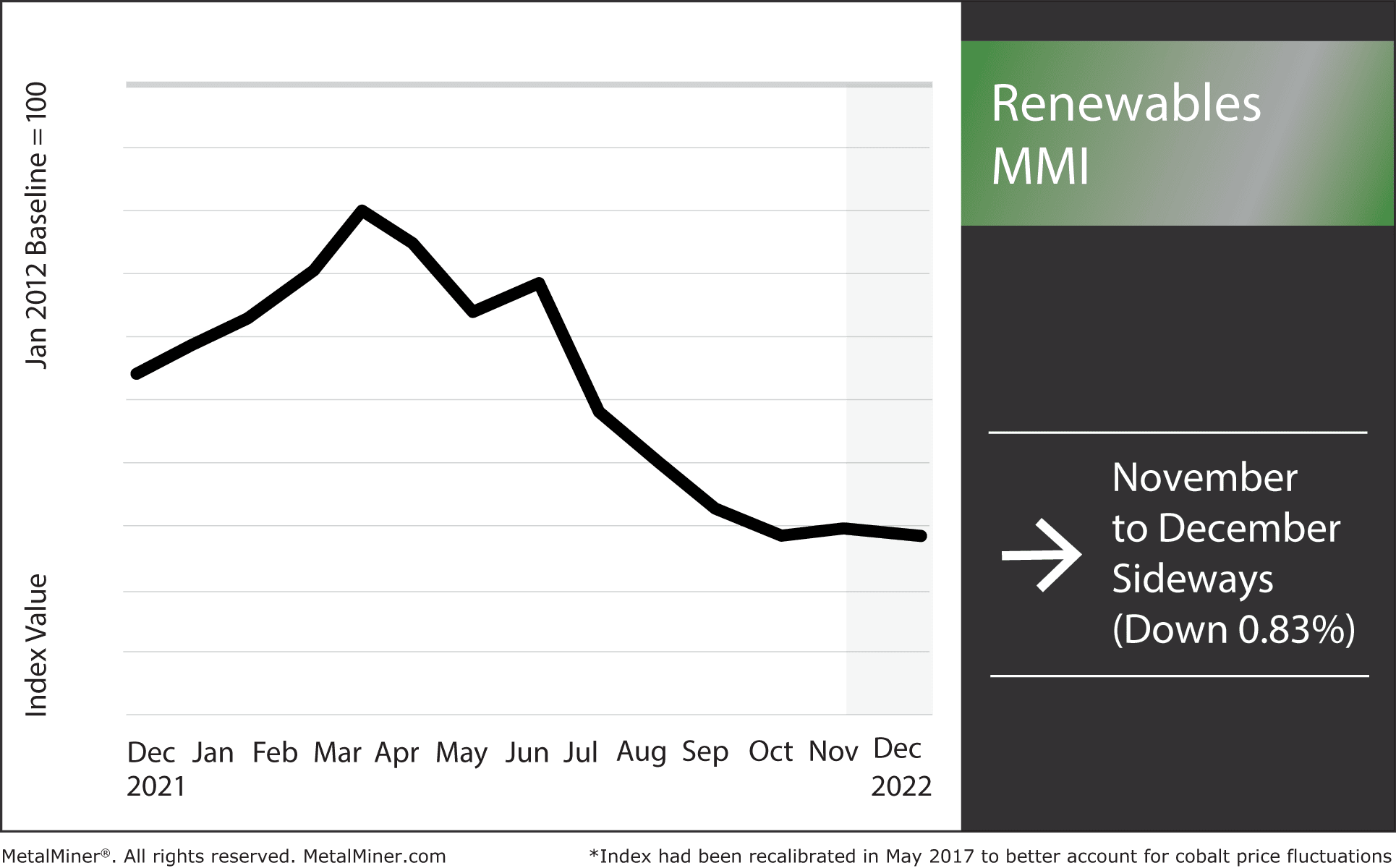

Renewables/GOES MMI: Steel Plate Drops While Battery Metals Hold Strong

The December Renewables MMI (Monthly MetalMiner Index) traded sideways, practically in a straight line. Overall, metal prices within the index only dropped 0.83%. This sideways trend contrasts sharply with the steep drop renewables saw just six months ago. Battery metals within the index, such as cobalt and silicon, held a steady sideways trend, only rising […]

Iron Ore Futures to Rise as China Eases zero-COVID

China’s steady easing of COVID-19 restrictions finally allowed the beleaguered economy to begin reopening. Many experts expect a renewed demand for steel, which means an increased appetite for steel-making raw materials such as iron ore. Both analysts and traders believe the lifting the restrictions was a step in the right direction. This current positivity is […]

Stainless MMI: Reduced Stainless Imports Could Cause Shortages, Bullish Nickel Price

The Stainless Monthly Metals Index (MMI) moved up with a 7.32% rise from November to December. Meanwhile, the nickel price index appeared decidedly bullish throughout the month. While nickel prices modestly retraced from their early month rally, upside price action continued to support the short-term range breakout. Sustained increases should foster further bullish anticipation, which […]

Mastering Metal Prices: 5 Sourcing Strategies That Only Pros Know

“It is a fact researchers have settled on – the 10,000-hour rule is a definite key in success.”– Malcolm Gladwell, ‘Outliers.’ For those of you who have not read Gladwell’s “Outliers,” no worries. Essentially, the key theme of the book involves the concept of practice. It states that those who dedicate 10,000 hours or more […]

Rare Earths MMI: Global Rare Earth Supply Chains in an Uproar

The December Rare Earths MMI (Monthly MetalMiner Index) traded sideways for the second month in a row. The index dropped 1.55% and MetalMiner anticipates it will continue sideways, most definitely for the short term and possibly in the long term. This is mostly thanks to the supply of global rare earth magnets being interrupted by […]

Are Manufacturing PMIs All They’re Cracked Up to Be?

Here at MetalMiner, we’re not very big fans of manufacturing PMIs. They tend to overstate trends, and month-by-month data can be misleading. This is especially true when trying to extrapolate medium term trends. That said, when taken in conjunction with metal price movements – which are driven more by actual demand than sentiment – PMI’s […]

Could Macroeconomics Cause a Steel Price Reversal?

Uncertainty regarding China’s stance on zero-COVID, when restrictions might ease, and riots within China throughout recent weeks have all contributed to more flat steel prices. What’s more, recession fears are starting to notably impact commodities. Yet another contributing factor? Fears of a railroad strike. With the cut-off date for meeting railroad unions’ terms fast approaching, […]