The Automotive MMI (Monthly Metals Index) increased by 4.47% month over month. The primary culprit for the bullish sentiment was hot-dipped galvanized prices rising due to tariff anticipation from the automotive industry. U.S. Automotive Industry Faces Rising Costs and Trade Challenges The U.S. automotive sector is grappling with economic pressures that could alter its operational […]

Category: Metal Pricing

Rare Earths MMI: Oval Office Blowout: Will the Ukrainian Rare Earths Deal Still Happen?

The Rare Earths MMI (Monthly Metals Index) experienced a spike in price action month-over-month, rising by 7.4%. The recent tariffs on China, the top global supplier of rare earths, caused a short-term upward trend for many of the elements in the index. Meanwhile, Ukraine’s mineral reserves have attracted considerable international attention, particularly from President Trump. […]

Worried About Trump Tariffs? Here’s Our Comprehensive Guide to 2025 Steel and Aluminum Tariffs

In February 2025, President Trump reinstated and expanded the Section 232 tariffs on all steel (including stainless steel products) and aluminum imports, setting a flat 25% duty effective March 12, 2025 (what’s known as the “Trump Tariffs”). This renewed policy removes all previously negotiated country-specific exemptions and broadens the tariff’s scope to include a diverse […]

Renewables MMI: What’s Next for Renewables With Recent Policy Changes?

The Renewables MMI (Monthly Metals Index) witnessed its highest rise in over five months, with the renewable resources index increasing by 6.58% month-over-month. This was mostly due to GOES (grain-oriented electrical steel) and neodymium shooting up in price in reaction to recent policy changes. U.S. Policy Shifts Reshape Renewable Energy Market and Metal Prices The […]

Global Precious Metals MMI: How Long Will the Gold Bull Train Last?

The Global Precious Metals MMI (Monthly Metals Index) experienced a significant rise month-over-month, shooting up 7.36%. The past month proved a whirlwind for the precious metal prices, with each metal reacting to shifting economic conditions and recent policy changes. Palladium: Market Uncertainty Takes Center Stage Palladium experienced a particularly volatile month. Prices initially climbed in […]

Aluminum MMI: Aluminum Prices Stable, Premiums Bullish Amid Tariff Threats

The Aluminum Monthly Metals Index (MMI) continued to move sideways, with a modest 1.11% rise from January to February. In the face ongoing tariff threats, LME aluminum prices remained consolidated while the Midwest Premium surged. Tariffs Add Chaos to the Aluminum Market Since President Trump’s term started, the aluminum market has been squarely in the […]

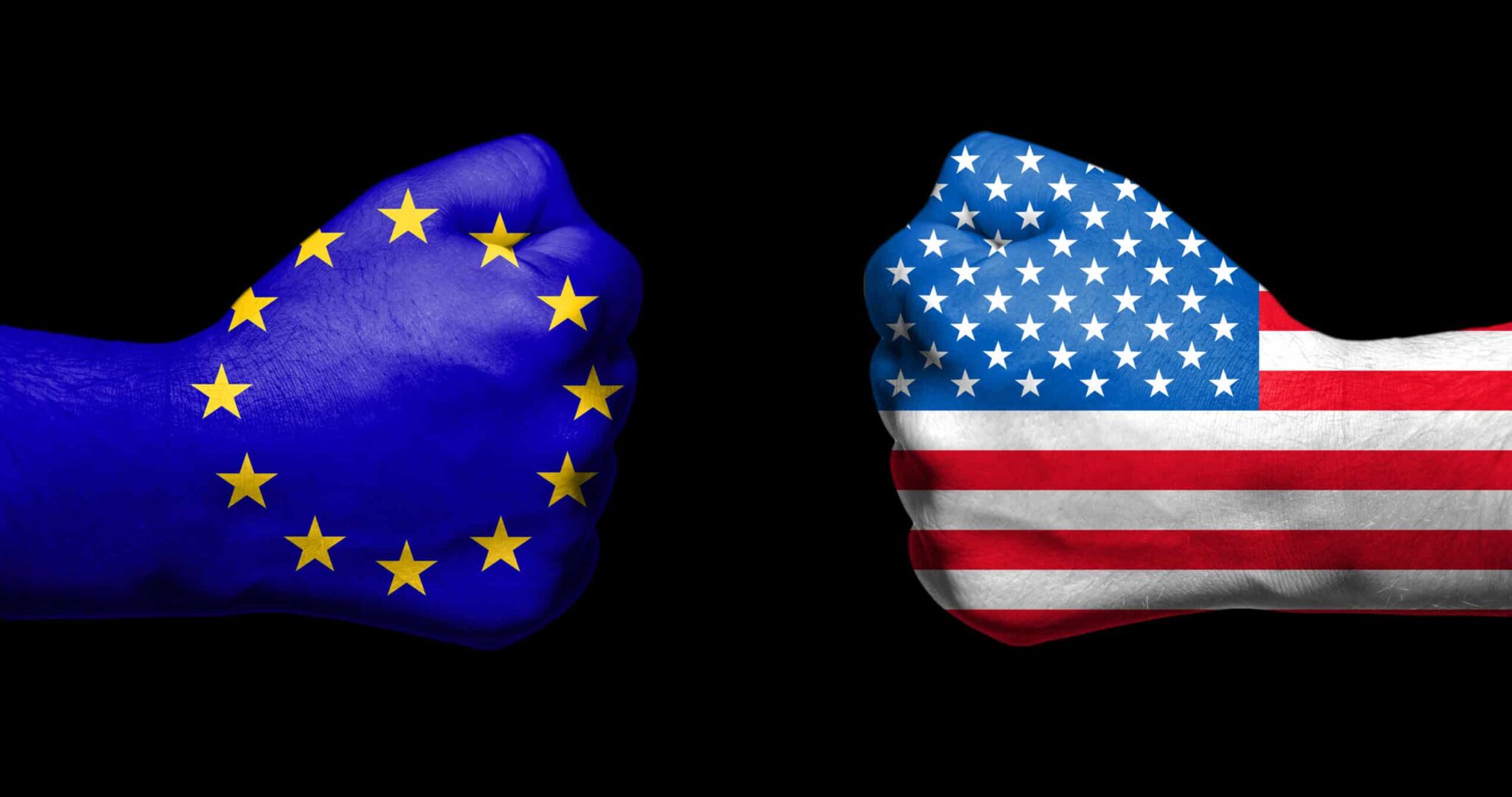

Trump’s Tariffs: EU Warns of ‘Firm and Proportionate’ Counterstrike

European bodies recently criticized U.S. President Donald Trump’s order to introduce tariffs on all steel and aluminum imports entering the country. Meanwhile, experts at home and abroad continue to evaluate how the trade dispute will affect steel prices and aluminum prices. The European Commission, the European Union’s executive arm, recently vowed that it would respond […]

Stainless MMI: Stainless Market Remains Slow Despite Tariffs

The Stainless Monthly Metals Index (MMI) remained sideways, but continued to slide. Overall, the index fell by 0.72% from January to February as nickel prices remained consolidated. Bearish Conditions Continue to Haunt 304 Stainless The chaos of tariffs was seemingly lost on large portions of the stainless steel market. For many, the return of a […]

Construction MMI: Tariff Talk: What Should the Construction Industry Expect?

The Construction MMI (Monthly Metals Index) held its sideways trend, budging down a slight 1.35%. Meanwhile, the U.S. construction industry faces a complex landscape shaped by recent policy changes, Trump tariffs and other economic factors. Tariffs and Their Effect on Construction Materials Steel remains a fundamental component of modern construction, playing a crucial role in […]

Copper MMI: Copper Prices Up as Comex Premium Advances

The Copper Monthly Metals Index (MMI) held sideways, although the upside bias appeared to accelerate. In total, the index rose 1.64% from January to February, supported by rising U.S. copper prices. Keep up with the latest tariff news impacting copper prices. Subscribe to MetalMiner’s free weekly newsletter. Copper Prices Bullish as Exchange Delta Grows Traders […]