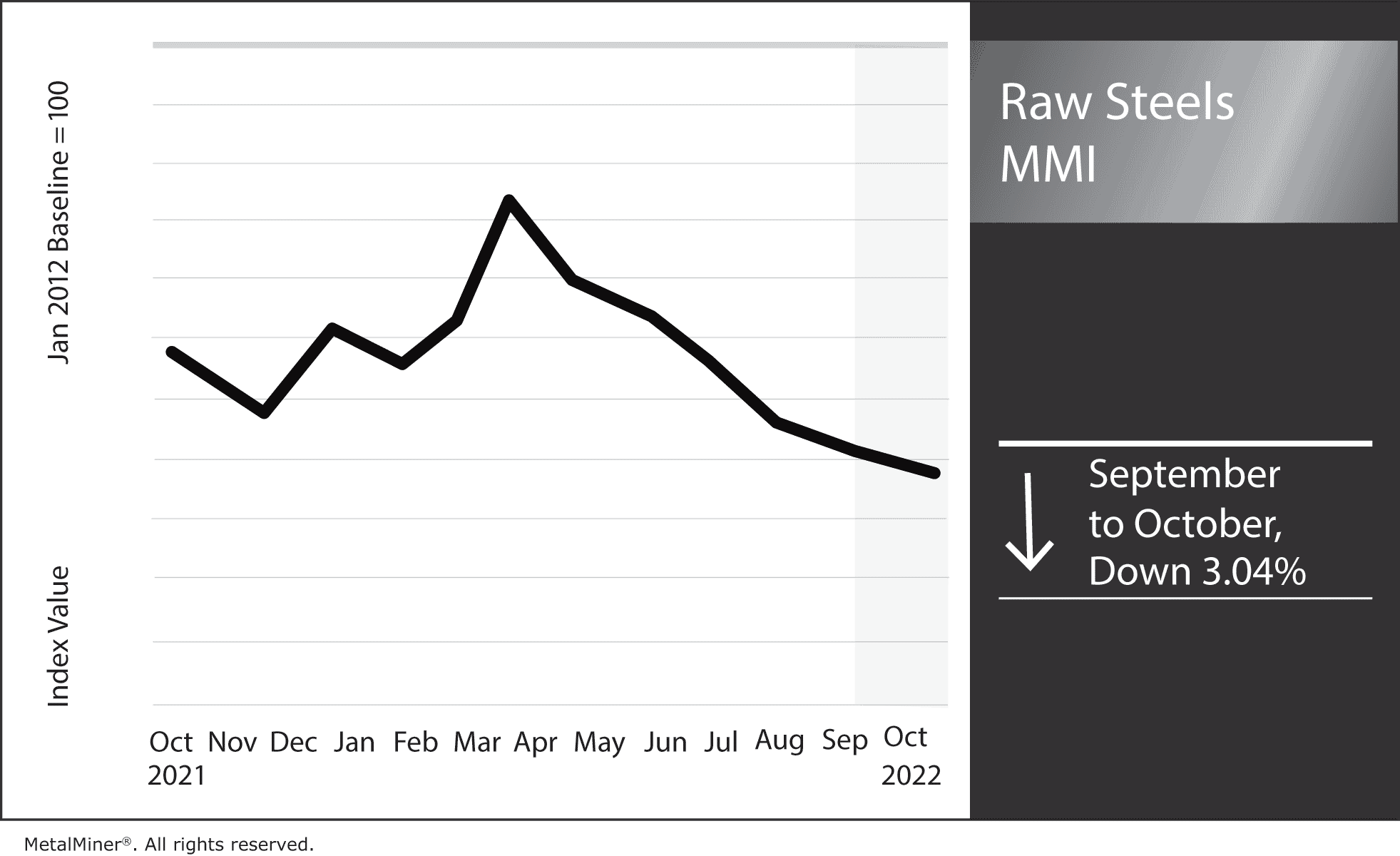

The Raw Steels Monthly Metals Index (MMI) fell by 3.04% from September to October. U.S. steel prices continued to drop throughout September. However, declines for both hot rolled coil prices and cold rolled coil prices slowed to a sideways trend. Plate prices, which have shown the most strength of steel prices, traded down for the […]

Tag: steel price

HRC and CRC Steel Prices Stagnate Amid Energy Crisis

Hot rolled coil steel prices in Western Europe remain largely unchanged since early September. However, as various market participants told MetalMiner, this is despite attempts by at least one steelmaker to increase them According to our sources, multiple factors continue to suppress demand for flat rolled products. These include a slowdown of public works programs […]

Raw Steels MMI: Steel Prices Decline, Pace Slows

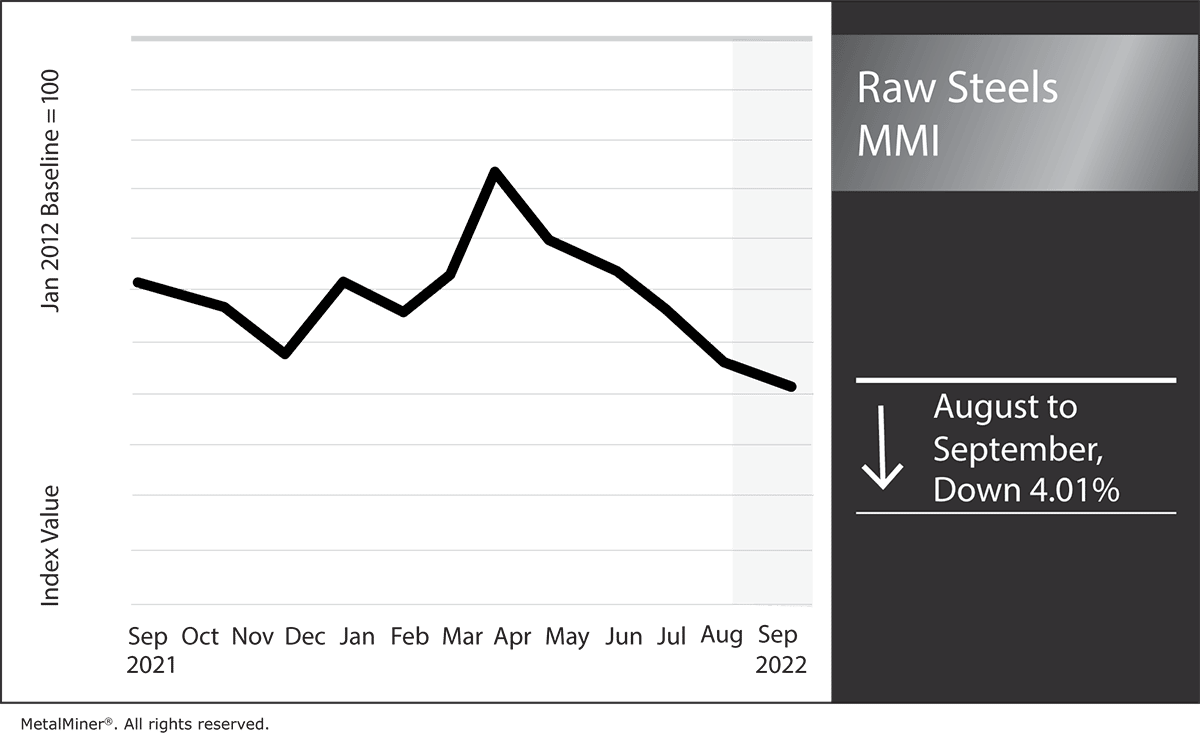

U.S. steel prices continue to search for a bottom, although the pace of declines began to slow as August saw the smallest month-over-month percent decrease since May. Nonetheless, by early September, hot rolled coil prices fell beneath the $800/st mark for the first time since December 2020. Plate prices also trended downward last month, dipping […]

UPI Closure to Have Limited Impact on Steel Prices

USS-Posco Industries (UPI) to close, sell plant in 2023 or 2024 The Pittsburg, CA based finished steel producer USS-Posco Industries (UPI) will close its doors in 2023. UPI manufactures hot rolled pickled and oiled, cold rolled coil, hot dipped galvanized and tin plate. Although unconfirmed, the facility was reportedly purchased by Amazon for use as […]

Raw Steels MMI: Hot Rolled Coil Prices Hit New Lows

U.S. steel prices continued their decline this month alongside other steel markets. Hot rolled coil, cold rolled coil, and hot dipped galvanized prices all dropped beneath their early March bottoms. HRC prices, in particular, continue to close in on the $1,000/st mark, while plate prices saw their second consecutive month-over-month decline.The Raw Steels Monthly Metals […]

Construction MMI: Indices and Demand Decline for Another Month

The Construction MMI (Monthly Metals Index) extended its decline from last month. Altogether, the index fell 10.69% from June to July. China is Poised to Inject Big Money into Infrastructure News recently broke that China’s State Council is preparing to increase credit lines across the board, providing an additional 800 billion yuan to fund […]

International Commodities Market Fluctuates, Global Slowdown Impending

Mexico’s steel metal market recently saw a slowdown on metal prices, leading experts to believe that Mexico’s industrial metal market may soon turn bearish. Flat steel prices, along with long steel prices, have been dropping over the past several weeks. In fact, Mexico’s steel prices have been in steady decline since April. However, in mid-May, […]

Estimating Stainless Steel Costs Becoming More Complicated

Last Month, MetalMiner reported that stainless steel cost had been holding strong amid high demand and increased production. However, we did identify some cracks in what might otherwise look like a solid recovery. As we transition from Q2 to Q3, some of those cracks have grown significantly. Low Demand in China Affecting Stainless Steel Cost […]

British Steel Begins Construction of New Billet Caster at Scunthorpe

New Steel Billet Caster in the Works Longs producer British Steel has begun constructing a billet casting machine at its Scunthorpe works. It will be the second such machine built at the site, which lies in England’s East Midlands region.On June 15th, the company said that the continuous caster should come on stream in late 2022. Once […]

Renewables Monthly Metals Index (MMI) Renewables and GOES Prices Rise

The Renewables Monthly Metals Index (MMI) rose by 2.27%. After trending downward since March, renewable resources finally saw a price boost. Renewable Resources Partnership: Hydro Power and Air Battery Systems According to an article from Renewable Energy World, Augwind, a company specializing in renewable resources and energy, has launched a collaboration with Voith Hydro. The […]