U.S. steel prices continue to rise amid ongoing price hikes from domestic steelmakers. The ascent for HRC prices accelerated throughout January as they jumped by over 10%. Meanwhile, plate prices returned sideways with a modest month-over-month rise of just under 2%. Of course, this came after prices traded down throughout December. Overall, the Raw Steels […]

Tag: steel price

Is the Face of the Steel Industry Changing?

After weathering a bumpy ride throughout 2022, one of the world’s most traded commodities still isn’t out of the woods just yet. Though steel prices rose across the board over the past few weeks, mills around the world remain shuttered, and demand continues to fluctuate. Zero-COVID and limited energy across places like Europe are just […]

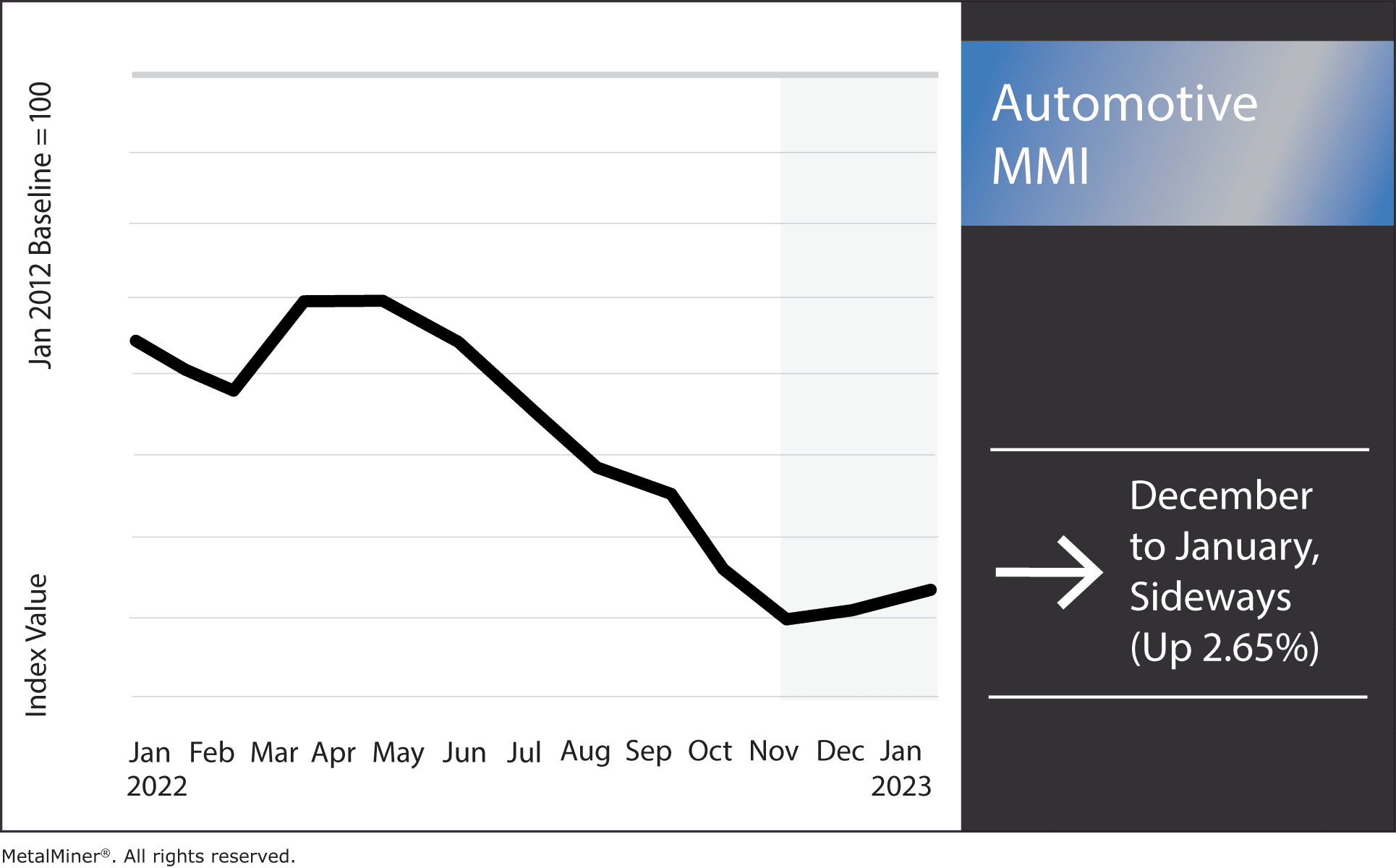

Automotive MMI: 2023 Could Bring More Car Parts Shortages

The Automotive MMI (Monthly MetalMiner Index) traded sideways for the second month in a row, rising by just 2.65%. The automotive index was impacted heavily by China rescinding zero-COVID restrictions, which caused a spike in cases. However, Chinese-sourced lead and HDG steel prices rose significantly, pulling the index upward. The overall volatility in metals used […]

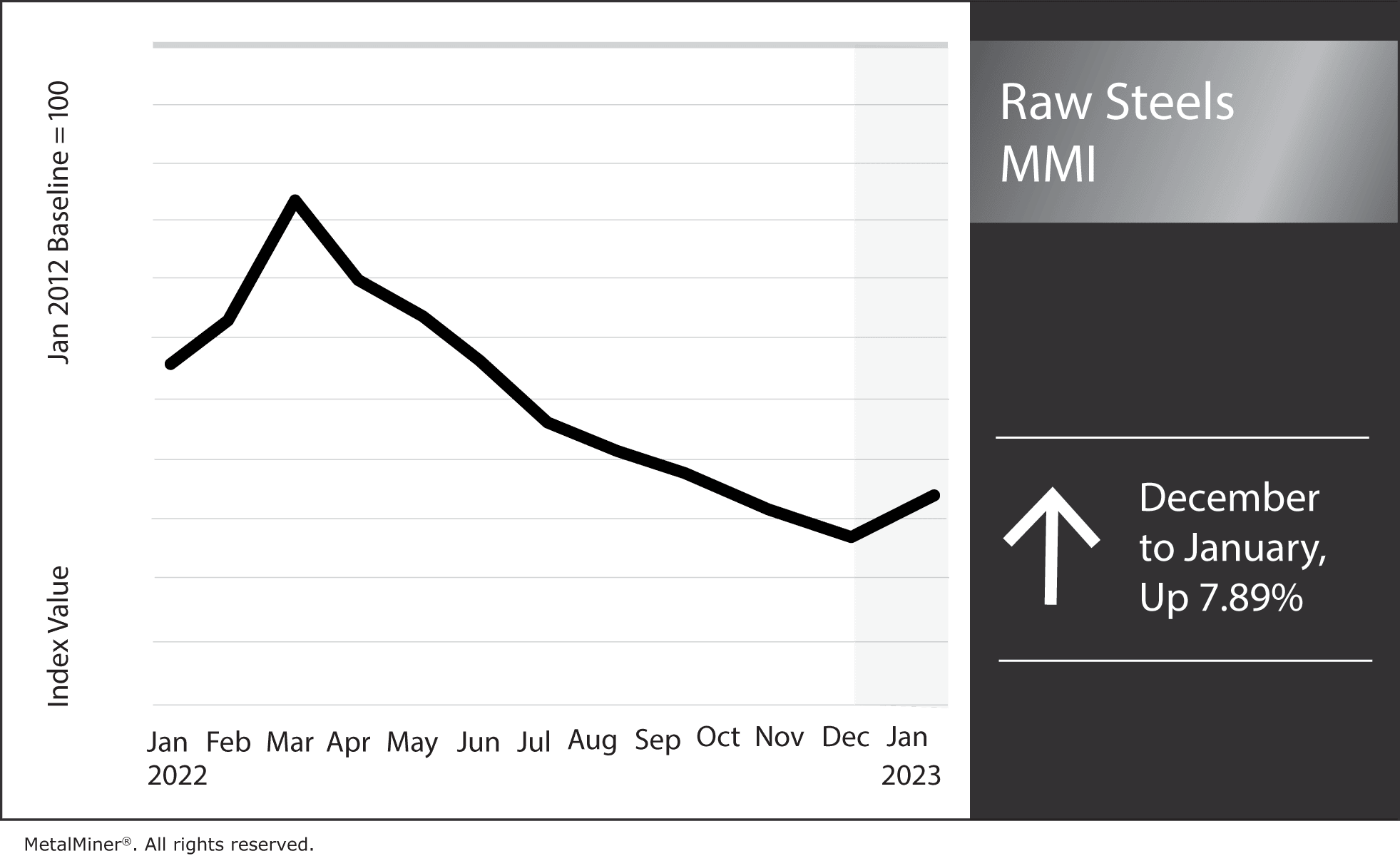

Raw Steels MMI: U.S. Steel Prices Find Bottom, Begin Rising

U.S. steel prices hit a bottom at the beginning of December, then began to climb. Hot rolled coil prices rose over 8% from their December low. Meanwhile, plate prices traded down for the first time since September. Overall, the Raw Steels Monthly Metals Index (MMI) rose by 7.98% from December to January. MetalMiner’s free weekly […]

Construction MMI: Chinese Sourced Steel Prices Spike, Supply Pinches Possible

The Construction MMI (Monthly MetalMiner Index) rose considerably by 7.68%, with Chinese steel prices getting a significant boost. In fact, all facets of the index related to China (except for iron ore) increased. The movement came in the wake of zero-COVID restrictions lifting, which resulted in a sharp rise in coronavirus cases. While this was […]

Steel Prices and Global Market: a 2022 Review

Steel prices endured long-term declines throughout 2022. However, with so many geopolitical events and supply chain pinches, it is important to note that the market in general was quite volatile. Steel Prices: Q1 of 2022 Raw steels started the year with a huge bang, rising over 12% between January and February. China’s climate efforts caused […]

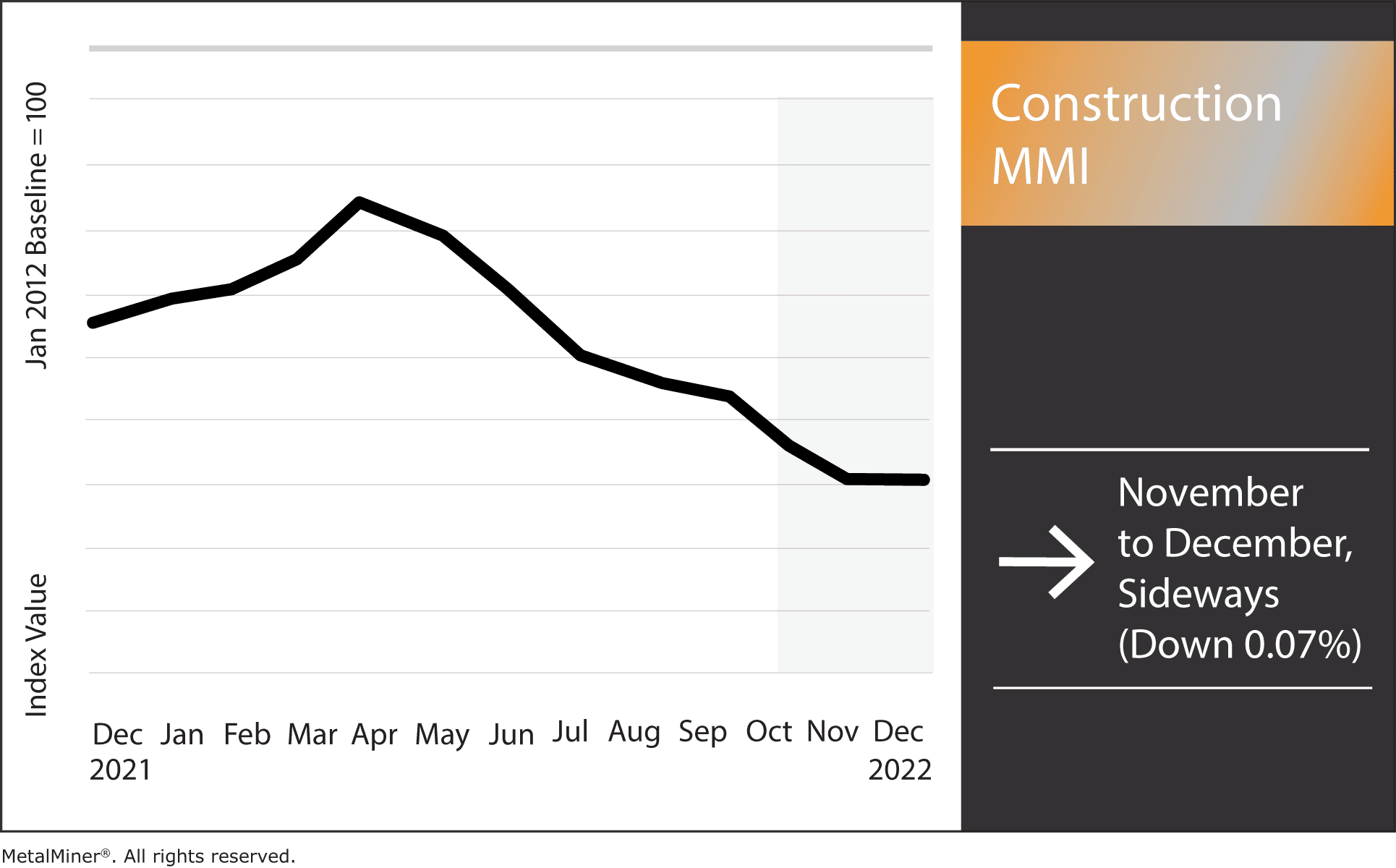

Construction MMI: Aluminum Plate and Steel Rebar Reverse

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index. The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included […]

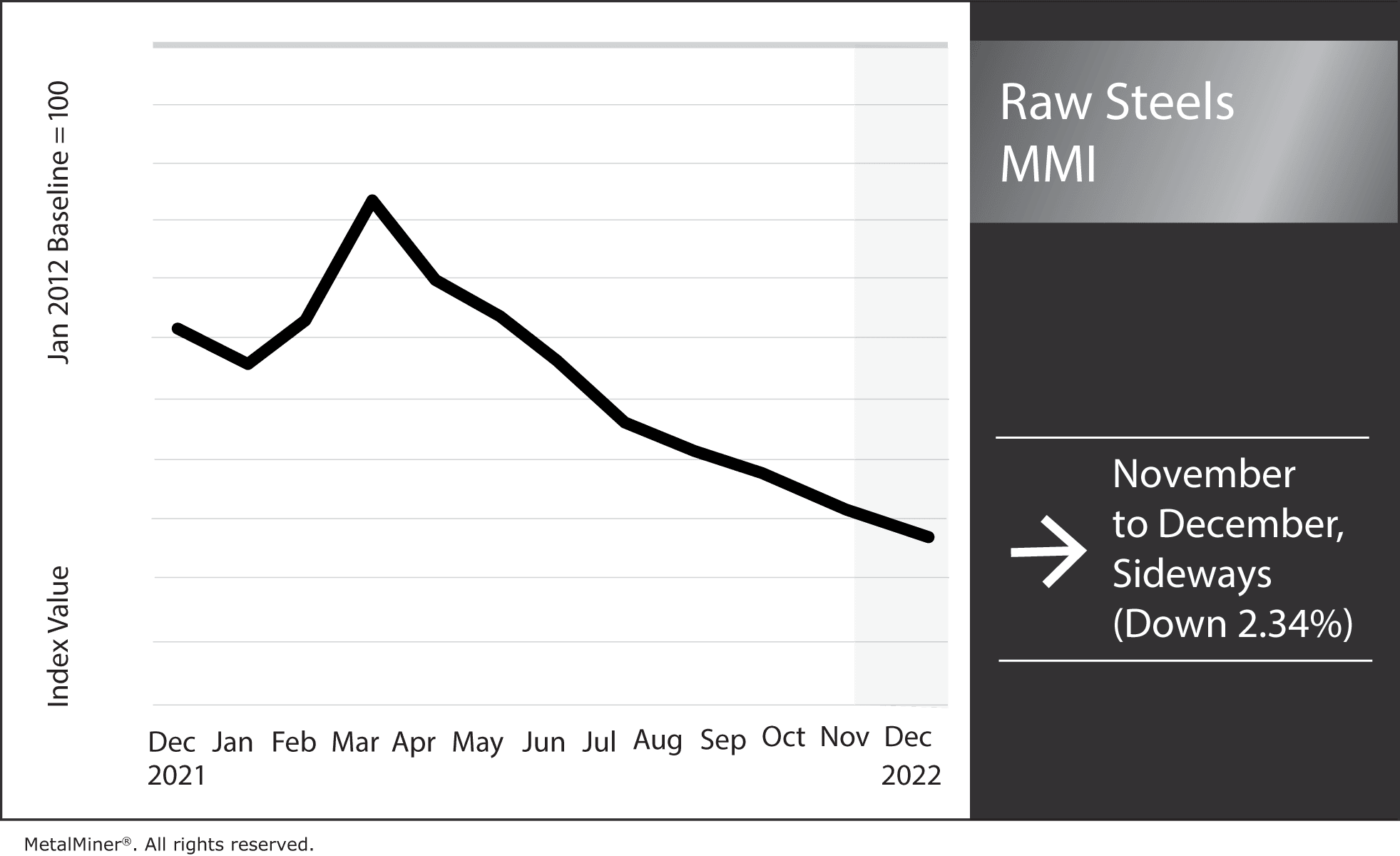

Raw Steels MMI: Where is the Bottom for Falling Steel Prices?

The Raw Steels Monthly Metals Index (MMI) fell by 2.34% from November to December. Ultimately, U.S. steel prices remain decidedly bearish. Meanwhile, hot rolled coil prices saw the most substantial decline, falling 12.6% month over month. Plate prices, on the other hand, mainly remained sideways but continued to edge slowly downward with a 2.9% decline. […]

Could Macroeconomics Cause a Steel Price Reversal?

Uncertainty regarding China’s stance on zero-COVID, when restrictions might ease, and riots within China throughout recent weeks have all contributed to more flat steel prices. What’s more, recession fears are starting to notably impact commodities. Yet another contributing factor? Fears of a railroad strike. With the cut-off date for meeting railroad unions’ terms fast approaching, […]

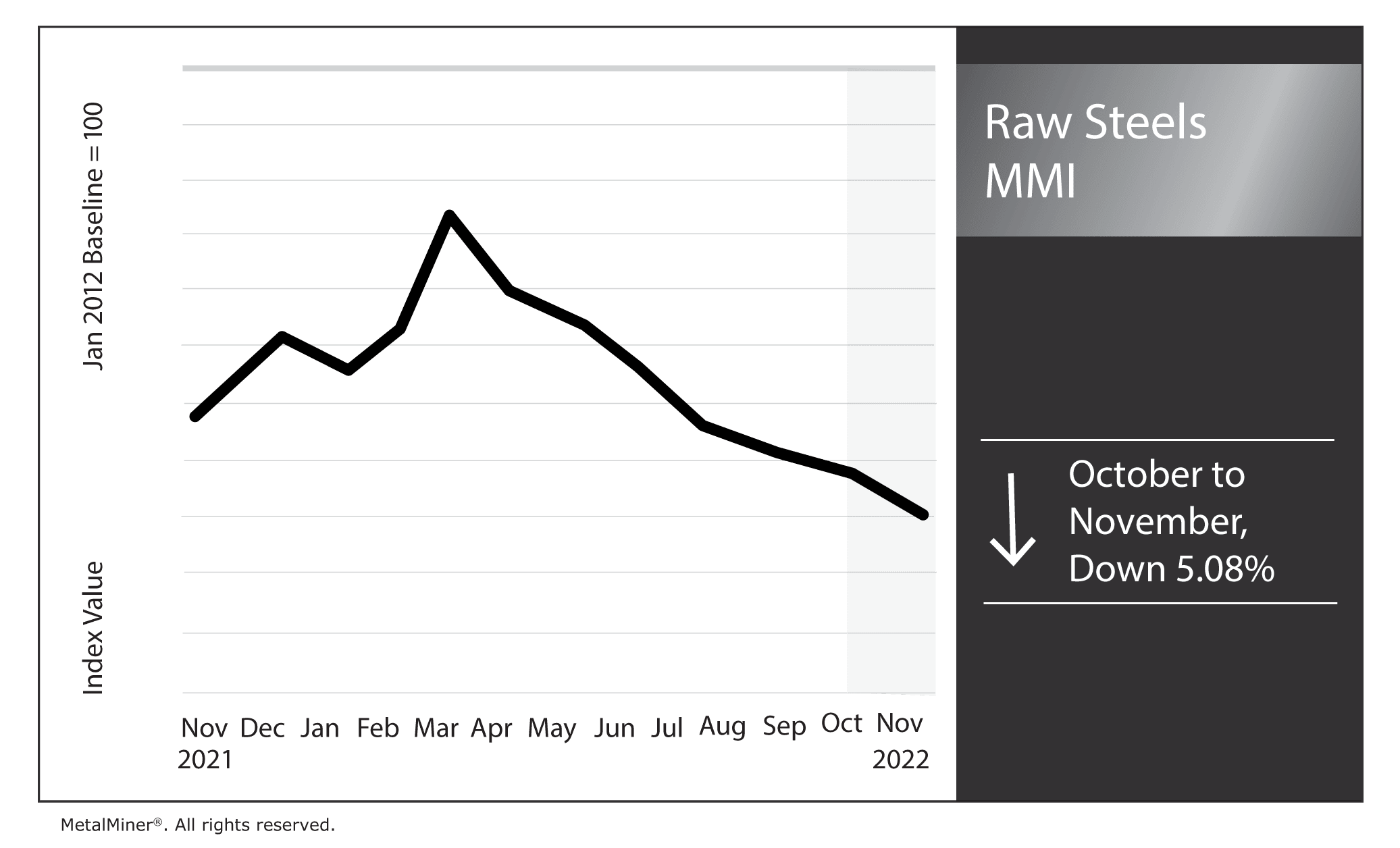

Raw Steels MMI: Steel Price Downtrend Resumes While Plate Prices Hold Flat

The Raw Steels Monthly Metals Index (MMI) fell by 5.08% from October to November. A number of factors played into steel prices dropping. After U.S. steel prices appeared to flatten, the descent for hot rolled coil, cold rolled coil, and hot dipped galvanized prices accelerated throughout October. Hot rolled coil prices now sit at their […]